USD/CAD: Murrey analysis

24 May 2019, 14:19

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL |

| Entry Point | 1.3446 |

| Take Profit | 1.3366, 1.3305 |

| Stop Loss | 1.3480 |

| Key Levels | 1.3305, 1.3366, 1.3427, 1.3488, 1.3550, 1.3672 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.3490 |

| Take Profit | 1.3550, 1.3672 |

| Stop Loss | 1.3450 |

| Key Levels | 1.3305, 1.3366, 1.3427, 1.3488, 1.3550, 1.3672 |

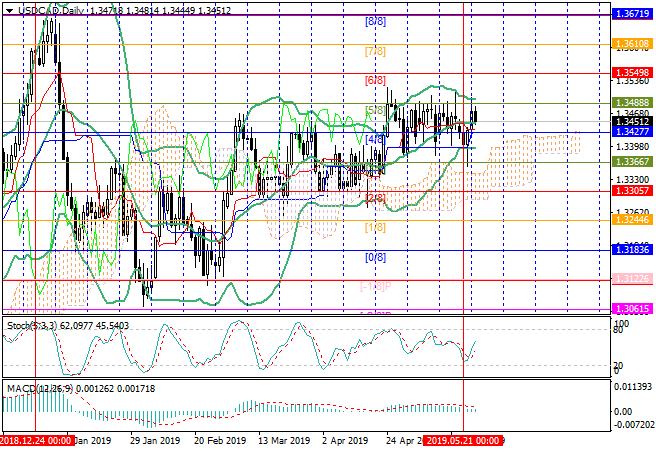

On the D1 chart, the price again unsuccessfully tested the upper border of

the Murrey’s central channel at 1.3488 ([5/8]) and corrected to the midline of

Bollinger Bands near 1.3450. Probably in the near future quotes will continue to

remain within the central channel of 1.3488 ([5/8])–1.3366 ([3/8]). The level of

1.3427 ([4/8]) is the key for the "bears". After its breakdown, a decline is

possible to 1.3366 ([3/8]) and 1.3305 ([2/8]). The consolidation of the price

above 1.3488 ([5/8]) will lead to growth to 1.3550 ([6/8]) and 1.3672 ([8/8]),

but in the near future, this scenario seems less likely. Technical indicators

don't provide a clear signal: Bollinger Bands are directed horizontally,

Stochastic has reversed upwards, and MACD histogram is near the zero line, its

volumes are insignificant.

Support and resistance

Support levels: 1.3427, 1.3366, 1.3305.

Resistance levels: 1.3488, 1.3550, 1.3672.

Trading tips

Short positions may be opened from the current level with targets at 1.3366, 1.3305 and stop loss at 1.3480.

Long positions should be opened after the price consolidates above 1.3488 with targets at 1.3550, 1.3672 and stop loss at 1.3450.

Implementation period: 3-4 days.

Support and resistance

Support levels: 1.3427, 1.3366, 1.3305.

Resistance levels: 1.3488, 1.3550, 1.3672.

Trading tips

Short positions may be opened from the current level with targets at 1.3366, 1.3305 and stop loss at 1.3480.

Long positions should be opened after the price consolidates above 1.3488 with targets at 1.3550, 1.3672 and stop loss at 1.3450.

Implementation period: 3-4 days.

No comments:

Write comments