USD/JPY: the pair is trading in both directions

14 June 2019, 10:18

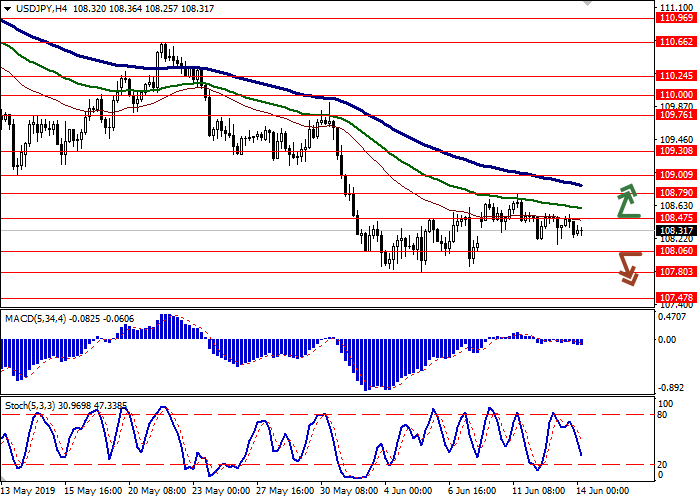

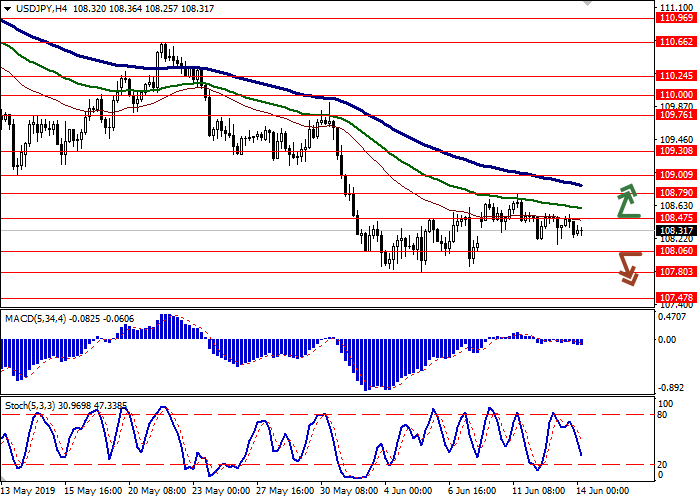

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 108.50, 108.65, 108.85 |

| Take Profit | 109.50, 109.76 |

| Stop Loss | 108.30, 108.10 |

| Key Levels | 107.47, 107.80, 108.06, 108.47, 108.79, 109.00, 109.30 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 108.00 |

| Take Profit | 107.47, 107.20 |

| Stop Loss | 108.30, 108.40 |

| Key Levels | 107.47, 107.80, 108.06, 108.47, 108.79, 109.00, 109.30 |

Current trend

USD fell against JPY on Thursday, being under pressure from weak US statistics. Also, market uncertainty provides significant support to JPY. Thursday's data from the US indicated an increase in Initial Jobless Claims by 222K, which turned out to be worse than the data for the previous period (219K) and the forecast of 216K. Import Price Index in May decreased by –0.3% MoM and –1.5% YoY, with the forecast of –0.2% MoM and –1.4% YoY. Export Price Index showed a decrease of –0.2% MoM and –0.7% YoY, which also turned out to be worse than forecasts of –0.1% MoM and –0.5% YoY.

Today, the instrument is relatively stable. Some support for JPY has been provided by macroeconomic statistics on Japan Industrial Production. In April, production volumes increased by 0.6% MoM, which coincided with the forecasts. Capacity Utilization in April increased by 1.6% MoM after the decline by 0.4% MoM in the previous month.

