EUR/USD: general review

24 May 2019, 09:39

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL LIMIT |

| Entry Point | 1.1255 |

| Take Profit | 1.1134 |

| Stop Loss | 1.1280 |

| Key Levels | 1.1103, 1.1134, 1.1208, 1.1255 |

Current trend

EUR strengthened against USD by more than 50 points with the opening of the American session.

The growth of EUR was caused by macroeconomic data from the United States, which was not in favor of the dollar. Continuing Jobless Claims number rose to 1.676 million. Manufacturing PMI fell to 50.6 points against the forecast of a decline to 52.5 points. Against this background, the Fed will continue to keep rates unchanged for at least another six months to reduce the risks of economic growth. In addition, it is worth considering the additional risks to the economy in the form of a trade war with China and the high debt load of American business. According to foreign sources, Washington can blacklist Chinese companies operating in the field of video surveillance. If this really happens, Beijing’s response may be a total ban on the sale of Apple products to the local market. According to preliminary data, the company may lose about 29% of its income.

The macroeconomic data released yesterday in the euro area also fell short of expectations. Composite PMI in May added only 0.1 points, reaching 51.6 points. Manufacturing PMI fell to 47.7 points, which is a sign of a slowdown in economic growth.

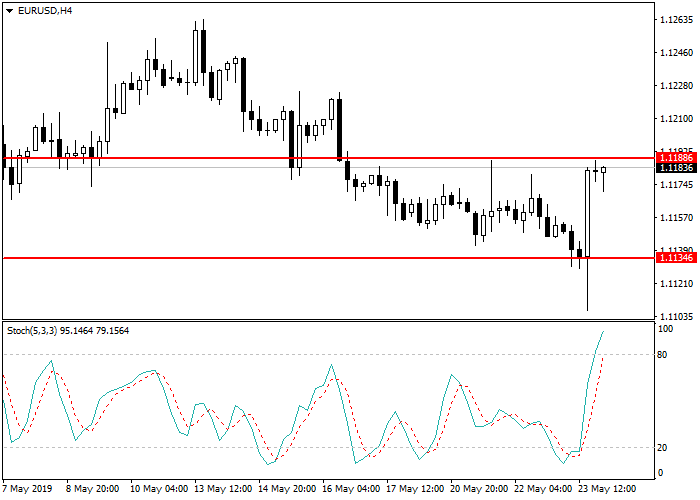

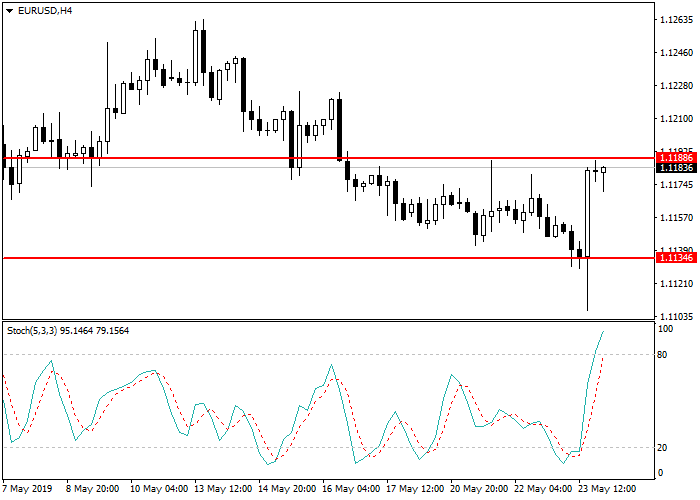

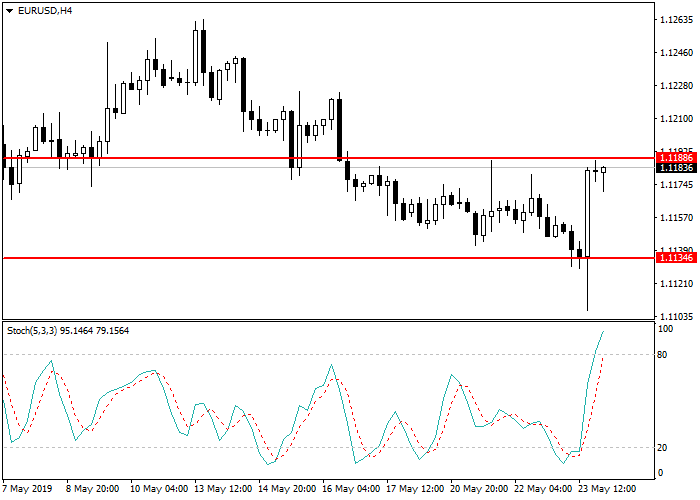

Support and resistance

Stochastic is at the level of 92 points and indicates the possible correction.

Resistance levels: 1.1208, 1.1255.

Support levels: 1.1134, 1.1103.

Trading tips

Short positions may be opened from the resistance level of 1.1255 with take profit at 1.1134 and stop loss at 1.1280.

EUR strengthened against USD by more than 50 points with the opening of the American session.

The growth of EUR was caused by macroeconomic data from the United States, which was not in favor of the dollar. Continuing Jobless Claims number rose to 1.676 million. Manufacturing PMI fell to 50.6 points against the forecast of a decline to 52.5 points. Against this background, the Fed will continue to keep rates unchanged for at least another six months to reduce the risks of economic growth. In addition, it is worth considering the additional risks to the economy in the form of a trade war with China and the high debt load of American business. According to foreign sources, Washington can blacklist Chinese companies operating in the field of video surveillance. If this really happens, Beijing’s response may be a total ban on the sale of Apple products to the local market. According to preliminary data, the company may lose about 29% of its income.

The macroeconomic data released yesterday in the euro area also fell short of expectations. Composite PMI in May added only 0.1 points, reaching 51.6 points. Manufacturing PMI fell to 47.7 points, which is a sign of a slowdown in economic growth.

Support and resistance

Stochastic is at the level of 92 points and indicates the possible correction.

Resistance levels: 1.1208, 1.1255.

Support levels: 1.1134, 1.1103.

Trading tips

Short positions may be opened from the resistance level of 1.1255 with take profit at 1.1134 and stop loss at 1.1280.

No comments:

Write comments