USD/JPY: the dollar is consolidating

07 June 2019, 09:59

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 108.60 |

| Take Profit | 109.30, 109.50 |

| Stop Loss | 108.15 |

| Key Levels | 107.47, 107.80, 108.15, 108.55, 109.00, 109.30, 109.76 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 108.10 |

| Take Profit | 107.47, 107.30 |

| Stop Loss | 108.55 |

| Key Levels | 107.47, 107.80, 108.15, 108.55, 109.00, 109.30, 109.76 |

Current trend

USD showed ambiguous dynamic of trading against JPY, ending yesterday’s trading session with a slight decrease. Pressure on USD was exerted by weak macroeconomic data from the United States published on Thursday. In addition, investors are cautiously waiting for the release of the May report on the US labor market, because according to the previously published ADP report, the real state of the market may be significantly worse than expectations.

In turn, the yen continues to receive moderate support from the risks of developing US trade conflicts with China and Mexico and a possible interest rate cut by the Fed in the foreseeable future. The process of negotiations between the US and Mexico has not yet brought visible success, but the market as a whole is quite optimistic and expects that on June 10, import duties on Mexican goods will not be introduced.

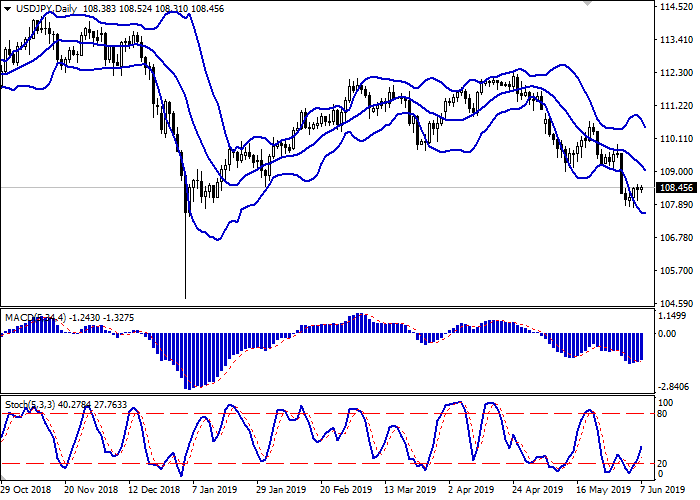

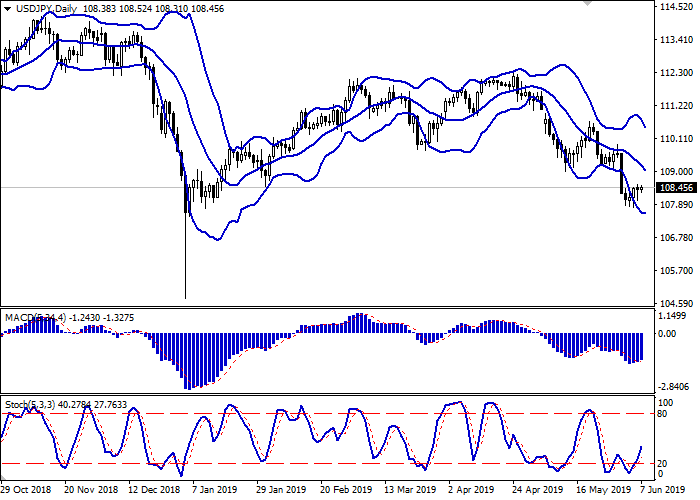

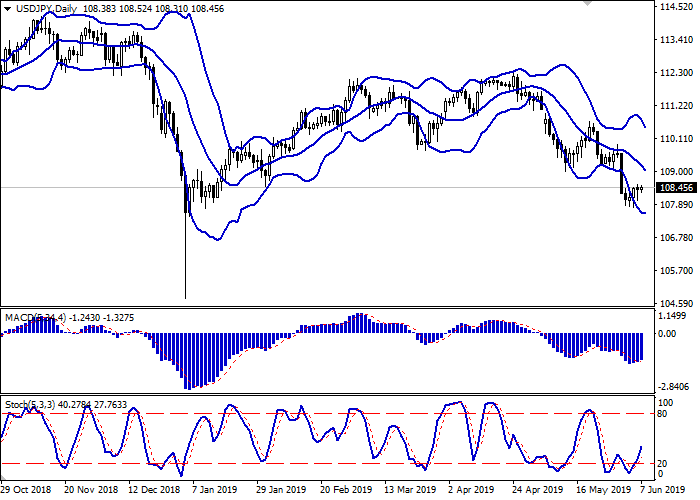

Support and resistance

Bollinger Bands in D1 chart demonstrate a gradual decrease. The price range is narrowing, reflecting the emergence of ambiguous dynamics of trading in the short term. MACD is growing, keeping a weak buy signal (located above the signal line). Stochastic shows similar dynamics, actively recovering from Tuesday. The indicator still points at sufficient potential for the development of corrective growth in the ultra-short term.

