NZD/USD: New Zealand dollar strengthens

03 June 2019, 10:23

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.6570 |

| Take Profit | 0.6613, 0.6630 |

| Stop Loss | 0.6540 |

| Key Levels | 0.6480, 0.6500, 0.6524,0.6546, 0.6562, 0.6581, 0.6613, 0.6645 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6540 |

| Take Profit | 0.6500 |

| Stop Loss | 0.6570 |

| Key Levels | 0.6480, 0.6500, 0.6524,0.6546, 0.6562, 0.6581, 0.6613, 0.6645 |

Current trend

NZD strengthens noticeably against USD, developing an upward momentum formed at the end of last week. Demand for NZD rose significantly on May 31 after Donald Trump threatened to raise import duties on all Mexican goods, if Mexico did not restrict the flow of illegal migrants. The opening of the new front in the US trade war serves as a source of uncertainty and threatens with the negative consequences for the world economy. Moreover, the American economy may also be significantly affected, since the trade turnover between the United States and Mexico is still very high.

Today, New Zealand’s markets are closed to commemorate the Queen’s Birthday, so the focus will continue to be on the prospects for a new trade war between the United States and Mexico. Additional support for NZD is provided by Chinese statistics. Caixin Manufacturing PMI in May remained at the same level of 50.2 points, while the forecast was for a decline to 50.0 points.

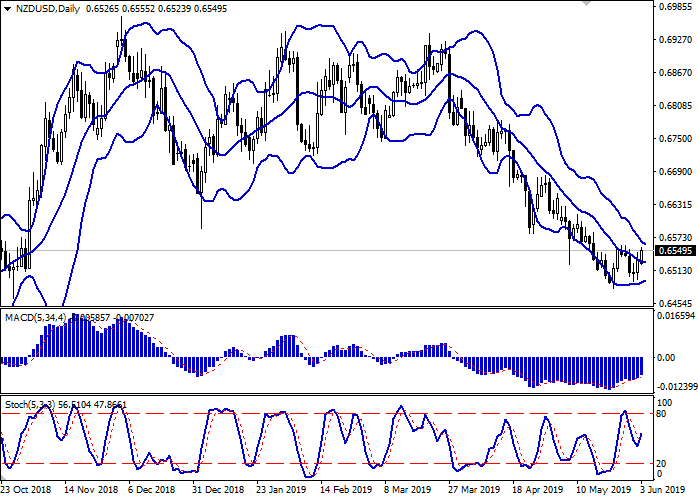

Support and resistance

On the D1 chart, Bollinger Bands are gradually reversing horizontally. The price range is narrowing, reflecting a change of trend in the short/medium term. MACD is growing, keeping a weak buy signal (located above the signal line). Stochastic reversed upwards again after a short decline last week.

Technical indicators do not contradict the further development of the uptrend in the short and/or ultra-short term.

Resistance levels: 0.6562, 0.6581, 0.6613, 0.6645.

Support levels: 0.6546, 0.6524, 0.6500, 0.6480.

Trading tips

To open long positions, one can rely on the breakout of 0.6562. Take profit — 0.6613 or 0.6630. Stop loss — 0.6540.

A rebound from 0.6562 as from resistance followed by a breakdown of 0.6546 may become a signal for corrective sales with the target at 0.6500. Stop loss — 0.6570.

Implementation time: 2-3 days.

NZD strengthens noticeably against USD, developing an upward momentum formed at the end of last week. Demand for NZD rose significantly on May 31 after Donald Trump threatened to raise import duties on all Mexican goods, if Mexico did not restrict the flow of illegal migrants. The opening of the new front in the US trade war serves as a source of uncertainty and threatens with the negative consequences for the world economy. Moreover, the American economy may also be significantly affected, since the trade turnover between the United States and Mexico is still very high.

Today, New Zealand’s markets are closed to commemorate the Queen’s Birthday, so the focus will continue to be on the prospects for a new trade war between the United States and Mexico. Additional support for NZD is provided by Chinese statistics. Caixin Manufacturing PMI in May remained at the same level of 50.2 points, while the forecast was for a decline to 50.0 points.

Support and resistance

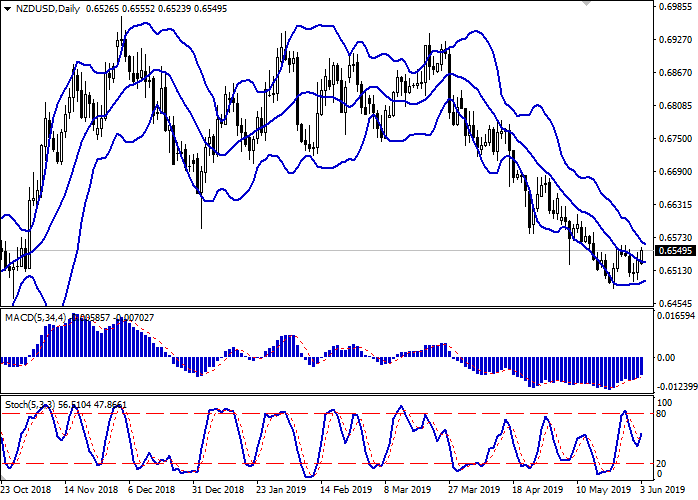

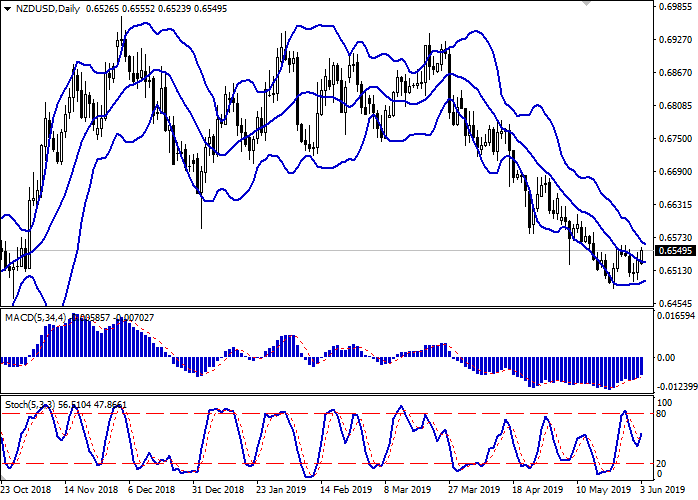

On the D1 chart, Bollinger Bands are gradually reversing horizontally. The price range is narrowing, reflecting a change of trend in the short/medium term. MACD is growing, keeping a weak buy signal (located above the signal line). Stochastic reversed upwards again after a short decline last week.

Technical indicators do not contradict the further development of the uptrend in the short and/or ultra-short term.

Resistance levels: 0.6562, 0.6581, 0.6613, 0.6645.

Support levels: 0.6546, 0.6524, 0.6500, 0.6480.

Trading tips

To open long positions, one can rely on the breakout of 0.6562. Take profit — 0.6613 or 0.6630. Stop loss — 0.6540.

A rebound from 0.6562 as from resistance followed by a breakdown of 0.6546 may become a signal for corrective sales with the target at 0.6500. Stop loss — 0.6570.

Implementation time: 2-3 days.

No comments:

Write comments