EUR/USD: Euro is corrected

03 June 2019, 10:05

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.1200 |

| Take Profit | 1.1250, 1.1263 |

| Stop Loss | 1.1175 |

| Key Levels | 1.1100, 1.1115, 1.1133, 1.1165, 1.1198, 1.1223, 1.1250, 1.1263 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL |

| Entry Point | 1.1165 |

| Take Profit | 1.1133 |

| Stop Loss | 1.1190 |

| Key Levels | 1.1100, 1.1115, 1.1133, 1.1165, 1.1198, 1.1223, 1.1250, 1.1263 |

Current trend

EUR is actively recovering against USD after updating local lows on May 30. Technical factors contribute to the development of "bullish" dynamics, while the fundamental background for the euro remains very ambiguous.

Investors fear the development of a political crisis in Italy, as well as watching the development of trade relations between the EU and the US, which have worsened after the harsh statements by Donald Trump. Published on Friday, macroeconomic indicators from Europe failed to provide significant support to the euro. Retail Sales in Germany in April decreased by 2.0% MoM, but unexpectedly increased strongly in annual terms (+4.0% YoY). German CPI in May slowed from +1.0% MoM to +0.2% MoM, which turned out to be worse than the average market expectations. Meanwhile, HCPI slowed down from +2.1% YoY to 1.3% YoY over the same period.

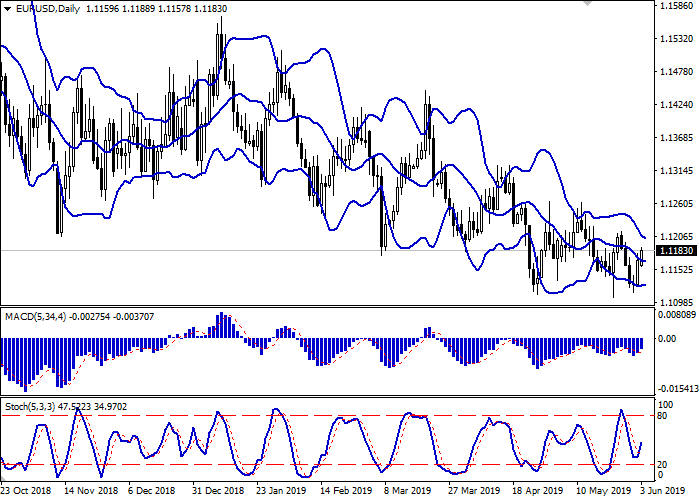

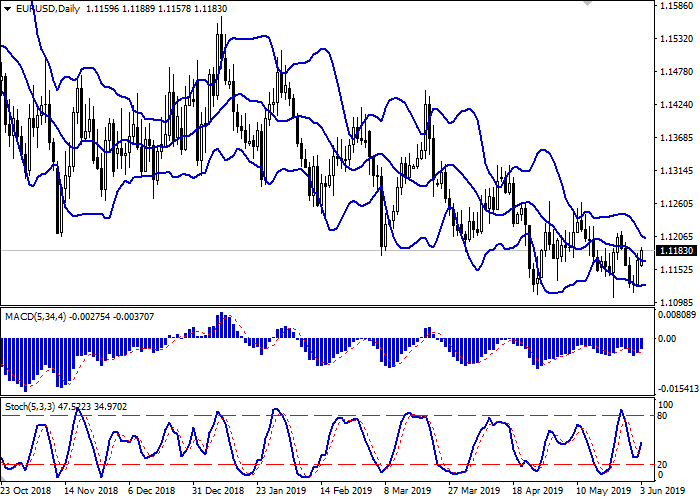

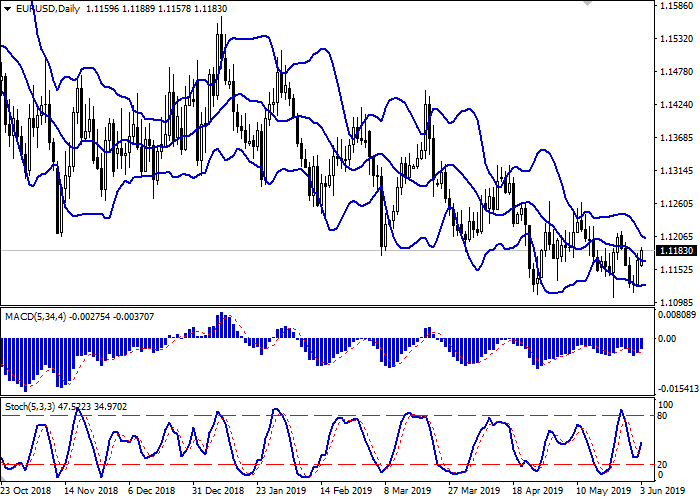

Support and resistance

In the D1 chart, Bollinger Bands are reversing horizontally. The price range is narrowing from below, reflecting a quite sharp change of trend in the short term. MACD is growing, keeping a weak buy signal (located above the signal line). Stochastic reversed upwards near the level of "20", indicating good prospects for the development of an upward trend in the short/ultra-short term.

