USD/JPY: technical analysis

17 June 2019, 11:21

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL |

| Entry Point | 108.59 |

| Take Profit | 108.15 |

| Stop Loss | 108.80 |

| Key Levels | 107.51, 107.81, 108.15, 108.54, 108.80, 109.14, 109.46, 109.92 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 108.80 |

| Take Profit | 109.40 |

| Stop Loss | 108.50 |

| Key Levels | 107.51, 107.81, 108.15, 108.54, 108.80, 109.14, 109.46, 109.92 |

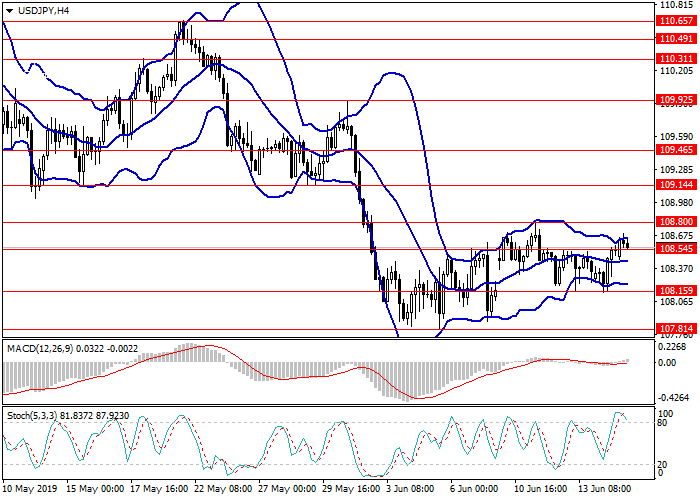

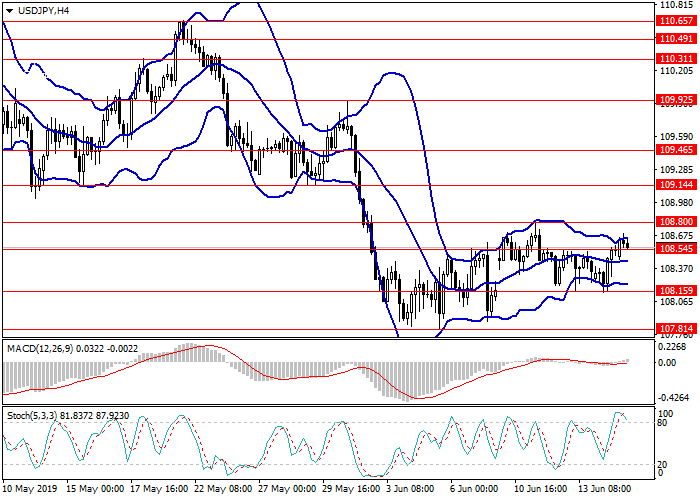

USD/JPY, H4

On the H4 chart, a lateral trend has formed. The instrument is moving within a narrow lateral channel formed by the boundaries of Bollinger Bands. MACD histogram is close to the zero level, keeping the minimum volumes; the indicator signal line moves parallel to the zero level, without generating a specific signal to enter the market. Stochastic is in the overbought zone, the oscillator lines are reversing downwards, forming a signal to open short positions.

