XAU/USD: gold prices are rising

07 June 2019, 09:58

| Scenario | |

|---|---|

| Timeframe | Intraday |

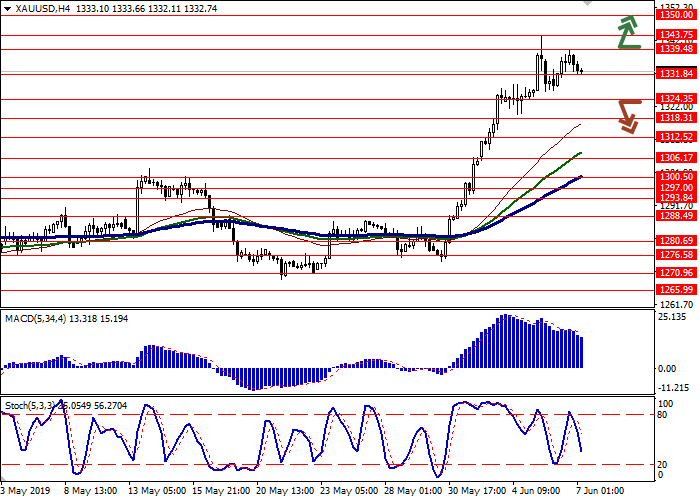

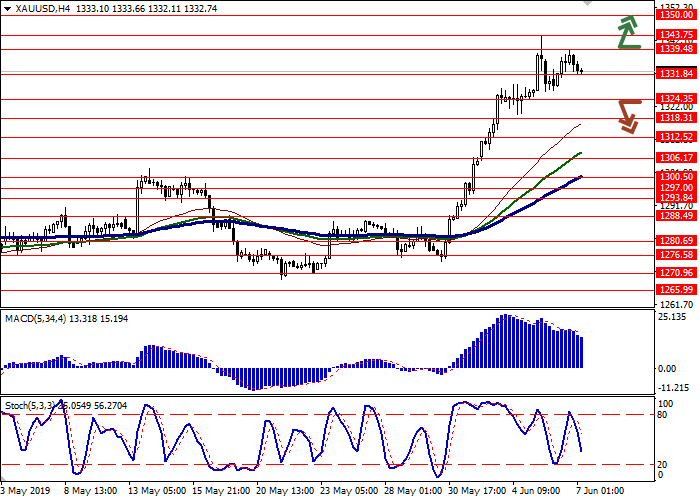

| Recommendation | BUY STOP |

| Entry Point | 1339.55 |

| Take Profit | 1350.00, 1355.00 |

| Stop Loss | 1333.00 |

| Key Levels | 1312.52, 1318.31, 1324.35, 1331.84, 1339.48, 1343.75, 1350.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1324.30 |

| Take Profit | 1312.52,1306.17 |

| Stop Loss | 1330.00, 1331.84 |

| Key Levels | 1312.52, 1318.31, 1324.35, 1331.84, 1339.48, 1343.75, 1350.00 |

Current trend

Yesterday, gold prices rose markedly, again approaching its local highs, renewed on Wednesday. The instrument is supported by poor positions of the US currency, which is under pressure from uncertain macroeconomic statistics and is awaiting the publication of the May report on the labor market. Also, the course is positively influenced by expectations of lower interest rates by the US Federal Reserve System, which official representatives of the regulator are increasingly saying recently. Demand is also supported by US trade conflicts with China and Mexico, which provoke investors to avoid unnecessary risk.

