AUD/USD: Australian dollar is going down

17 June 2019, 09:54

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.6885, 0.6905 |

| Take Profit | 0.6946, 0.6964 |

| Stop Loss | 0.6860 |

| Key Levels | 0.6826, 0.6850, 0.6860, 0.6883, 0.6900, 0.6920, 0.6933 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6855, 0.6845 |

| Take Profit | 0.6826, 0.6810, 0.6800 |

| Stop Loss | 0.6870, 0.6883 |

| Key Levels | 0.6826, 0.6850, 0.6860, 0.6883, 0.6900, 0.6920, 0.6933 |

Current trend

AUD showed a decline against USD on Friday, having updated local lows of the beginning of 2019. The development of negative dynamics of the instrument on Friday was due to strong macroeconomic statistics from the US, coupled with increased uncertainty in the market. Macroeconomic statistics from China also put certain pressure on the pair. Industrial Production in May slowed down from +5.4% to +5.0% YoY, while analysts predicted growth of the rate to +5.5% YoY. Fixed Asset Investment decreased from +6.1% YoY to +5.6% YoY, which also turned out to be worse than forecast of 6.1%.

During the Asian session on June 17, the instrument is trading ambiguously, waiting for new drivers to appear at the market. The macroeconomic background is relatively poor today, so an increase in volatility is expected from Tuesday, when the minutes of the RBA meeting will be published.

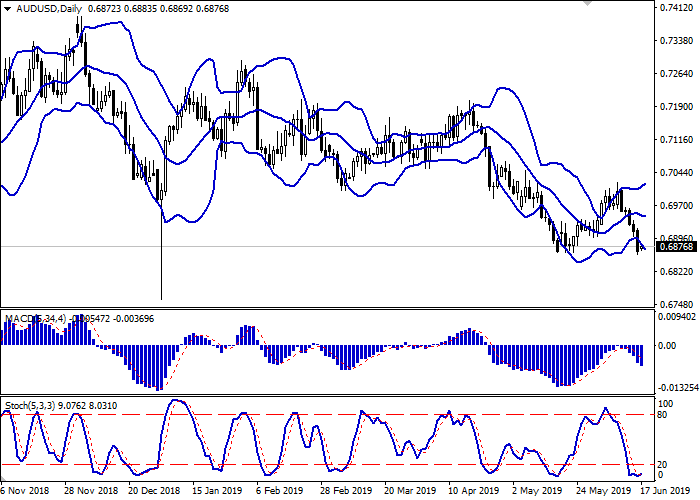

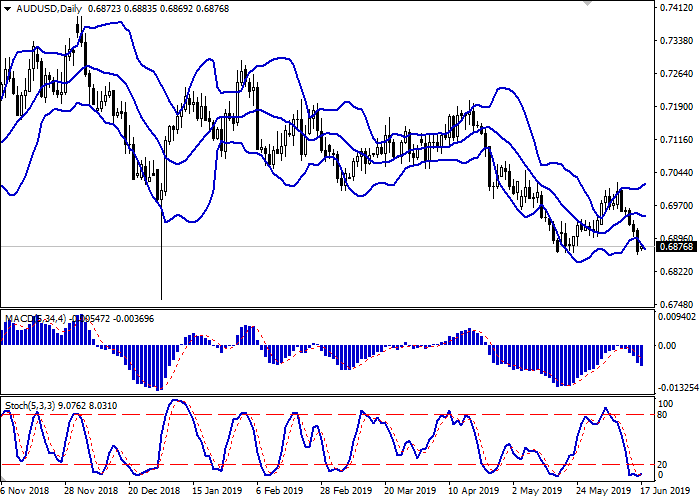

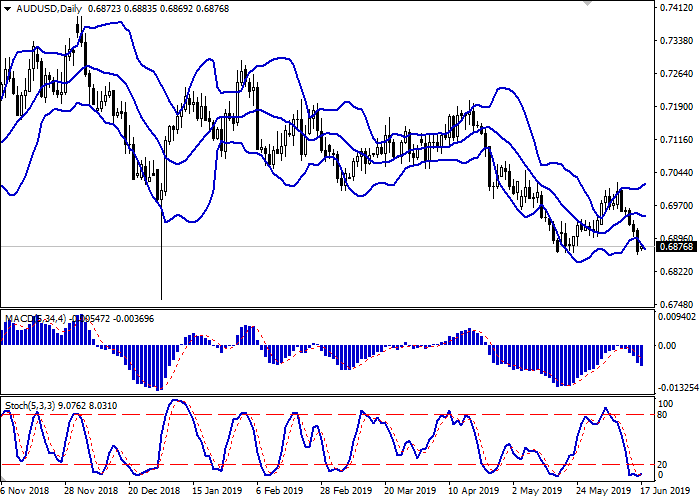

Support and resistance

Bollinger Bands in the D1 chart demonstrate flat dynamics. The price range is widening but does not conform to the development of the "bearish" trend yet. MACD is going down keeping a fairly stable sell signal (located below the signal line). Stochastic, having reached its lows, reversed to the horizontal plane, indicating risks of correctional growth development in the short and/or ultra-short term.