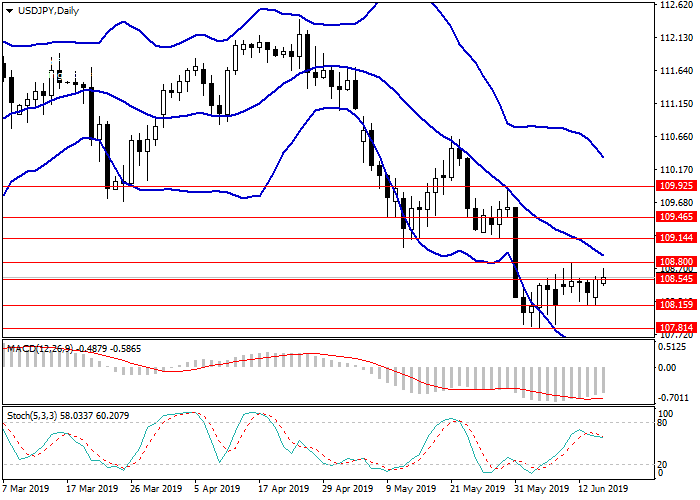

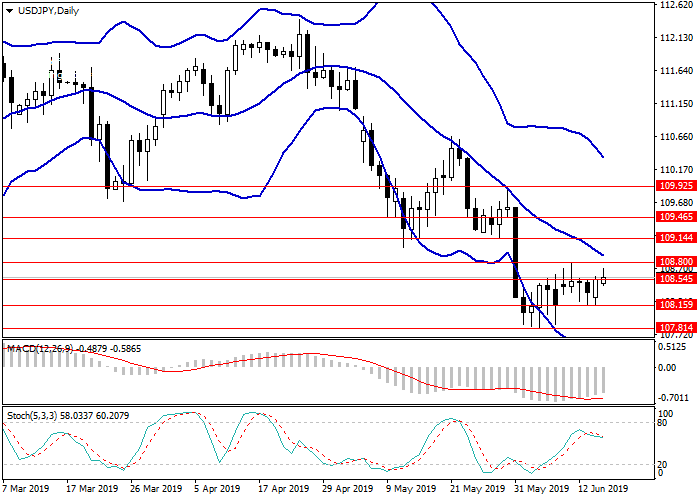

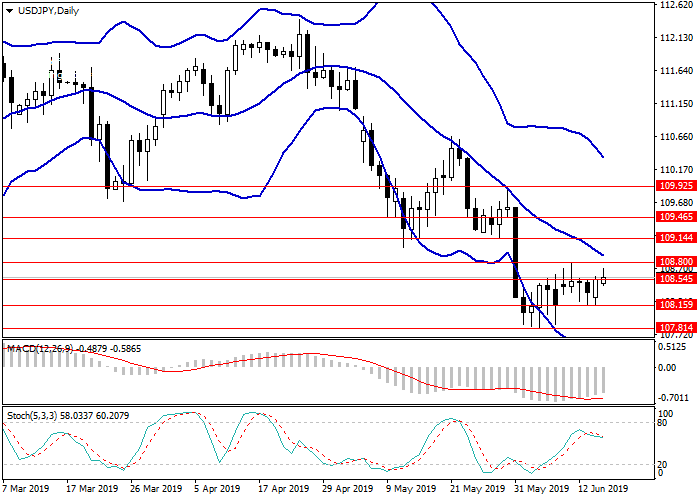

USD/JPY, D1

On the D1 chart, the downtrend is still in force. The instrument is trading between the center and lower lines of Bollinger Bands; the price range is narrowed. MACD histogram is in the negative zone keeping a signal for the opening of sell positions. Stochastic is in the neutral zone, and the lines of the oscillator are reversing downwards.

Key levels

Resistance levels: 108.80, 109.14, 109.46, 109.92.

Support levels: 108.54, 108.15, 107.81, 107.51.

Trading tips

Short positions may be opened from the current level with target at 108.15. Stop loss – 108.80.

Long positions may be opened from the level of 108.80 with target at 109.40 and stop loss at 108.50.

Implementation time: 1-3 days.

On the H4 chart, a lateral trend has formed. The instrument is moving within a narrow lateral channel formed by the boundaries of Bollinger Bands. MACD histogram is close to the zero level, keeping the minimum volumes; the indicator signal line moves parallel to the zero level, without generating a specific signal to enter the market. Stochastic is in the overbought zone, the oscillator lines are reversing downwards, forming a signal to open short positions.

USD/JPY, D1

On the D1 chart, the downtrend is still in force. The instrument is trading between the center and lower lines of Bollinger Bands; the price range is narrowed. MACD histogram is in the negative zone keeping a signal for the opening of sell positions. Stochastic is in the neutral zone, and the lines of the oscillator are reversing downwards.

Key levels

Resistance levels: 108.80, 109.14, 109.46, 109.92.

Support levels: 108.54, 108.15, 107.81, 107.51.

Trading tips

Short positions may be opened from the current level with target at 108.15. Stop loss – 108.80.

Long positions may be opened from the level of 108.80 with target at 109.40 and stop loss at 108.50.

Implementation time: 1-3 days.

No comments:

Write comments