EUR/USD: Euro falls

13 June 2019, 09:48

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.1310 |

| Take Profit | 1.1346, 1.1360 |

| Stop Loss | 1.1281 |

| Key Levels | 1.1217, 1.1250, 1.1263, 1.1281, 1.1305, 1.1322, 1.1346 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.1275 |

| Take Profit | 1.1217, 1.1200 |

| Stop Loss | 1.1305 |

| Key Levels | 1.1217, 1.1250, 1.1263, 1.1281, 1.1305, 1.1322, 1.1346 |

Current trend

Yesterday, EUR confidently declined against EUS, departing from the highs of March 22, renewed late last week, which was largely technical in nature, since the news background did not change much. EUR was under pressure after the speech of the head of the European Central Bank Mario Draghi, who focused on the vulnerability of the Central European countries to new threats of the global trade war. During the opening of the American session, investors focused on US consumer inflation. In May, CPI rose by 0.1% MoM and 1.8% YoY against the previous +0.3% MoM and +2.0% YoY. Core CPI excluding food and energy increased by 0.1% MoM and 2.0% YoY, which was slightly worse than market expectations. Today, during the Asian session, the pair is trading ambiguously, and investors expect new drivers to appear on the market.

Traders are focused on the German May’s CPI and EU April’s Industrial Production data.

