USD/CAD: general analysis

17 June 2019, 12:20

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.3430 |

| Take Profit | 1.3480 |

| Stop Loss | 1.3400 |

| Key Levels | 1.3237, 1.3250, 1.3288, 1.3312, 1.3344, 1.3373, 1.3388, 1.3405, 1.3422, 1.3448, 1.3488, 1.3523, 1.3564 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.3340 |

| Take Profit | 1.3290 |

| Stop Loss | 1.3370 |

| Key Levels | 1.3237, 1.3250, 1.3288, 1.3312, 1.3344, 1.3373, 1.3388, 1.3405, 1.3422, 1.3448, 1.3488, 1.3523, 1.3564 |

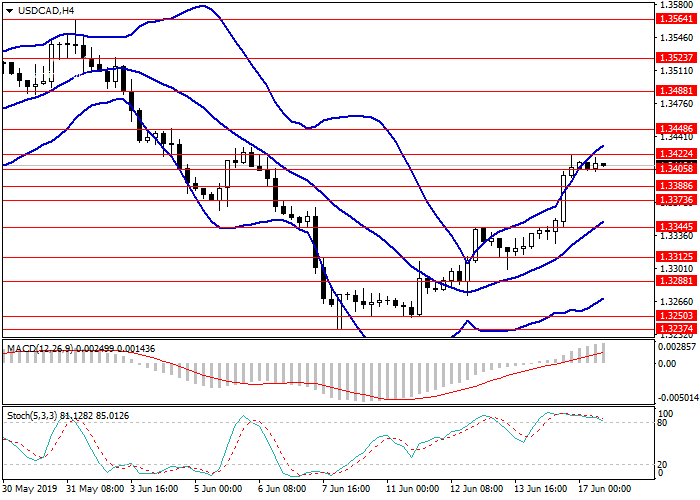

Current trend

On Friday, USD strengthened significantly against CAD due to the publication of strong US macroeconomic statistics: Industrial Production in May rose by 0.4% MoM after falling by 0.4% MoM in the previous month. Analysts were expecting a recovery of positive dynamics but waited for the increase only by 0.2% MoM. The Capacity Utilization rate in May rose from 77.9% to 78.1%, which turned out to be better than the market forecast of 78.0%.

Today, US NY Empire State Manufacturing Index, which will be published at 14:30 (GMT+2), may affect the price movement. At the same time, in Canada Foreign Securities Purchases and Foreign Securities Purchases by Canadians data will be released. The market predicts moderate volatility.

Support and resistance

Resistance levels: 1.3422, 1.3448, 1.3488, 1.3523, 1.3564.

Support levels: 1.3405, 1.3388, 1.3373, 1.3344, 1.3312, 1.3288, 1.3250, 1.3237.

Trading tips

Long positions can be opened from the level of 1.3430 with the target at 1.3480 and stop loss 1.3400.

Short positions can be opened from the level of 1.3340 with the target at 1.3290 and stop loss 1.3370.

Implementation period: 1–3 days.

On Friday, USD strengthened significantly against CAD due to the publication of strong US macroeconomic statistics: Industrial Production in May rose by 0.4% MoM after falling by 0.4% MoM in the previous month. Analysts were expecting a recovery of positive dynamics but waited for the increase only by 0.2% MoM. The Capacity Utilization rate in May rose from 77.9% to 78.1%, which turned out to be better than the market forecast of 78.0%.

Today, US NY Empire State Manufacturing Index, which will be published at 14:30 (GMT+2), may affect the price movement. At the same time, in Canada Foreign Securities Purchases and Foreign Securities Purchases by Canadians data will be released. The market predicts moderate volatility.

Support and resistance

Resistance levels: 1.3422, 1.3448, 1.3488, 1.3523, 1.3564.

Support levels: 1.3405, 1.3388, 1.3373, 1.3344, 1.3312, 1.3288, 1.3250, 1.3237.

Trading tips

Long positions can be opened from the level of 1.3430 with the target at 1.3480 and stop loss 1.3400.

Short positions can be opened from the level of 1.3340 with the target at 1.3290 and stop loss 1.3370.

Implementation period: 1–3 days.

No comments:

Write comments