NZD/USD: New Zealand Dollar strengthens

28 June 2019, 09:47

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.6710, 0.6740 |

| Take Profit | 0.6781, 0.6800 |

| Stop Loss | 0.6690, 0.6665 |

| Key Levels | 0.6610, 0.6640, 0.6665, 0.6680, 0.6707, 0.6737, 0.6781 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6670, 0.6660 |

| Take Profit | 0.6610, 0.6580, 0.6665 |

| Stop Loss | 0.6720 |

| Key Levels | 0.6610, 0.6640, 0.6665, 0.6680, 0.6707, 0.6737, 0.6781 |

Current trend

NZD is steadily growing against USD, renewing the highs of April 18. The instrument is supported by the prospects for concluding a US-PRC trade agreement, which will put an end to the protracted trade war. An additional impact is the publication of poor macroeconomic statistics from the US, as well as the risks of decrease of the Fed’s interest rate during the July meeting of the regulator.

Yesterday’s the macroeconomic statistics from New Zealand did not support the instrument. Thus, June’s ANZ Business Confidence fell again from –32.0 to –38.1 points, while investors expected a positive trend and growth of the indicator to –22.7 points. June’s NBNZ Own Activity was revised downwards from 8.5% to 8.0%, which still was better than the forecast of 7.8%.

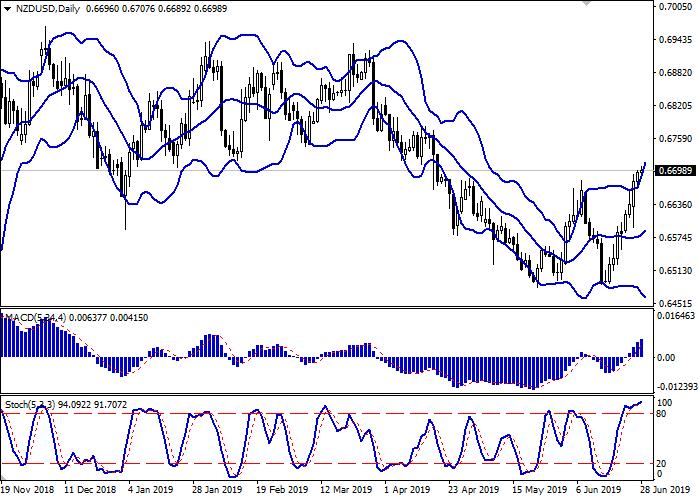

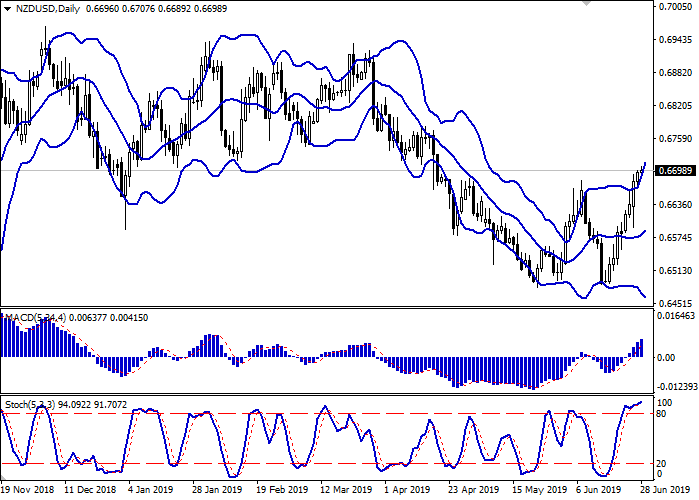

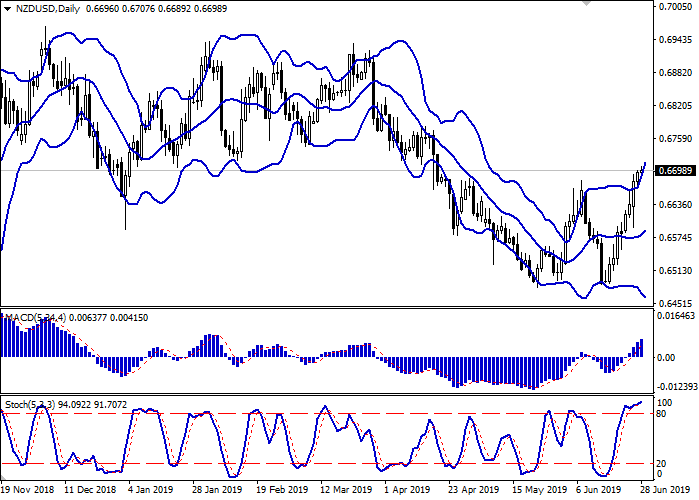

Support and resistance

On the daily chart, Bollinger bands grow moderately. The price range expands dramatically but not as fast as the "bullish" dynamic develops. The MACD grows, keeping a strong buy signal (the histogram is above the signal line). Stochastic approached its maximum level of 100, which indicates that NZD is overbought in the super-short term, and a corrective decline in the super-short term may appear.