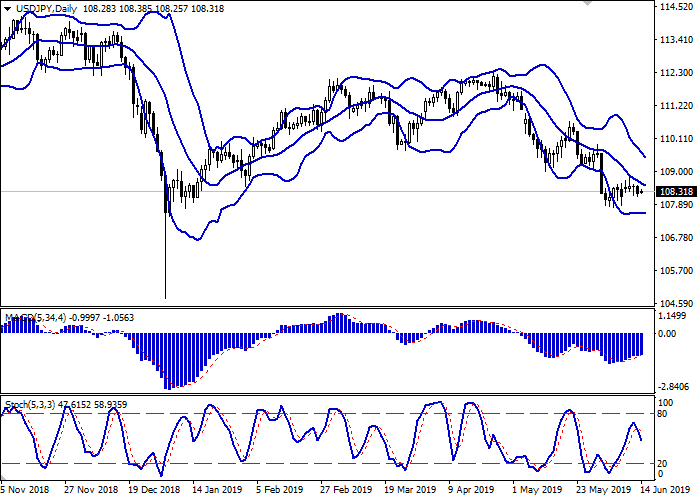

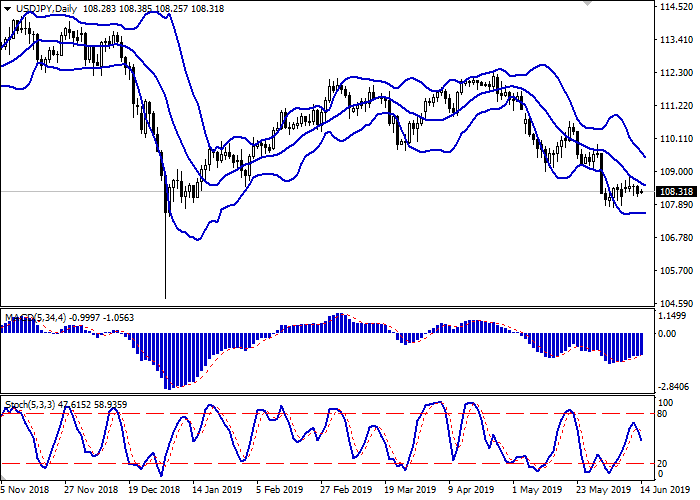

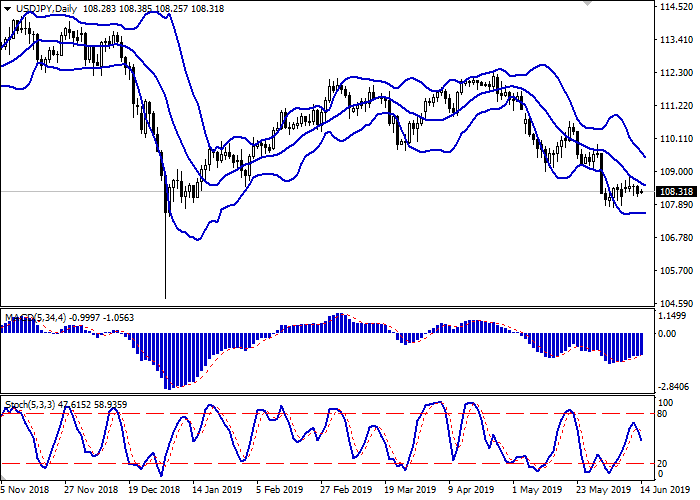

Support and resistance

Bollinger Bands in D1 chart decrease gradually. The price range is narrowing, reflecting ambiguous dynamics of trading in the short term. MACD is growing, keeping a weak buy signal (located above the signal line). Stochastic interrupted steady growth and reversed into a descending plane, responding to the "bearish" trend, observed since the middle of this week.

One should wait for clarification of the situation to open new transactions.

Resistance levels: 108.47, 108.79, 109.00, 109.30.

Support levels: 108.06, 107.80, 107.47.

Trading tips

To open long positions, one can rely on the breakout of 108.47 or 108.60–108.79. Take profit — 109.50 or 109.76. Stop loss — 108.30 or 108.10.

A breakdown of 108.06 may be a signal to further sales with target at 107.47 or 107.20. Stop loss — 108.30–108.40.

Implementation time: 2-3 days.

USD fell against JPY on Thursday, being under pressure from weak US statistics. Also, market uncertainty provides significant support to JPY. Thursday's data from the US indicated an increase in Initial Jobless Claims by 222K, which turned out to be worse than the data for the previous period (219K) and the forecast of 216K. Import Price Index in May decreased by –0.3% MoM and –1.5% YoY, with the forecast of –0.2% MoM and –1.4% YoY. Export Price Index showed a decrease of –0.2% MoM and –0.7% YoY, which also turned out to be worse than forecasts of –0.1% MoM and –0.5% YoY.

Today, the instrument is relatively stable. Some support for JPY has been provided by macroeconomic statistics on Japan Industrial Production. In April, production volumes increased by 0.6% MoM, which coincided with the forecasts. Capacity Utilization in April increased by 1.6% MoM after the decline by 0.4% MoM in the previous month.

Support and resistance

Bollinger Bands in D1 chart decrease gradually. The price range is narrowing, reflecting ambiguous dynamics of trading in the short term. MACD is growing, keeping a weak buy signal (located above the signal line). Stochastic interrupted steady growth and reversed into a descending plane, responding to the "bearish" trend, observed since the middle of this week.

One should wait for clarification of the situation to open new transactions.

Resistance levels: 108.47, 108.79, 109.00, 109.30.

Support levels: 108.06, 107.80, 107.47.

Trading tips

To open long positions, one can rely on the breakout of 108.47 or 108.60–108.79. Take profit — 109.50 or 109.76. Stop loss — 108.30 or 108.10.

A breakdown of 108.06 may be a signal to further sales with target at 107.47 or 107.20. Stop loss — 108.30–108.40.

Implementation time: 2-3 days.

No comments:

Write comments