EUR/USD: general review

14 June 2019, 11:05

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 1.1265 |

| Take Profit | 1.1220 |

| Stop Loss | 1.1300 |

| Key Levels | 1.1203, 1.1219, 1.1244, 1.1267, 1.1303, 1.1325, 1.1336, 1.1347 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.1305 |

| Take Profit | 1.1345 |

| Stop Loss | 1.1270 |

| Key Levels | 1.1203, 1.1219, 1.1244, 1.1267, 1.1303, 1.1325, 1.1336, 1.1347 |

Current trend

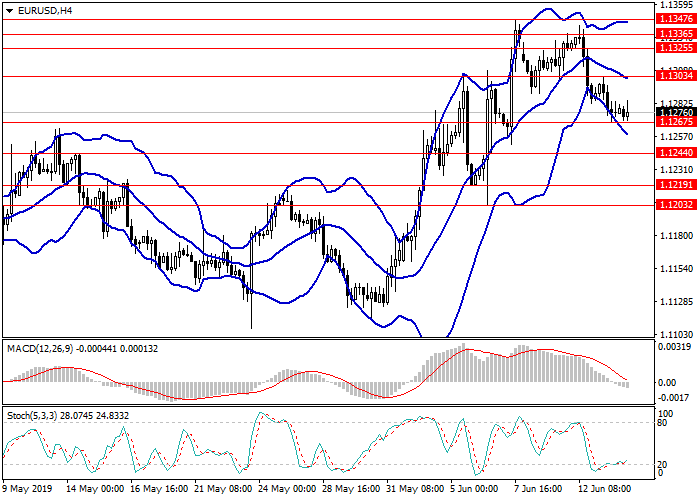

EUR, having reached two-month highs against USD at 1.1347, weakened dropping below 1.1300 under pressure from the possible imposition of US sanctions on Germany regarding the construction of a gas pipeline from Russia. The fear is that if the gas transit through Ukraine is stopped, the constructed pipeline can be used by Moscow as an instrument of pressure on the countries of Western Europe. Macroeconomic data did not support the euro either: Industrial Production in the euro area slowed down by 0.5% MoM and by 0.4% YoY.

Today market participants are waiting for the release of the data on the US Retail Sales (14:30 GMT+2). The market is expected to be highly volatile.

Support and resistance

Resistance levels: 1.1303, 1.1325, 1.1336, 1.1347.

Support levels: 1.1267, 1.1244, 1.1219, 1.1203.

Trading tips

Short positions may be opened from the level of 1.1265 with target at 1.1220 and stop loss at 1.1300.

Long positions may be opened from the level of 1.1305 with target at 1.1345 and stop loss at 1.1270.

Implementation time: 1-3 days.

EUR, having reached two-month highs against USD at 1.1347, weakened dropping below 1.1300 under pressure from the possible imposition of US sanctions on Germany regarding the construction of a gas pipeline from Russia. The fear is that if the gas transit through Ukraine is stopped, the constructed pipeline can be used by Moscow as an instrument of pressure on the countries of Western Europe. Macroeconomic data did not support the euro either: Industrial Production in the euro area slowed down by 0.5% MoM and by 0.4% YoY.

Today market participants are waiting for the release of the data on the US Retail Sales (14:30 GMT+2). The market is expected to be highly volatile.

Support and resistance

Resistance levels: 1.1303, 1.1325, 1.1336, 1.1347.

Support levels: 1.1267, 1.1244, 1.1219, 1.1203.

Trading tips

Short positions may be opened from the level of 1.1265 with target at 1.1220 and stop loss at 1.1300.

Long positions may be opened from the level of 1.1305 with target at 1.1345 and stop loss at 1.1270.

Implementation time: 1-3 days.

No comments:

Write comments