Resistance levels: 0.6707, 0.6737, 0.6781.

Support levels: 0.6680, 0.6665, 0.6640, 0.6610.

Trading tips

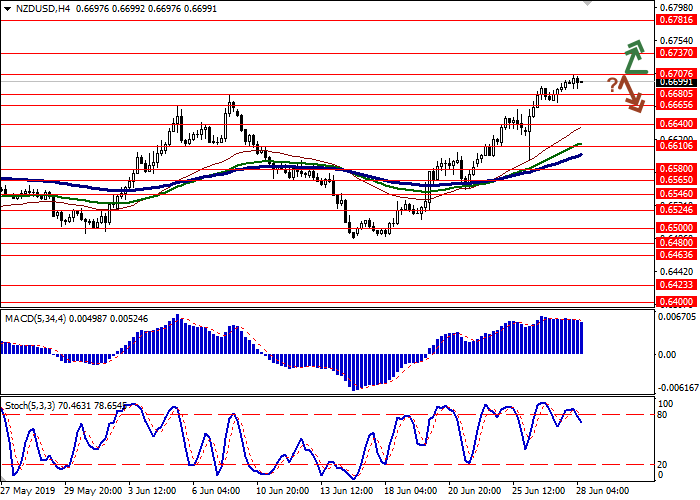

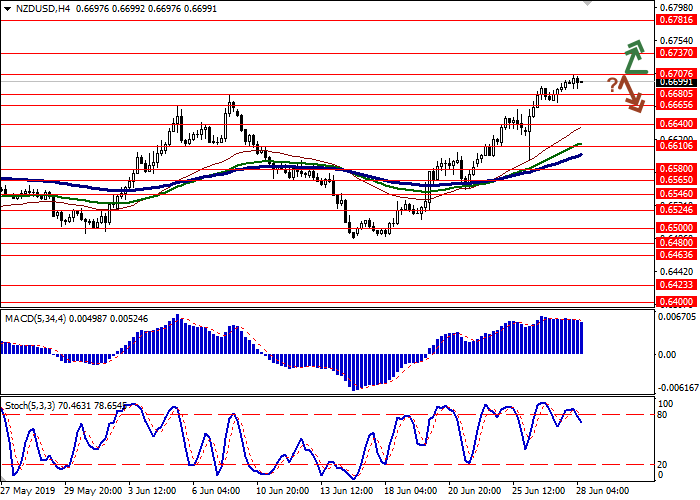

Long positions can be opened after the breakout of 0.6707 or 0.6737 with the target at 0.6781 or 0.6800. Stop loss is 0.6690–0.6665. Implementation period: 1–2 days.

Short positions can be opened after a rebound from 0.6707 and a breakdown of 0.6680–0.6665 with the targets at 0.6610 or 0.6580–0.6665. Stop loss is 0.6720. Implementation period: 2–3 days.

NZD is steadily growing against USD, renewing the highs of April 18. The instrument is supported by the prospects for concluding a US-PRC trade agreement, which will put an end to the protracted trade war. An additional impact is the publication of poor macroeconomic statistics from the US, as well as the risks of decrease of the Fed’s interest rate during the July meeting of the regulator.

Yesterday’s the macroeconomic statistics from New Zealand did not support the instrument. Thus, June’s ANZ Business Confidence fell again from –32.0 to –38.1 points, while investors expected a positive trend and growth of the indicator to –22.7 points. June’s NBNZ Own Activity was revised downwards from 8.5% to 8.0%, which still was better than the forecast of 7.8%.

Support and resistance

On the daily chart, Bollinger bands grow moderately. The price range expands dramatically but not as fast as the "bullish" dynamic develops. The MACD grows, keeping a strong buy signal (the histogram is above the signal line). Stochastic approached its maximum level of 100, which indicates that NZD is overbought in the super-short term, and a corrective decline in the super-short term may appear.

Resistance levels: 0.6707, 0.6737, 0.6781.

Support levels: 0.6680, 0.6665, 0.6640, 0.6610.

Trading tips

Long positions can be opened after the breakout of 0.6707 or 0.6737 with the target at 0.6781 or 0.6800. Stop loss is 0.6690–0.6665. Implementation period: 1–2 days.

Short positions can be opened after a rebound from 0.6707 and a breakdown of 0.6680–0.6665 with the targets at 0.6610 or 0.6580–0.6665. Stop loss is 0.6720. Implementation period: 2–3 days.

No comments:

Write comments