GBP/USD: the downward trend will continue

24 May 2019, 14:21

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL |

| Entry Point | 1.2686 |

| Take Profit | 1.2500, 1.2410 |

| Stop Loss | 1.2830 |

| Key Levels | 1.2410, 1.2500, 1.2585, 1.2600, 1.2640, 1.2700, 1.2755, 1.2810, 1.2865, 1.2930, 1.3000, 1.3030, 1.3080, 1.3120 |

Current trend

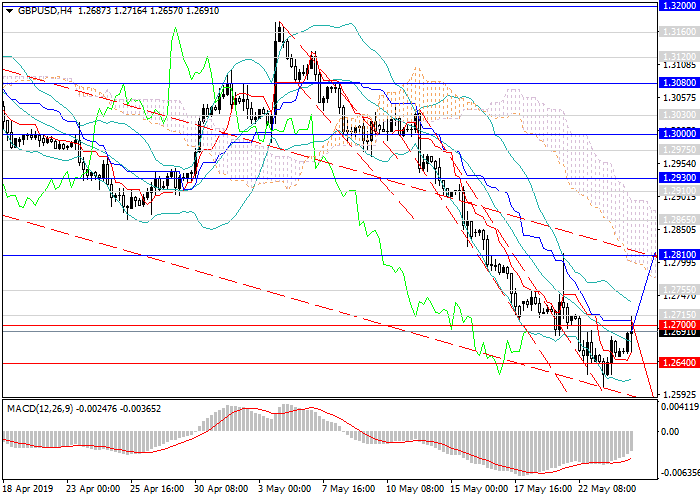

In May, GBP declined significantly against USD. During this period, the pair has lost more than 500 points and has reached the lows at 1.2700, 1.2640. Such a long-term weakening is due to the growing interest in USD and the fall of GBP due to the poor fundamental background, as well as the political and economic uncertainty associated with Brexit. Today, the price has moved to the stage of an upward correction, regaining more than 100 points in a few hours. Most likely, the course will quickly return to previous levels.

Today, the instrument was supported by strong Retail Sales data. In the afternoon, special attention should be paid to American statistics on Durable Goods Orders.

Support and resistance

An upward correction may develop to levels of 1.2755, 1.2810 but a longer upward impulse and a change in trend are unlikely. The pair will go down from the current level or from the key resistance and test local lows. The probability of reduction to the new lows of 1.2585, 1.2500, 1.2410 is high.

On the 4-hour chart and above, technical indicators confirm a downward forecast: the MACD keeps high volumes of short positions, Bollinger bands are directed downwards.

Resistance levels: 1.2755, 1.2810, 1.2865, 1.2930, 1.3000, 1.3030, 1.3080, 1.3120.

The support levels are 1.2700, 1.2640, 1.2600, 1.2585, 1.2500, 1.2410.

Trading tips

Short positions can be opened from the current level with the targets at 1.2585, 1.2500, 1.2410 and stop loss 1.2830.

In May, GBP declined significantly against USD. During this period, the pair has lost more than 500 points and has reached the lows at 1.2700, 1.2640. Such a long-term weakening is due to the growing interest in USD and the fall of GBP due to the poor fundamental background, as well as the political and economic uncertainty associated with Brexit. Today, the price has moved to the stage of an upward correction, regaining more than 100 points in a few hours. Most likely, the course will quickly return to previous levels.

Today, the instrument was supported by strong Retail Sales data. In the afternoon, special attention should be paid to American statistics on Durable Goods Orders.

Support and resistance

An upward correction may develop to levels of 1.2755, 1.2810 but a longer upward impulse and a change in trend are unlikely. The pair will go down from the current level or from the key resistance and test local lows. The probability of reduction to the new lows of 1.2585, 1.2500, 1.2410 is high.

On the 4-hour chart and above, technical indicators confirm a downward forecast: the MACD keeps high volumes of short positions, Bollinger bands are directed downwards.

Resistance levels: 1.2755, 1.2810, 1.2865, 1.2930, 1.3000, 1.3030, 1.3080, 1.3120.

The support levels are 1.2700, 1.2640, 1.2600, 1.2585, 1.2500, 1.2410.

Trading tips

Short positions can be opened from the current level with the targets at 1.2585, 1.2500, 1.2410 and stop loss 1.2830.

No comments:

Write comments