USD/JPY: general review

18 February 2019, 13:55

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 110.52 |

| Take Profit | 111.75 |

| Stop Loss | 109.50 |

| Key Levels | 107.30, 107.70, 108.00, 109.10, 109.55, 110.00, 110.00, 110.65, 110.85, 111.10, 111.75, 112.30, 112.85, 113.00, 114.50 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY LIMIT |

| Entry Point | 110.20, 110.00 |

| Take Profit | 111.75 |

| Stop Loss | 109.50 |

| Key Levels | 107.30, 107.70, 108.00, 109.10, 109.55, 110.00, 110.00, 110.65, 110.85, 111.10, 111.75, 112.30, 112.85, 113.00, 114.50 |

Current trend

The American dollar continues to strengthen against the Japanese yen due to the growth in demand over the past month and a half.

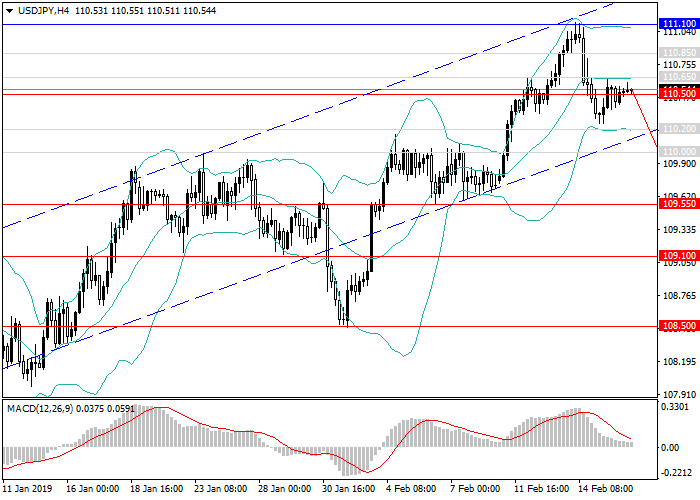

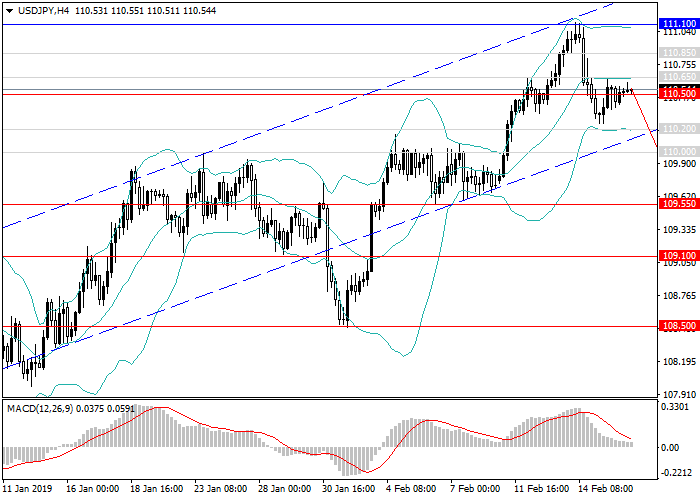

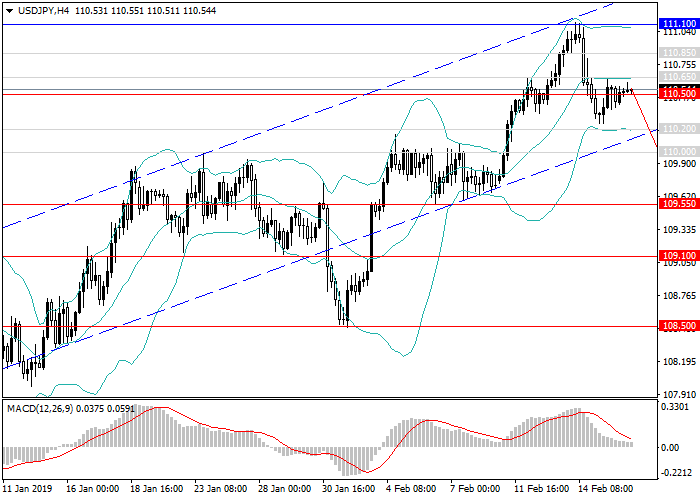

Last week, the pair gained more than 100 points and reached a new local maximum of 111.10. The main catalyst for growth was favorable data on inflation and major US indices, while the yen continued to lose investor interest and weakened to all major currencies. An additional factor in JPY decline was negative data on the growth rate of the Japanese economy: preliminary GDP data for 4Q2018 was below forecasts. The pair has consolidated within a narrow upward channel and maintains the current dynamics. At the end of the week, the instrument showed a slight downward correction on the depreciation of the American currency due to weak data on industrial production and US retail sales.

Support and resistance

In the first half of the week, key macroeconomic releases are not expected. On Thursday, data on orders for durable goods, the index of leading indicators, and the US labor market will be published. Most likely, the pair will keep an upward impulse with the target at 111.75 (local maximum and the upper border of the current range). Later, the instrument may continue its upward movement within the long-term lateral channel with the target at 114.50.

Technical indicators confirm the growth forecast: on H4 and D1 charts, MACD shows growth in the volume of long positions and Bollinger Bands are directed upwards.

Support levels: 110.20, 110.00, 109.55, 109.10, 108.50, 108.00, 107.70, 107.30.

Resistance levels: 110.65, 110.85, 111.10, 111.75, 112.30, 112.85, 113.00, 114.50.

Trading tips

Long positions may be opened from the current level; pending long positions may be opened from 110.20, 110.00 with the target at 111.75 and stop loss at 109.50.

The American dollar continues to strengthen against the Japanese yen due to the growth in demand over the past month and a half.

Last week, the pair gained more than 100 points and reached a new local maximum of 111.10. The main catalyst for growth was favorable data on inflation and major US indices, while the yen continued to lose investor interest and weakened to all major currencies. An additional factor in JPY decline was negative data on the growth rate of the Japanese economy: preliminary GDP data for 4Q2018 was below forecasts. The pair has consolidated within a narrow upward channel and maintains the current dynamics. At the end of the week, the instrument showed a slight downward correction on the depreciation of the American currency due to weak data on industrial production and US retail sales.

Support and resistance

In the first half of the week, key macroeconomic releases are not expected. On Thursday, data on orders for durable goods, the index of leading indicators, and the US labor market will be published. Most likely, the pair will keep an upward impulse with the target at 111.75 (local maximum and the upper border of the current range). Later, the instrument may continue its upward movement within the long-term lateral channel with the target at 114.50.

Technical indicators confirm the growth forecast: on H4 and D1 charts, MACD shows growth in the volume of long positions and Bollinger Bands are directed upwards.

Support levels: 110.20, 110.00, 109.55, 109.10, 108.50, 108.00, 107.70, 107.30.

Resistance levels: 110.65, 110.85, 111.10, 111.75, 112.30, 112.85, 113.00, 114.50.

Trading tips

Long positions may be opened from the current level; pending long positions may be opened from 110.20, 110.00 with the target at 111.75 and stop loss at 109.50.

No comments:

Write comments