USD/JPY: general review

24 May 2019, 12:39

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL |

| Entry Point | 109.62 |

| Take Profit | 109.00 |

| Stop Loss | 109.85 |

| Key Levels | 109.00, 109.13, 109.29, 109.44, 109.69, 109.80, 110.04, 110.32, 110.54, 110.65 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 110.10 |

| Take Profit | 110.60 |

| Stop Loss | 109.80 |

| Key Levels | 109.00, 109.13, 109.29, 109.44, 109.69, 109.80, 110.04, 110.32, 110.54, 110.65 |

Current trend

The pair lost more than 80 points on Thursday amid aggravated trade wars between the US and China, as well as the publication of negative macroeconomic statistics from the US.

New Home Sales in April amounted to 0.673 million, which turned out to be worse than the forecast of 0.675 million, and below the previous figure of 0.723 million. Markit Services PMI dropped from 53.0 points to 50.9 points, against the expected growth to 53.2 points. Markit Manufacturing PMI also fell short of forecasts, dropping from 52.6 to 50.6 points. Data on the US labor market were contradictory: Continuing Jobless Claims as of May 10 increased to 1.676 million. At the same time, Initial Jobless Claims as of May 17 decreased to 211 thousand from 212 thousand, which provided some support for the American currency.

Today, JPY continued to strengthen against USD amid a rise in Japan's National CPI by 0.9%.The market is waiting for the publication of data on the US Durable Goods Orders (14:30 GMT+2), the market is expected to be highly volatile.

Support and resistance

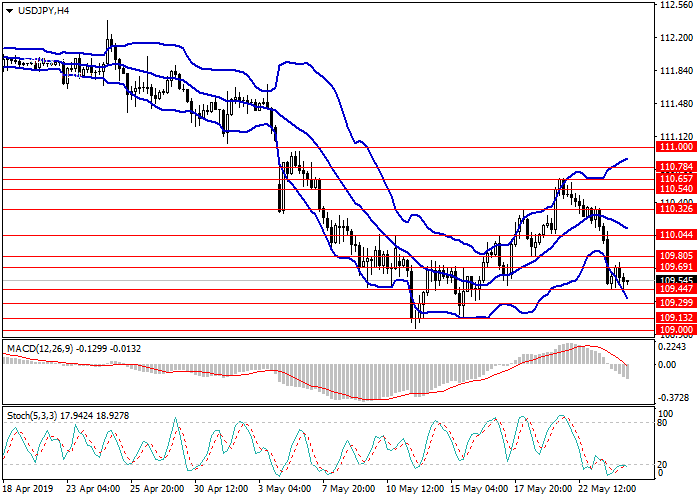

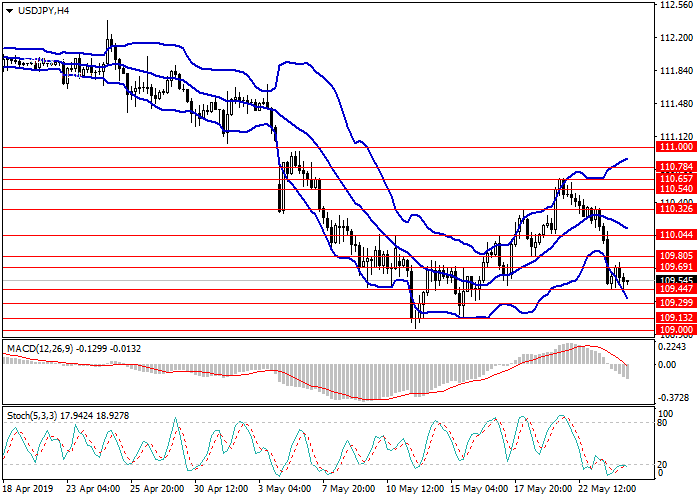

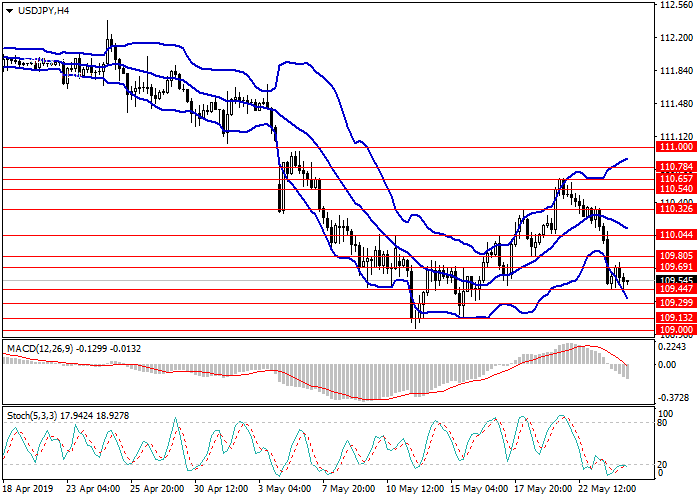

On the H4 chart, the instrument is declining along the lower border of Bollinger Bands, and the price range is widened. MACD histogram is in the negative zone. The signal line is crossing the zero level from above, which is a sign for opening short positions.

Resistance levels: 109.69, 109.80, 110.04, 110.32, 110.54, 110.65.

Support levels: 109.44, 109.29, 109.13, 109.00.

Trading tips

Short positions may be opened from the current level with target at 109.00 and stop loss at 109.85.

Long positions may be opened from 110.10 with target at 110.60 and stop loss at 109.80.

Implementation time: 1-3 days.

The pair lost more than 80 points on Thursday amid aggravated trade wars between the US and China, as well as the publication of negative macroeconomic statistics from the US.

New Home Sales in April amounted to 0.673 million, which turned out to be worse than the forecast of 0.675 million, and below the previous figure of 0.723 million. Markit Services PMI dropped from 53.0 points to 50.9 points, against the expected growth to 53.2 points. Markit Manufacturing PMI also fell short of forecasts, dropping from 52.6 to 50.6 points. Data on the US labor market were contradictory: Continuing Jobless Claims as of May 10 increased to 1.676 million. At the same time, Initial Jobless Claims as of May 17 decreased to 211 thousand from 212 thousand, which provided some support for the American currency.

Today, JPY continued to strengthen against USD amid a rise in Japan's National CPI by 0.9%.The market is waiting for the publication of data on the US Durable Goods Orders (14:30 GMT+2), the market is expected to be highly volatile.

Support and resistance

On the H4 chart, the instrument is declining along the lower border of Bollinger Bands, and the price range is widened. MACD histogram is in the negative zone. The signal line is crossing the zero level from above, which is a sign for opening short positions.

Resistance levels: 109.69, 109.80, 110.04, 110.32, 110.54, 110.65.

Support levels: 109.44, 109.29, 109.13, 109.00.

Trading tips

Short positions may be opened from the current level with target at 109.00 and stop loss at 109.85.

Long positions may be opened from 110.10 with target at 110.60 and stop loss at 109.80.

Implementation time: 1-3 days.

No comments:

Write comments