WTI Crude Oil: general analysis

03 June 2019, 10:17

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 51.90 |

| Take Profit | 50.10 |

| Stop Loss | 52.40 |

| Key Levels | 50.50, 51.98, 52.83, 54.84 |

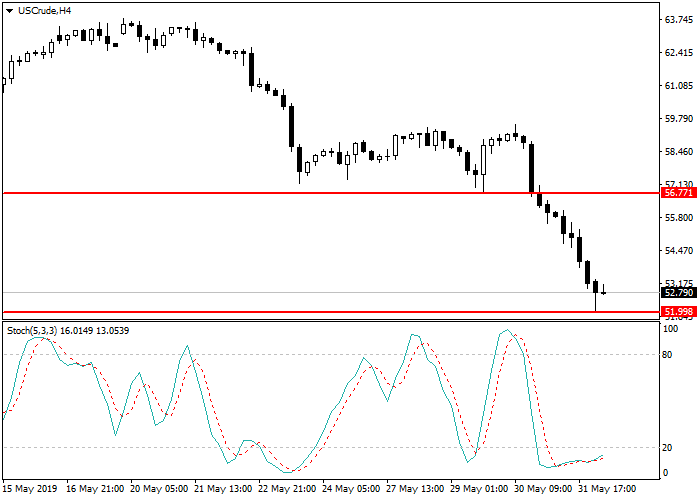

Current trend

Oil continues to decline. The nearest support level is at 51.99.

Negative statistics on commercial hydrocarbon reserves in the United States exerts pressure on the market: analysts predicted a drop of 850,000 barrels, while the figure was only 282,000. The total volume is approaching the level of 476.5 million barrels. Commercial gasoline inventories increased by 2.2 million against –800K, which also affected the quotes of “black gold” negatively. The course is also adversely affected by increased global risks. The United States is waging a trade war with China, and recently Trump announced a possible increase in duties for Mexico if it does not take a more active part in the fight against illegal emigration. China is preparing a series of measures against FedEx, as several illegal packages were sent to the United States for Huawei customers through this delivery service. In addition, Beijing plans to create another additional list of corporations to respond to new sanctions in Washington. All this can significantly affect the global economy and slow down business activity. Analysts already call May one of the worst months of this year for oil: its price has fallen by about 14%.

Support and resistance

Stochastic is at 16 points and signals a possible correction.

Resistance levels: 52.83, 54.84.

Support levels: 51.98, 50.50.

Trading tips

Short positions can be opened after the breakdown of the level of 51.98 with the target at 50.10 and stop loss 52.40.

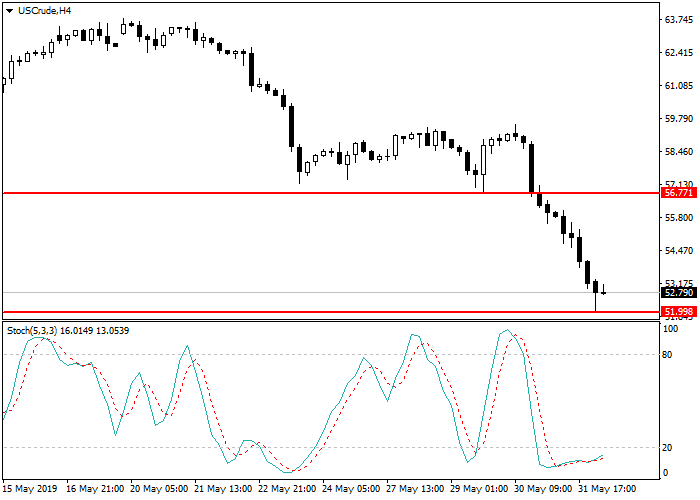

Oil continues to decline. The nearest support level is at 51.99.

Negative statistics on commercial hydrocarbon reserves in the United States exerts pressure on the market: analysts predicted a drop of 850,000 barrels, while the figure was only 282,000. The total volume is approaching the level of 476.5 million barrels. Commercial gasoline inventories increased by 2.2 million against –800K, which also affected the quotes of “black gold” negatively. The course is also adversely affected by increased global risks. The United States is waging a trade war with China, and recently Trump announced a possible increase in duties for Mexico if it does not take a more active part in the fight against illegal emigration. China is preparing a series of measures against FedEx, as several illegal packages were sent to the United States for Huawei customers through this delivery service. In addition, Beijing plans to create another additional list of corporations to respond to new sanctions in Washington. All this can significantly affect the global economy and slow down business activity. Analysts already call May one of the worst months of this year for oil: its price has fallen by about 14%.

Support and resistance

Stochastic is at 16 points and signals a possible correction.

Resistance levels: 52.83, 54.84.

Support levels: 51.98, 50.50.

Trading tips

Short positions can be opened after the breakdown of the level of 51.98 with the target at 50.10 and stop loss 52.40.

No comments:

Write comments