XAU/USD: general analysis

24 May 2019, 09:38

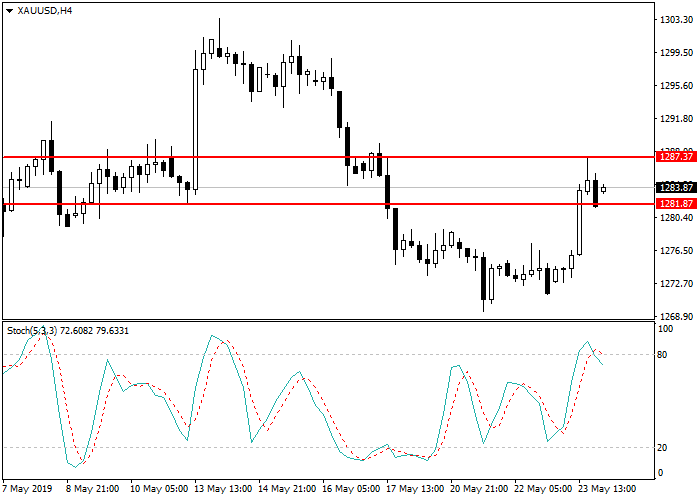

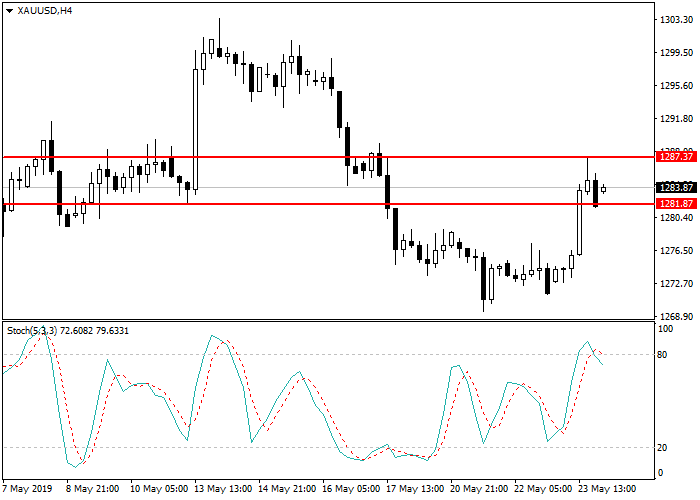

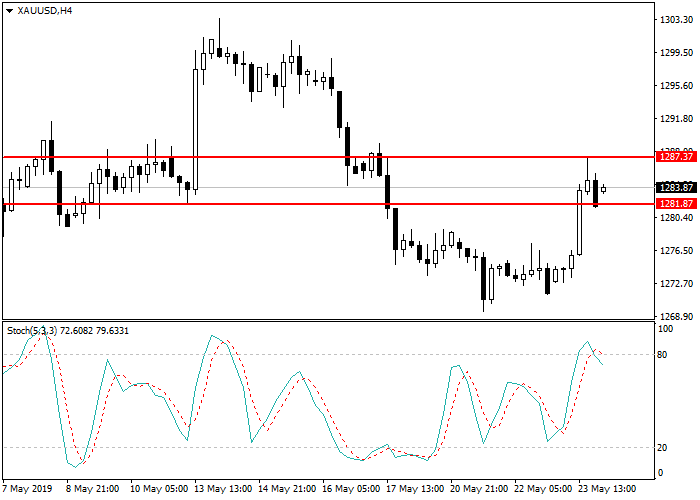

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1287.45 |

| Take Profit | 1295.00 |

| Stop Loss | 1281.87 |

| Key Levels | 1276.50, 1281.87, 1287.37, 1295.00 |

Current trend

Gold continues to increase slightly against USD. The nearest resistance level is at 1287.37, support is at 1281.00.

According to experts, the growth of the precious metal is caused by the exacerbation of the trade conflict between the United States and China, as the instrument is used as a shelter asset. It is possible that other technology companies, such as Hikvision, will fall under the new sanctions, and the American market will be completely closed for them. In addition, White House spokesman Stephen Mnuchin said that Chinese imports will be subject to an additional tax of $300 billion but this will happen no earlier than a month later when research on the possible consequences for American consumers will be conducted. It also became known about a transfer of warships to the strait between Taiwan and China. The reaction of the PRC is still unknown. On Wednesday, the US Fed’s Meeting Minutes were published, which reflected that interest rates changes are not expected. However, the Committee will focus on economic indicators, and in case of an increase in inflationary pressure, monetary policy may be tightened.

Today, US Durable Goods Orders data will be released.

Support and resistance

Stochastic is at the level of 70 and does not give signals to open positions.

Resistance levels: 1287.37, 1295.00.

Support levels: 1281.87, 1276.50.

Trading tips

Long positions can be opened after the breakout of the level of 1287.37 with the target at 1295.00 and stop loss 1281.87.

Gold continues to increase slightly against USD. The nearest resistance level is at 1287.37, support is at 1281.00.

According to experts, the growth of the precious metal is caused by the exacerbation of the trade conflict between the United States and China, as the instrument is used as a shelter asset. It is possible that other technology companies, such as Hikvision, will fall under the new sanctions, and the American market will be completely closed for them. In addition, White House spokesman Stephen Mnuchin said that Chinese imports will be subject to an additional tax of $300 billion but this will happen no earlier than a month later when research on the possible consequences for American consumers will be conducted. It also became known about a transfer of warships to the strait between Taiwan and China. The reaction of the PRC is still unknown. On Wednesday, the US Fed’s Meeting Minutes were published, which reflected that interest rates changes are not expected. However, the Committee will focus on economic indicators, and in case of an increase in inflationary pressure, monetary policy may be tightened.

Today, US Durable Goods Orders data will be released.

Support and resistance

Stochastic is at the level of 70 and does not give signals to open positions.

Resistance levels: 1287.37, 1295.00.

Support levels: 1281.87, 1276.50.

Trading tips

Long positions can be opened after the breakout of the level of 1287.37 with the target at 1295.00 and stop loss 1281.87.

No comments:

Write comments