Existing long positions should be kept until the situation clears up.

Resistance levels: 1.1198, 1.1223, 1.1250, 1.1263.

Support levels: 1.1165, 1.1133, 1.1115, 1.1100.

Trading tips

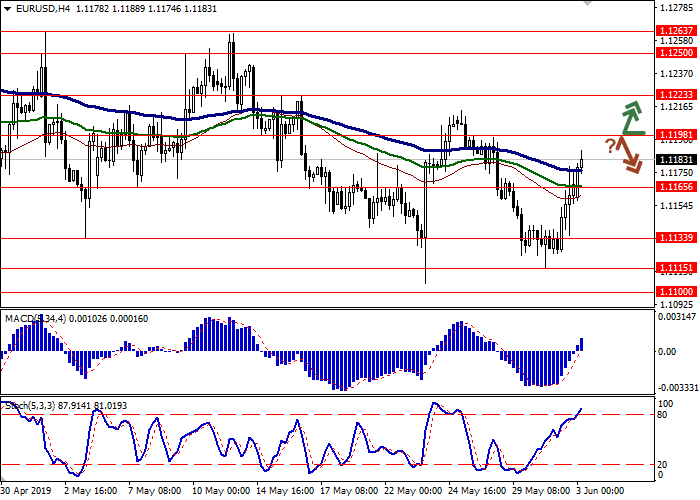

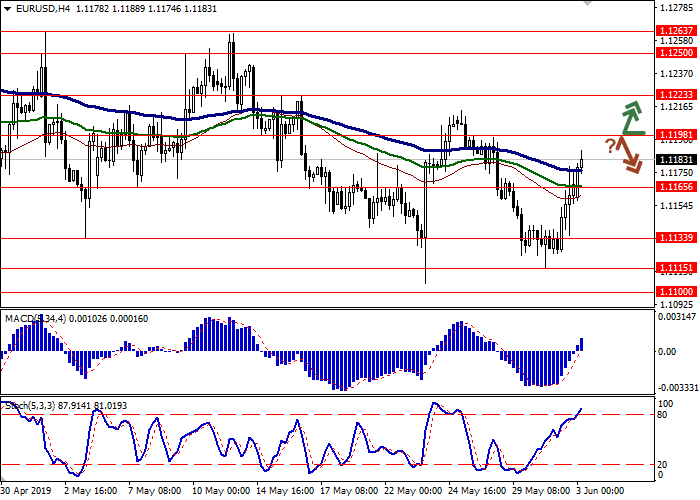

To open long positions, one can rely on the breakout of 1.1198. Take profit — 1.1250 or 1.1263. Stop loss — 1.1175.

The rebound from 1.1198 as from resistance with the subsequent breakdown of 1.1180–1.1175 can become a signal to return to sales with targets at 1.1140–1.1133. Stop loss — 1.1200.

Implementation time: 2-3 days.

EUR is actively recovering against USD after updating local lows on May 30. Technical factors contribute to the development of "bullish" dynamics, while the fundamental background for the euro remains very ambiguous.

Investors fear the development of a political crisis in Italy, as well as watching the development of trade relations between the EU and the US, which have worsened after the harsh statements by Donald Trump. Published on Friday, macroeconomic indicators from Europe failed to provide significant support to the euro. Retail Sales in Germany in April decreased by 2.0% MoM, but unexpectedly increased strongly in annual terms (+4.0% YoY). German CPI in May slowed from +1.0% MoM to +0.2% MoM, which turned out to be worse than the average market expectations. Meanwhile, HCPI slowed down from +2.1% YoY to 1.3% YoY over the same period.

Support and resistance

In the D1 chart, Bollinger Bands are reversing horizontally. The price range is narrowing from below, reflecting a quite sharp change of trend in the short term. MACD is growing, keeping a weak buy signal (located above the signal line). Stochastic reversed upwards near the level of "20", indicating good prospects for the development of an upward trend in the short/ultra-short term.

Existing long positions should be kept until the situation clears up.

Resistance levels: 1.1198, 1.1223, 1.1250, 1.1263.

Support levels: 1.1165, 1.1133, 1.1115, 1.1100.

Trading tips

To open long positions, one can rely on the breakout of 1.1198. Take profit — 1.1250 or 1.1263. Stop loss — 1.1175.

The rebound from 1.1198 as from resistance with the subsequent breakdown of 1.1180–1.1175 can become a signal to return to sales with targets at 1.1140–1.1133. Stop loss — 1.1200.

Implementation time: 2-3 days.

No comments:

Write comments