USD/CAD: dollar is being corrected

11 June 2019, 09:47

| Scenario | |

|---|---|

| Timeframe | Intraday |

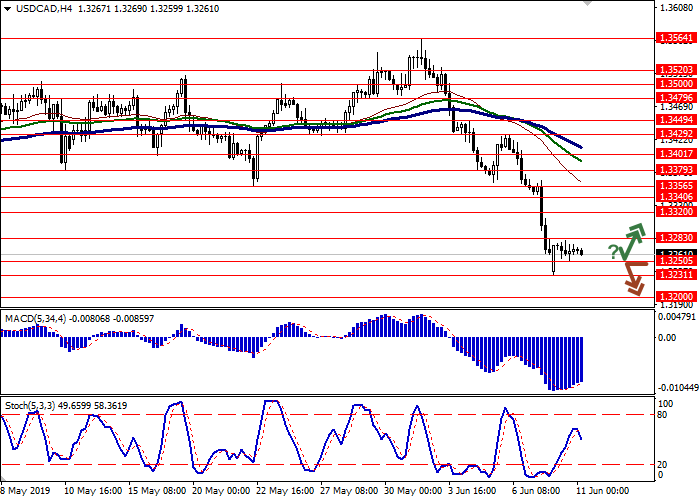

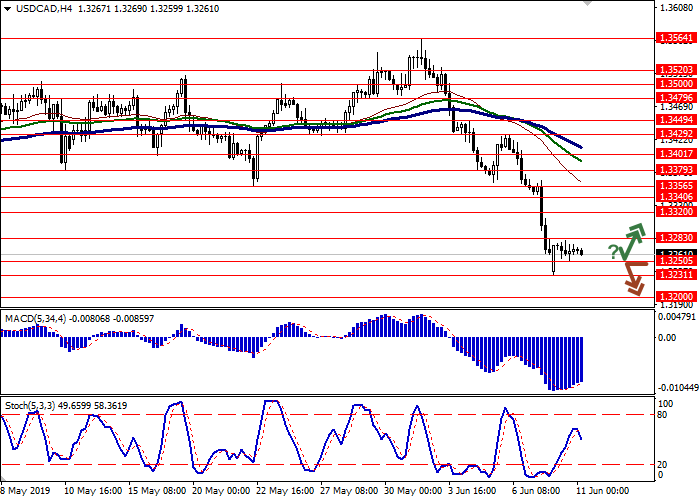

| Recommendation | BUY STOP |

| Entry Point | 1.3290 |

| Take Profit | 1.3356, 1.3379 |

| Stop Loss | 1.3240, 1.3231 |

| Key Levels | 1.3200, 1.3231, 1.3250, 1.3283, 1.3320, 1.3340, 1.3356 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.3245 |

| Take Profit | 1.3200, 1.3185 |

| Stop Loss | 1.3283 |

| Key Levels | 1.3200, 1.3231, 1.3250, 1.3283, 1.3320, 1.3340, 1.3356 |

Current trend

Yesterday, USD grew moderately against CAD, slightly balancing the sharp decline at the end of the last trading week, which was due to the release of the disappointing report on the US labor market. Poor data reinforced investors' concerns about the Fed's interest rate cut in the second half of this year. On Friday, Canada published much stronger data on the labor market. The unemployment rate in May dropped sharply from 5.7% to 5.4%, which is a record level since 1974.

At the beginning of the new week, consumer sentiment on CAD is supported by strong data from the country's construction market. Thus, the number of Building Permits in April rose by 14.7% MoM after rising by 2.8% MoM last month. Analysts counted on only +0.5% MoM. The volume of House Starts in May increased by 202.3K YoY after rising by 233.4K YoY last month.

