USD/CAD: Murrey analysis

18 February 2019, 13:48

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 1.3220 |

| Take Profit | 1.3183, 1.3122, 1.3060 |

| Stop Loss | 1.3255 |

| Key Levels | 1.3060, 1.3122, 1.3183, 1.3244, 1.3305, 1.3366, 1.3427 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.3310 |

| Take Profit | 1.3366, 1.3427 |

| Stop Loss | 1.3265 |

| Key Levels | 1.3060, 1.3122, 1.3183, 1.3244, 1.3305, 1.3366, 1.3427 |

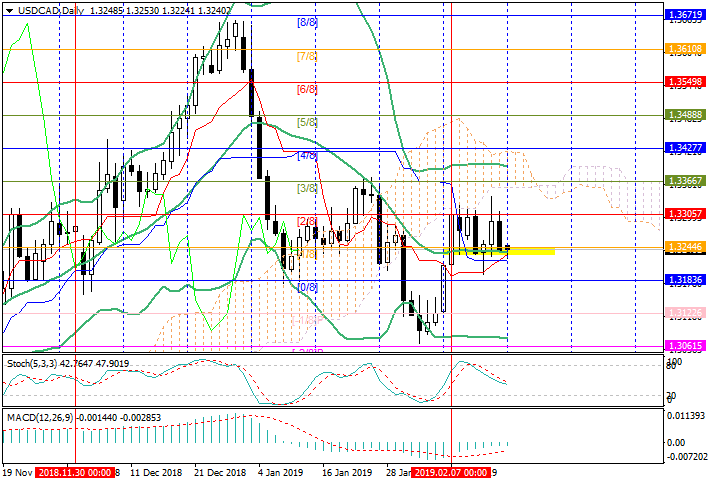

On the daily chart, for more than a week, the price has been trading within

the main channel 1.3305 ([2/8])–1.2344 ([1/8]). The middle line of Bollinger

bands located under the trading range also prevents the instrument form breaking

down. Fixing below the line can provide a drop up to the February's lows around

1.3060 ([–2/8]). Otherwise, the rate will return to the level of 1.3305,

however, the serious growth is possible only after the breakout of the level. In

this case, the targets of the upward movement will be 1.3366 ([3/8]) and 1.3427

([4/8]).

Technical indicators do not give a clear signal. MACD histogram is at the zero line, its volumes are insignificant. Stochastic is directed downwards.

Support and resistance

Resistance levels: 1.3305, 1.3366, 1.3427.

Support levels: 1.3244, 1.3183, 1.3122, 1.3060.

Trading tips

Short positions can be opened from the level of 1.3220 with the targets at 1.3183, 1.3122, 1.3060 and stop loss around 1.3255.

Long positions can be opened above the level of 1.3305 with the targets at 1.3366, 1.3427 and stop loss around 1.3265.

Implementation period: 4–5 days.

Technical indicators do not give a clear signal. MACD histogram is at the zero line, its volumes are insignificant. Stochastic is directed downwards.

Support and resistance

Resistance levels: 1.3305, 1.3366, 1.3427.

Support levels: 1.3244, 1.3183, 1.3122, 1.3060.

Trading tips

Short positions can be opened from the level of 1.3220 with the targets at 1.3183, 1.3122, 1.3060 and stop loss around 1.3255.

Long positions can be opened above the level of 1.3305 with the targets at 1.3366, 1.3427 and stop loss around 1.3265.

Implementation period: 4–5 days.

No comments:

Write comments