NZD/USD: the New Zealand dollar grows

26 June 2019, 09:46

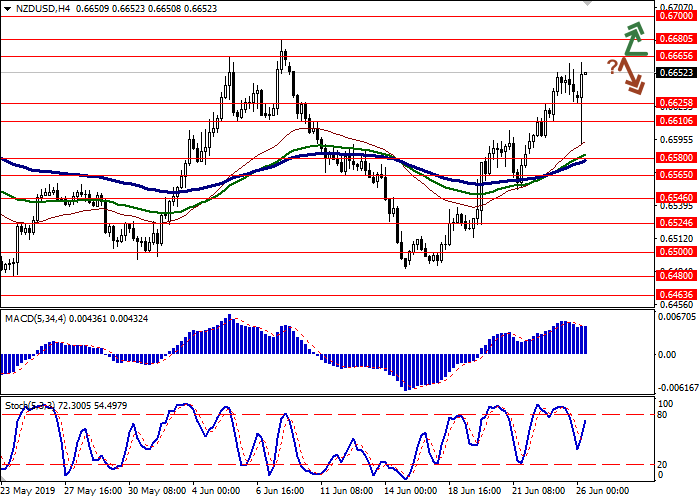

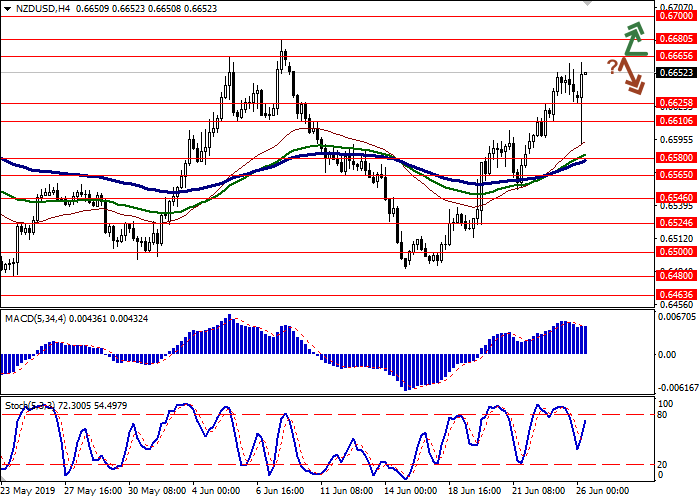

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.6670 |

| Take Profit | 0.6700, 0.6720 |

| Stop Loss | 0.6645 |

| Key Levels | 0.6565, 0.6580, 0.6610, 0.6625, 0.6665, 0.6680, 0.6700 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6630 |

| Take Profit | 0.6580, 0.6565 |

| Stop Loss | 0.6665 |

| Key Levels | 0.6565, 0.6580, 0.6610, 0.6625, 0.6665, 0.6680, 0.6700 |

Current trend

Yesterday, NZD rose moderately against USD. Closer to the end of the daily session, the instrument was corrected but the confident “bullish” advantage remained. Poor statistics on the trade balance did not prevent the growth of the rate: in May, the figure rose by $264 million after a growth of $383 million, which was significantly worse than analysts' forecasts of $971 million. Separately, May’s Exports rose from $5.50 to $5.81 billion. During the same period, Imports increased from $5.12 billion to $5.54 billion.

Today, during the Asian session, the RBNZ interest rate decision is in the focus of investors' attention. As expected, the regulator kept the rate at 1.5%, citing growing uncertainty in the global economy. Moreover, noting the slowdown in economic growth in New Zealand, the regulator said that in the future it might be necessary to further reduce the rate.

Support and resistance

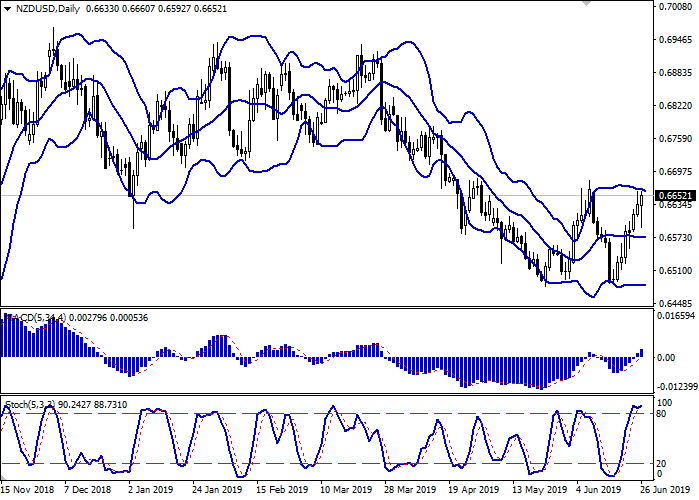

On the daily chart, Bollinger bands move flat. The price range is slightly narrowed, reflecting the uncertainty of recent trading. The MACD grows, keeping a moderate buy signal (the histogram is above the signal line). Stochastic, approaching its highs, reverses horizontally, signaling that NZD is strongly overbought in the super-short term.

The emergence of correctional dynamics is possible. Until the situation is clarified, it is better to keep part of the current long positions in the short term.

Resistance levels: 0.6665, 0.6680, 0.6700.

Support levels: 0.6625, 0.6610, 0.6580, 0.6565.

Trading tips

Long positions can be opened after the breakout of 0.6665 with the targets at 0.6700–0.6720. Stop loss is 0.6645. Implementation period: 1–2 days.

Short positions can be opened after a rebound from 0.6665 and a breakdown of 0.6640 with the target at 0.6580 or 0.6565. Stop loss is 0.6665. Implementation period: 2–3 days.

Yesterday, NZD rose moderately against USD. Closer to the end of the daily session, the instrument was corrected but the confident “bullish” advantage remained. Poor statistics on the trade balance did not prevent the growth of the rate: in May, the figure rose by $264 million after a growth of $383 million, which was significantly worse than analysts' forecasts of $971 million. Separately, May’s Exports rose from $5.50 to $5.81 billion. During the same period, Imports increased from $5.12 billion to $5.54 billion.

Today, during the Asian session, the RBNZ interest rate decision is in the focus of investors' attention. As expected, the regulator kept the rate at 1.5%, citing growing uncertainty in the global economy. Moreover, noting the slowdown in economic growth in New Zealand, the regulator said that in the future it might be necessary to further reduce the rate.

Support and resistance

On the daily chart, Bollinger bands move flat. The price range is slightly narrowed, reflecting the uncertainty of recent trading. The MACD grows, keeping a moderate buy signal (the histogram is above the signal line). Stochastic, approaching its highs, reverses horizontally, signaling that NZD is strongly overbought in the super-short term.

The emergence of correctional dynamics is possible. Until the situation is clarified, it is better to keep part of the current long positions in the short term.

Resistance levels: 0.6665, 0.6680, 0.6700.

Support levels: 0.6625, 0.6610, 0.6580, 0.6565.

Trading tips

Long positions can be opened after the breakout of 0.6665 with the targets at 0.6700–0.6720. Stop loss is 0.6645. Implementation period: 1–2 days.

Short positions can be opened after a rebound from 0.6665 and a breakdown of 0.6640 with the target at 0.6580 or 0.6565. Stop loss is 0.6665. Implementation period: 2–3 days.

No comments:

Write comments