Support and resistance

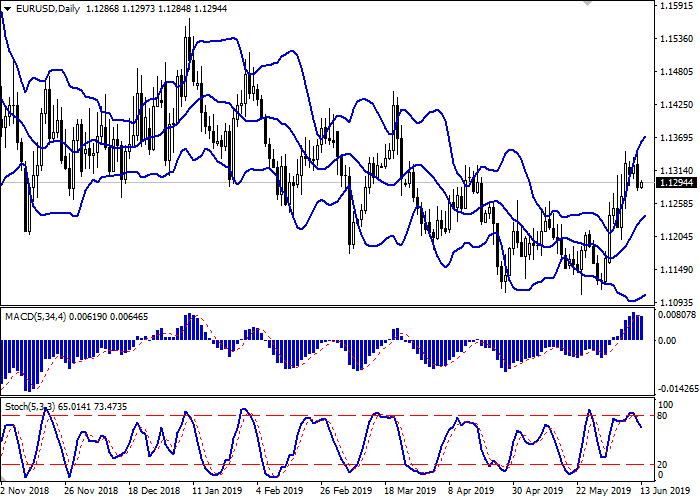

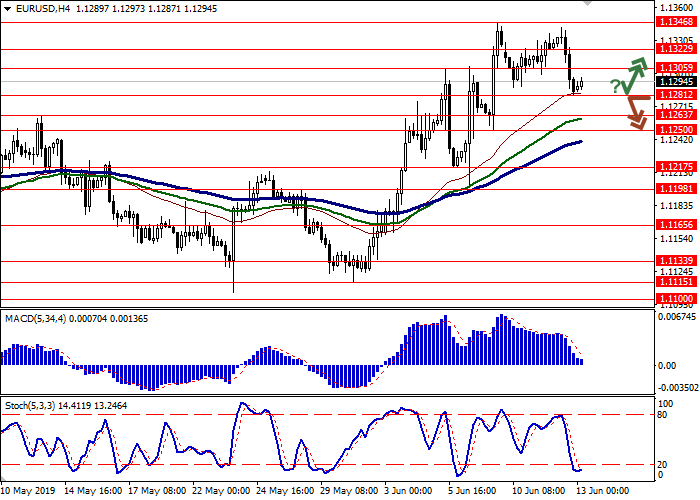

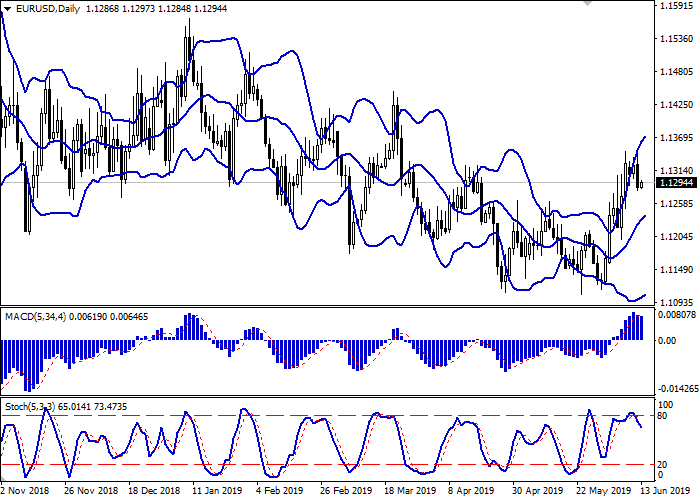

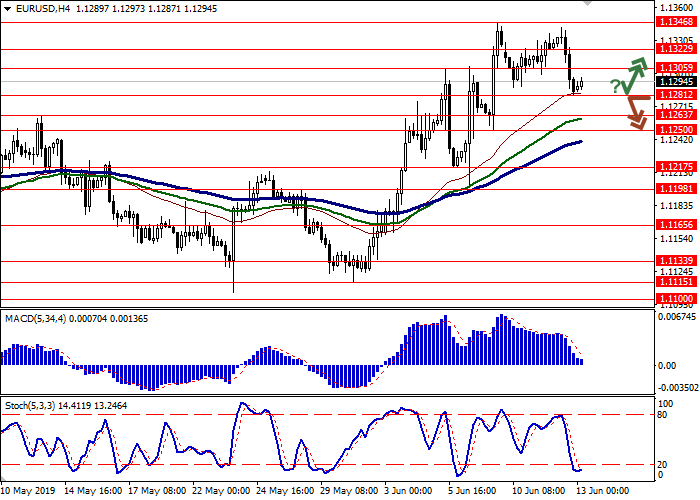

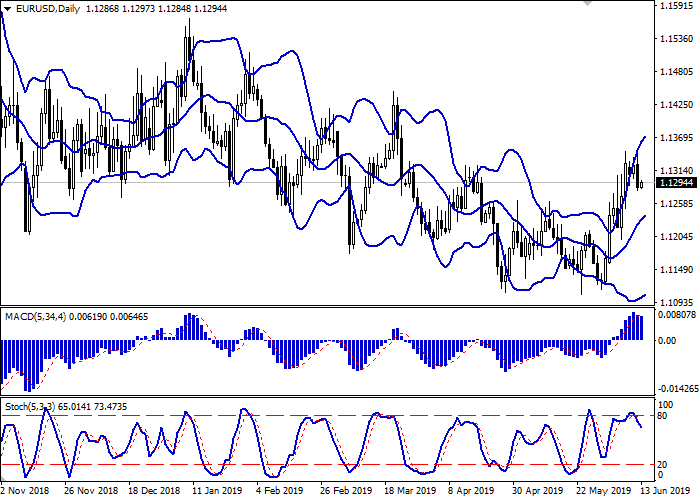

Bollinger bands grow steadily on the daily chart. The price range expands from above, indicating a strong “bullish” impulse that persists in the short and medium term. The MACD reverses downwards, forming a sell signal (the histogram is trying to consolidate below the signal line). Stochastic reversed into a downwards plane and did not reach its highs.

A corrective decline is possible in the short and/or ultra-short term.

Resistance levels: 1.1305, 1.1322, 1.1346.

Support levels: 1.1281, 1.1263, 1.1250, 1.1217.

Trading tips

Long positions can be opened after a rebound from 1.1281 and a breakout of 1.1305 with the target at 1.1346 or 1.1360. Stop loss – 1.1281. Implementation period: 1–2 days.

Short positions can be opened after the breakdown of 1.1281 with the target at 1.1217 or 1.1200. Stop loss – 1.1305. Implementation period: 2–3 days.

Yesterday, EUR confidently declined against EUS, departing from the highs of March 22, renewed late last week, which was largely technical in nature, since the news background did not change much. EUR was under pressure after the speech of the head of the European Central Bank Mario Draghi, who focused on the vulnerability of the Central European countries to new threats of the global trade war. During the opening of the American session, investors focused on US consumer inflation. In May, CPI rose by 0.1% MoM and 1.8% YoY against the previous +0.3% MoM and +2.0% YoY. Core CPI excluding food and energy increased by 0.1% MoM and 2.0% YoY, which was slightly worse than market expectations. Today, during the Asian session, the pair is trading ambiguously, and investors expect new drivers to appear on the market.

Traders are focused on the German May’s CPI and EU April’s Industrial Production data.

Support and resistance

Bollinger bands grow steadily on the daily chart. The price range expands from above, indicating a strong “bullish” impulse that persists in the short and medium term. The MACD reverses downwards, forming a sell signal (the histogram is trying to consolidate below the signal line). Stochastic reversed into a downwards plane and did not reach its highs.

A corrective decline is possible in the short and/or ultra-short term.

Resistance levels: 1.1305, 1.1322, 1.1346.

Support levels: 1.1281, 1.1263, 1.1250, 1.1217.

Trading tips

Long positions can be opened after a rebound from 1.1281 and a breakout of 1.1305 with the target at 1.1346 or 1.1360. Stop loss – 1.1281. Implementation period: 1–2 days.

Short positions can be opened after the breakdown of 1.1281 with the target at 1.1217 or 1.1200. Stop loss – 1.1305. Implementation period: 2–3 days.

No comments:

Write comments