Support and resistance

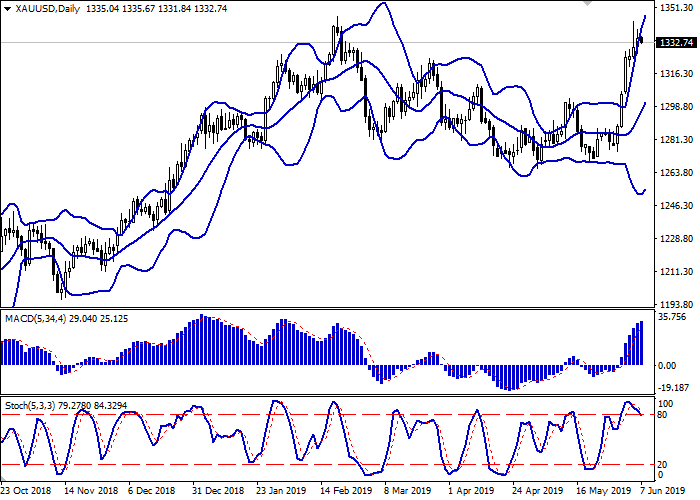

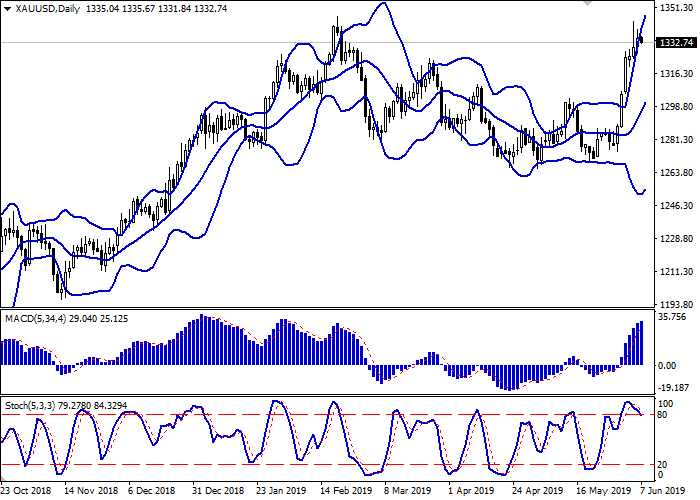

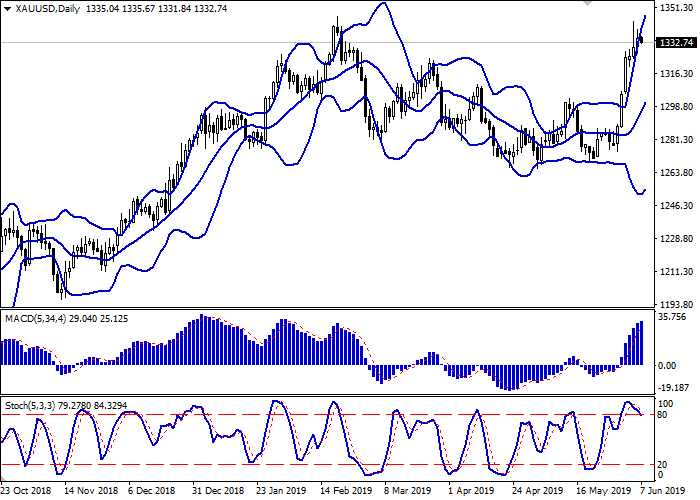

Bollinger bands are growing steadily on the daily chart. The price range is actively expanding from above, however, not as fast as the upward dynamics develop. The MACD indicator is growing, keeping a moderate buy signal (the histogram is above the signal line). Stochastic, reaching its highs, reverses downwards, indicating that the instrument is overbought in the super short term.

It is better to wait for the appearance of additional “bearish” signals from technical indicators.

Resistance levels: 1339.48, 1343.75, 1350.00.

Support levels: 1331.84, 1324.35, 1318.31, 1312.52.

Trading tips

Long positions can be opened after the breakout of the level of 1339.48 with the target at 1350.00 or 1355.00. Stop loss is 1333.00. Implementation period: 1–2 days.

Short positions can be opened after the breakdown of the level of 1324.35 with the target at 1312.52 or 1306.17. Stop loss is 1330.00 or 1331.84. Implementation period: 2–3 days.

Yesterday, gold prices rose markedly, again approaching its local highs, renewed on Wednesday. The instrument is supported by poor positions of the US currency, which is under pressure from uncertain macroeconomic statistics and is awaiting the publication of the May report on the labor market. Also, the course is positively influenced by expectations of lower interest rates by the US Federal Reserve System, which official representatives of the regulator are increasingly saying recently. Demand is also supported by US trade conflicts with China and Mexico, which provoke investors to avoid unnecessary risk.

Support and resistance

Bollinger bands are growing steadily on the daily chart. The price range is actively expanding from above, however, not as fast as the upward dynamics develop. The MACD indicator is growing, keeping a moderate buy signal (the histogram is above the signal line). Stochastic, reaching its highs, reverses downwards, indicating that the instrument is overbought in the super short term.

It is better to wait for the appearance of additional “bearish” signals from technical indicators.

Resistance levels: 1339.48, 1343.75, 1350.00.

Support levels: 1331.84, 1324.35, 1318.31, 1312.52.

Trading tips

Long positions can be opened after the breakout of the level of 1339.48 with the target at 1350.00 or 1355.00. Stop loss is 1333.00. Implementation period: 1–2 days.

Short positions can be opened after the breakdown of the level of 1324.35 with the target at 1312.52 or 1306.17. Stop loss is 1330.00 or 1331.84. Implementation period: 2–3 days.

No comments:

Write comments