AUD/USD: general review

13 June 2019, 10:57

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL |

| Entry Point | 0.6914 |

| Take Profit | 0.6865 |

| Stop Loss | 0.6940 |

| Key Levels | 0.6864, 0.6880, 0.6885, 0.6898, 0.6903, 0.6913, 0.6925, 0.6936, 0.6948, 0.6965 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.6950 |

| Take Profit | 0.7000 |

| Stop Loss | 0.6920 |

| Key Levels | 0.6864, 0.6880, 0.6885, 0.6898, 0.6903, 0.6913, 0.6925, 0.6936, 0.6948, 0.6965 |

Current trend

AUD is falling against USD after the publication of weak data on unemployment in Australia. According to published data, the unemployment rate was 5.2% against the forecast of 5.1%, which indicates a slowdown in the impetus to the development of the labor market, influencing the strength of the national economy and the national currency rate. A positive factor for the Australian economy was the growth in employment: the rate increased by 42.3 thousand against the forecast of 17.5 thousand, which, nevertheless, did not help AUD to strengthen against the main competitor, as investors mainly focused on unemployment data.

Today, the data on unemployment in the US will be published (14:30 GMT+2). Investors expect a decline in Initial and Continuing Jobless Claims, which may positively affect the rate of USD. The market is expected to be moderately volatile.

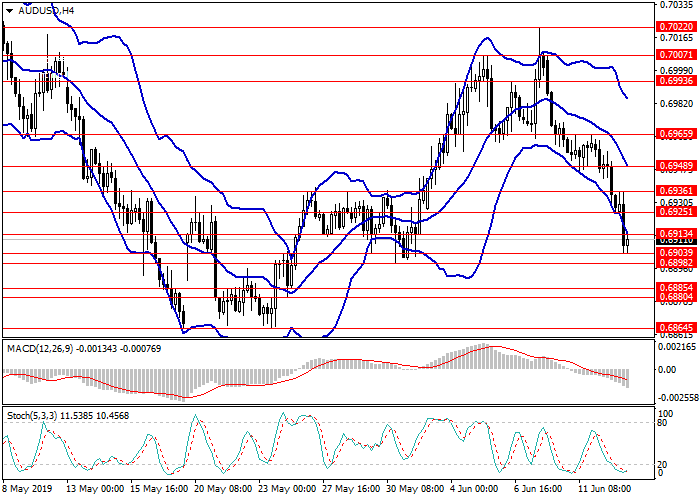

Support and resistance

On the H4 chart, the instrument broke through the lower border of Bollinger Bands, slowing down the decline. The price range is widened. MACD histogram is in the negative zone forming a signal for the opening of short positions.

Resistance levels: 0.6913, 0.6925, 0.6936, 0.6948, 0.6965.

Support levels: 0.6903, 0.6898, 0.6885, 0.6880, 0.6864.

Trading tips

Short positions may be opened from the current level with target at 0.6865 and stop loss at 0.6940.

Long positions may be opened from the level of 0.6950 with target at 0.7000 and stop loss at 0.6920.

Implementation time: 1-3 days.

AUD is falling against USD after the publication of weak data on unemployment in Australia. According to published data, the unemployment rate was 5.2% against the forecast of 5.1%, which indicates a slowdown in the impetus to the development of the labor market, influencing the strength of the national economy and the national currency rate. A positive factor for the Australian economy was the growth in employment: the rate increased by 42.3 thousand against the forecast of 17.5 thousand, which, nevertheless, did not help AUD to strengthen against the main competitor, as investors mainly focused on unemployment data.

Today, the data on unemployment in the US will be published (14:30 GMT+2). Investors expect a decline in Initial and Continuing Jobless Claims, which may positively affect the rate of USD. The market is expected to be moderately volatile.

Support and resistance

On the H4 chart, the instrument broke through the lower border of Bollinger Bands, slowing down the decline. The price range is widened. MACD histogram is in the negative zone forming a signal for the opening of short positions.

Resistance levels: 0.6913, 0.6925, 0.6936, 0.6948, 0.6965.

Support levels: 0.6903, 0.6898, 0.6885, 0.6880, 0.6864.

Trading tips

Short positions may be opened from the current level with target at 0.6865 and stop loss at 0.6940.

Long positions may be opened from the level of 0.6950 with target at 0.7000 and stop loss at 0.6920.

Implementation time: 1-3 days.

No comments:

Write comments