One should consider an opportunity to open new long positions in the short and/or ultra-short term.

Resistance levels: 108.55, 109.00, 109.30, 109.76.

Support levels: 108.15, 107.80, 107.47.

Trading tips

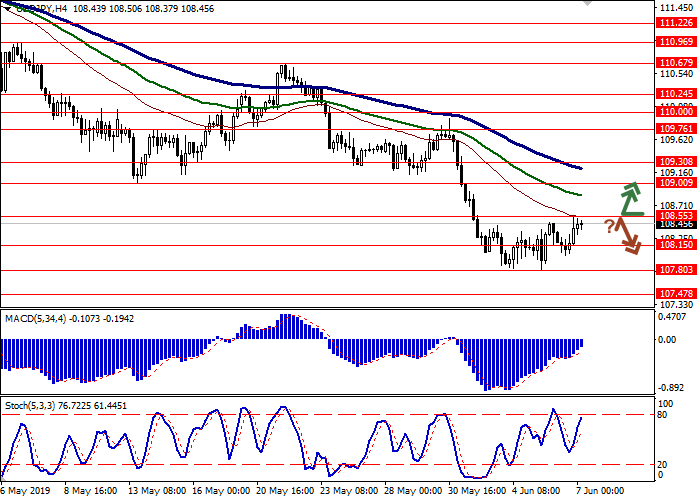

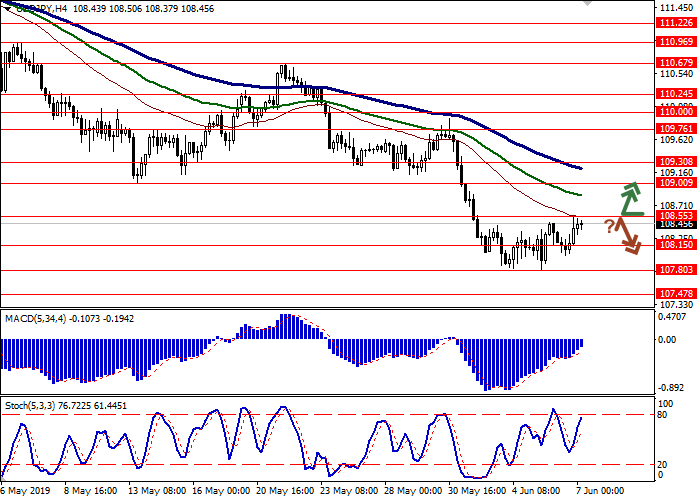

To open long positions, one can rely on the breakout of 108.55. Take profit — 109.30 or 109.50. Stop loss — 108.15.

The rebound from 108.55 as from resistance with the subsequent breakdown of 108.15 can become a signal to return to sales with targets at 107.47–107.30. Stop loss — 108.55.

Implementation time: 2-3 days.

USD showed ambiguous dynamic of trading against JPY, ending yesterday’s trading session with a slight decrease. Pressure on USD was exerted by weak macroeconomic data from the United States published on Thursday. In addition, investors are cautiously waiting for the release of the May report on the US labor market, because according to the previously published ADP report, the real state of the market may be significantly worse than expectations.

In turn, the yen continues to receive moderate support from the risks of developing US trade conflicts with China and Mexico and a possible interest rate cut by the Fed in the foreseeable future. The process of negotiations between the US and Mexico has not yet brought visible success, but the market as a whole is quite optimistic and expects that on June 10, import duties on Mexican goods will not be introduced.

Support and resistance

Bollinger Bands in D1 chart demonstrate a gradual decrease. The price range is narrowing, reflecting the emergence of ambiguous dynamics of trading in the short term. MACD is growing, keeping a weak buy signal (located above the signal line). Stochastic shows similar dynamics, actively recovering from Tuesday. The indicator still points at sufficient potential for the development of corrective growth in the ultra-short term.

One should consider an opportunity to open new long positions in the short and/or ultra-short term.

Resistance levels: 108.55, 109.00, 109.30, 109.76.

Support levels: 108.15, 107.80, 107.47.

Trading tips

To open long positions, one can rely on the breakout of 108.55. Take profit — 109.30 or 109.50. Stop loss — 108.15.

The rebound from 108.55 as from resistance with the subsequent breakdown of 108.15 can become a signal to return to sales with targets at 107.47–107.30. Stop loss — 108.55.

Implementation time: 2-3 days.

No comments:

Write comments