WTI Crude Oil: general analysis

05 June 2019, 10:24

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL |

| Entry Point | 52.82 |

| Take Profit | 50.00 |

| Stop Loss | 54.30 |

| Key Levels | 49.96, 51.68, 53.00, 54.16, 55.15, 57.63 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 53.85 |

| Take Profit | 55.80 |

| Stop Loss | 52.60 |

| Key Levels | 49.96, 51.68, 53.00, 54.16, 55.15, 57.63 |

Current trend

Oil is trading near January lows. The instrument is under pressure of the trade conflict, and no reducing of the pressure in international trade is expected. Moreover, Washington announced the introduction of duties on Mexican goods. The signals of a slowdown in global economic growth affect the demand, and efforts to stabilize prices under the OPEC + agreement, as well as sanctions against Iran and Venezuela, do not support the market.

At the end of July, OPEC and allies will discuss the feasibility of extending current agreements. On Monday, the Minister of Energy of Saudi Arabia said that all parties are ready to continue work aimed at stabilizing prices.

Today at 16:30 (GMT+2), the US Department of Energy will publish a report on oil reserves. In addition, at 15:45 (GMT+2), Fed officials Rafael Bostic and Richard Clarida will speak, and at 20:00 (GMT+2), the Beige Book will be released. Given the escalation of trade conflict and the willingness of the Fed chief to stimulate the American economy, officials' speeches are of great importance for the further dynamics of the trading instrument.

Support and resistance

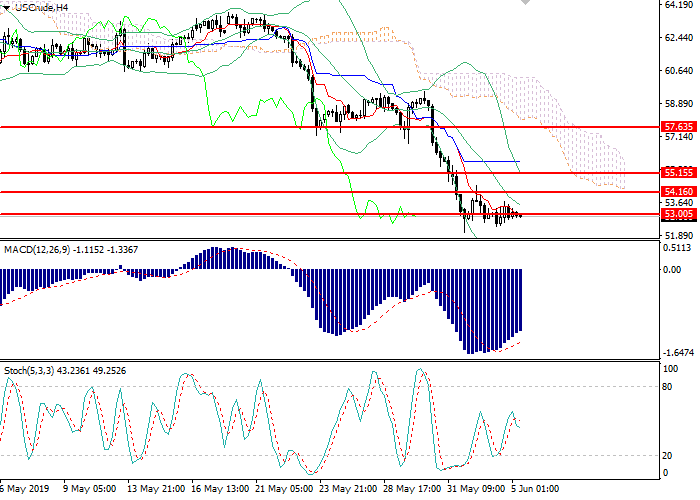

On the 4-hour chart, the instrument was corrected to an important psychological level of 53.00. Bollinger bands are directed vertically, and the price range has decreased slightly, confirming the downward trend. The MACD keeps a strong sell signal. Stochastic is being corrected in the neutral area, the signal to enter the market is not formed.

Resistance levels: 54.16, 55.15, 57.63.

Support levels: 53.00, 51.68, 49.96.

Trading tips

Short positions can be opened from the current level with the target at 50.00 and stop loss 54.30.

Long positions can be opened above 53.80 with the target at 55.80 and stop loss 52.60.

Implementation period: 2–3 days.

Oil is trading near January lows. The instrument is under pressure of the trade conflict, and no reducing of the pressure in international trade is expected. Moreover, Washington announced the introduction of duties on Mexican goods. The signals of a slowdown in global economic growth affect the demand, and efforts to stabilize prices under the OPEC + agreement, as well as sanctions against Iran and Venezuela, do not support the market.

At the end of July, OPEC and allies will discuss the feasibility of extending current agreements. On Monday, the Minister of Energy of Saudi Arabia said that all parties are ready to continue work aimed at stabilizing prices.

Today at 16:30 (GMT+2), the US Department of Energy will publish a report on oil reserves. In addition, at 15:45 (GMT+2), Fed officials Rafael Bostic and Richard Clarida will speak, and at 20:00 (GMT+2), the Beige Book will be released. Given the escalation of trade conflict and the willingness of the Fed chief to stimulate the American economy, officials' speeches are of great importance for the further dynamics of the trading instrument.

Support and resistance

On the 4-hour chart, the instrument was corrected to an important psychological level of 53.00. Bollinger bands are directed vertically, and the price range has decreased slightly, confirming the downward trend. The MACD keeps a strong sell signal. Stochastic is being corrected in the neutral area, the signal to enter the market is not formed.

Resistance levels: 54.16, 55.15, 57.63.

Support levels: 53.00, 51.68, 49.96.

Trading tips

Short positions can be opened from the current level with the target at 50.00 and stop loss 54.30.

Long positions can be opened above 53.80 with the target at 55.80 and stop loss 52.60.

Implementation period: 2–3 days.

No comments:

Write comments