Support and resistance

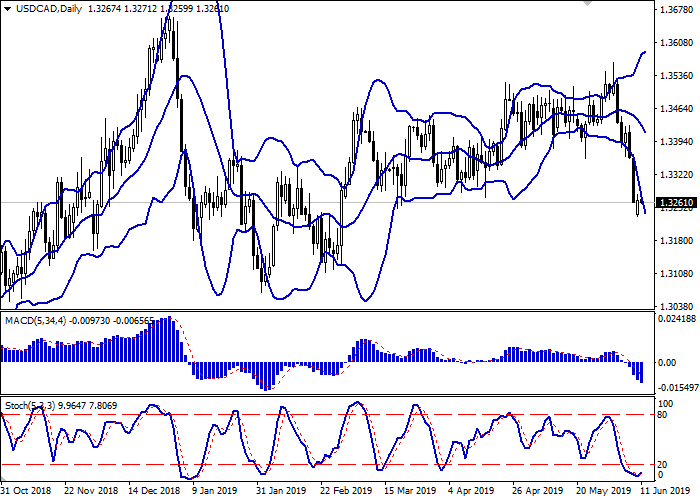

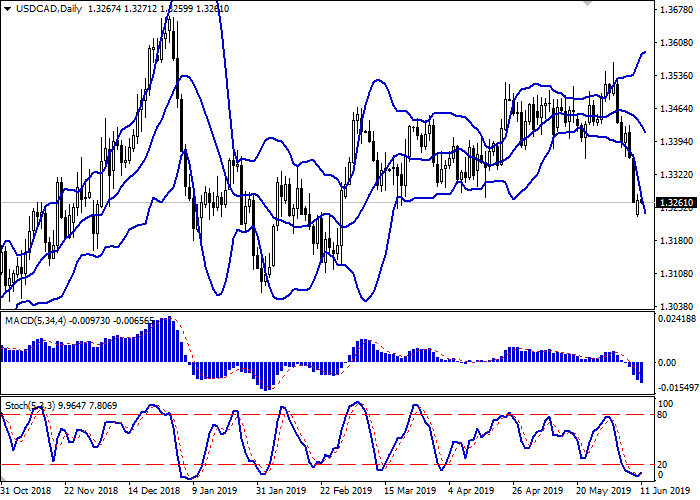

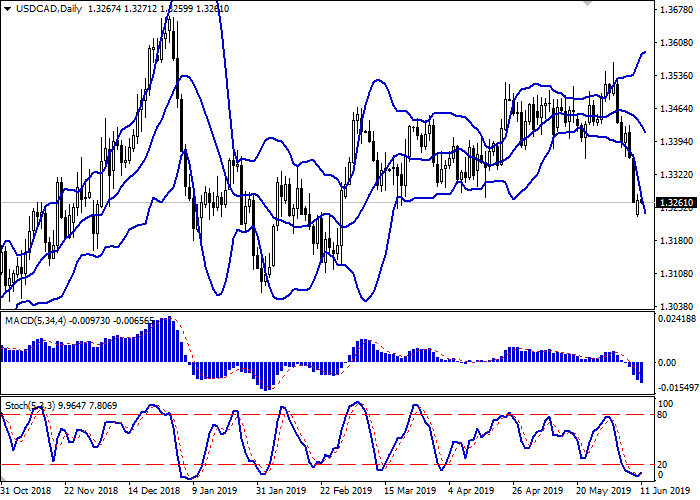

On the daily chart, Bollinger bands steadily decline. The price range actively expands but not as fast as the “bearish” moods develop. The MACD falls, keeping a strong sell signal (the histogram is below the signal line). Stochastic, having reached its lows, tries to reverse upwards, signaling that USD is strongly oversold in the super short term.

A corrective growth in the short and/or ultra-short term is possible.

Resistance levels: 1.3283, 1.3320, 1.3340, 1.3356.

Support levels: 1.3250, 1.3231, 1.3200.

Trading tips

Long positions can be opened after a rebound from 1.3250 and the breakout of 1.3283 with the target at 1.3356 or 1.3379. Stop loss is 1.3240–1.3231. Implementation period: 2–3 days.

Short positions can be opened after the breakdown of 1.3250 with the target at 1.3200 or 1.3185. Stop loss is 1.3283. Implementation period: 1–2 days.

Yesterday, USD grew moderately against CAD, slightly balancing the sharp decline at the end of the last trading week, which was due to the release of the disappointing report on the US labor market. Poor data reinforced investors' concerns about the Fed's interest rate cut in the second half of this year. On Friday, Canada published much stronger data on the labor market. The unemployment rate in May dropped sharply from 5.7% to 5.4%, which is a record level since 1974.

At the beginning of the new week, consumer sentiment on CAD is supported by strong data from the country's construction market. Thus, the number of Building Permits in April rose by 14.7% MoM after rising by 2.8% MoM last month. Analysts counted on only +0.5% MoM. The volume of House Starts in May increased by 202.3K YoY after rising by 233.4K YoY last month.

Support and resistance

On the daily chart, Bollinger bands steadily decline. The price range actively expands but not as fast as the “bearish” moods develop. The MACD falls, keeping a strong sell signal (the histogram is below the signal line). Stochastic, having reached its lows, tries to reverse upwards, signaling that USD is strongly oversold in the super short term.

A corrective growth in the short and/or ultra-short term is possible.

Resistance levels: 1.3283, 1.3320, 1.3340, 1.3356.

Support levels: 1.3250, 1.3231, 1.3200.

Trading tips

Long positions can be opened after a rebound from 1.3250 and the breakout of 1.3283 with the target at 1.3356 or 1.3379. Stop loss is 1.3240–1.3231. Implementation period: 2–3 days.

Short positions can be opened after the breakdown of 1.3250 with the target at 1.3200 or 1.3185. Stop loss is 1.3283. Implementation period: 1–2 days.

No comments:

Write comments