To open new positions, it is necessary to wait for the additional trade signals to appear.

Resistance levels: 0.6883, 0.6900, 0.6920, 0.6933.

Support levels: 0.6860, 0.6850, 0.6826.

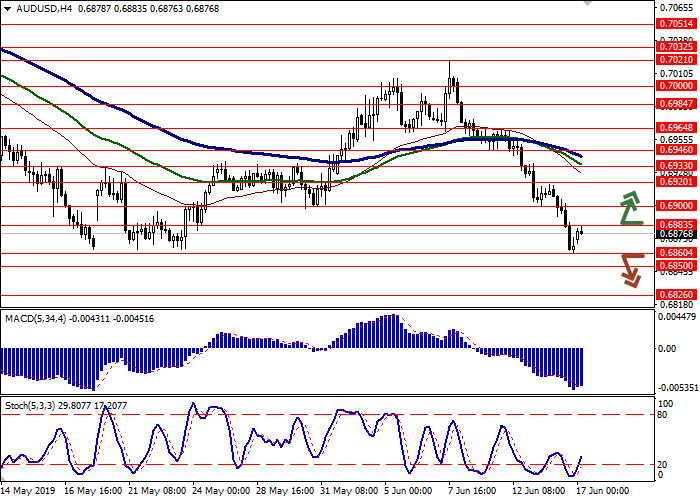

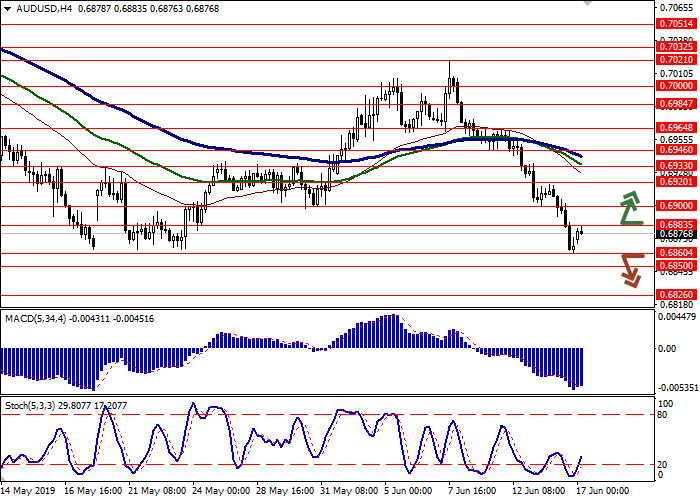

Trading tips

To open long positions, one can rely on the breakout of 0.6883 or 0.6900. Take profit — 0.6946 or 0.6964. Stop loss — 0.6870–0.6860.

A breakdown of 0.6860–0.6850 may be a signal to further sales with target at 0.6826 or 0.6810–0.6800. Stop loss — 0.6870–0.6883.

Implementation time: 2-3 days.

AUD showed a decline against USD on Friday, having updated local lows of the beginning of 2019. The development of negative dynamics of the instrument on Friday was due to strong macroeconomic statistics from the US, coupled with increased uncertainty in the market. Macroeconomic statistics from China also put certain pressure on the pair. Industrial Production in May slowed down from +5.4% to +5.0% YoY, while analysts predicted growth of the rate to +5.5% YoY. Fixed Asset Investment decreased from +6.1% YoY to +5.6% YoY, which also turned out to be worse than forecast of 6.1%.

During the Asian session on June 17, the instrument is trading ambiguously, waiting for new drivers to appear at the market. The macroeconomic background is relatively poor today, so an increase in volatility is expected from Tuesday, when the minutes of the RBA meeting will be published.

Support and resistance

Bollinger Bands in the D1 chart demonstrate flat dynamics. The price range is widening but does not conform to the development of the "bearish" trend yet. MACD is going down keeping a fairly stable sell signal (located below the signal line). Stochastic, having reached its lows, reversed to the horizontal plane, indicating risks of correctional growth development in the short and/or ultra-short term.

To open new positions, it is necessary to wait for the additional trade signals to appear.

Resistance levels: 0.6883, 0.6900, 0.6920, 0.6933.

Support levels: 0.6860, 0.6850, 0.6826.

Trading tips

To open long positions, one can rely on the breakout of 0.6883 or 0.6900. Take profit — 0.6946 or 0.6964. Stop loss — 0.6870–0.6860.

A breakdown of 0.6860–0.6850 may be a signal to further sales with target at 0.6826 or 0.6810–0.6800. Stop loss — 0.6870–0.6883.

Implementation time: 2-3 days.

No comments:

Write comments