GBP/USD: general analysis

18 February 2019, 09:18

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL LIMIT |

| Entry Point | 1.2939 |

| Take Profit | 1.2847 |

| Stop Loss | 1.2970 |

| Key Levels | 1.2847, 1.2878, 1.2939, 1.29 |

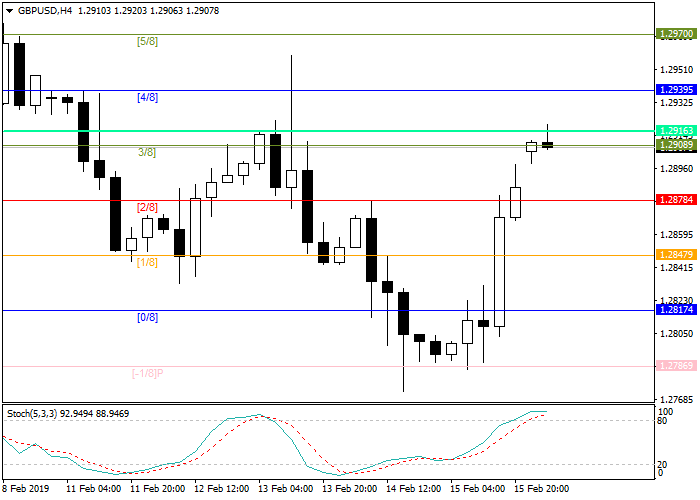

Current trend

Today, GBP continues to trade in the green zone. The important resistance is the level of 4/8 or 1.2939, and the next target will be the level of 1.2970.

The demand for GBP is due to positive data on Retail Sales. In January, the index added 1%, which is a record for the last year and a half. The greatest demand was for clothing and food. On the other hand, GBP is under pressure from the situation with Brexit: it is unknown whether the parliamentarians will be able to agree on an exit plan before March 29, or the agreement will not be signed. In the latter case, the labor market will be under attack not only in the UK but also in a number of other countries. For example, Germany may lose about 103K jobs. Another negative point for the currency is low inflation. In January, consumer prices fell to a two-year low. In such circumstances, the Bank of England is unlikely to change its monetary policy in the near future.

Today, there is a holiday in the US, and there is no strong movement expected in the market. On Tuesday, data on the average wage and the number of unemployment claims in the UK will be published.

Support and resistance

Stochastic is at 98 points and signals a possibility of a correction.

Resistance levels: 1.2939, 1.2970.

Support levels: 1.2878, 1.2847.

Trading tips

Short positions can be opened from the level of 1.2939 with the target at 1.2847 and stop loss 1.2970.

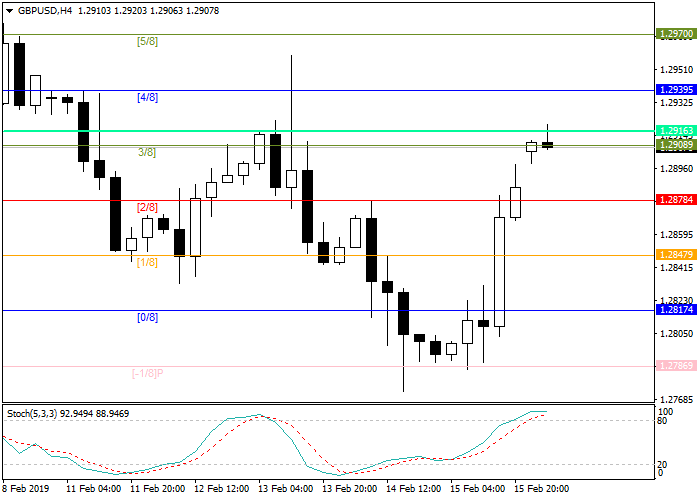

Today, GBP continues to trade in the green zone. The important resistance is the level of 4/8 or 1.2939, and the next target will be the level of 1.2970.

The demand for GBP is due to positive data on Retail Sales. In January, the index added 1%, which is a record for the last year and a half. The greatest demand was for clothing and food. On the other hand, GBP is under pressure from the situation with Brexit: it is unknown whether the parliamentarians will be able to agree on an exit plan before March 29, or the agreement will not be signed. In the latter case, the labor market will be under attack not only in the UK but also in a number of other countries. For example, Germany may lose about 103K jobs. Another negative point for the currency is low inflation. In January, consumer prices fell to a two-year low. In such circumstances, the Bank of England is unlikely to change its monetary policy in the near future.

Today, there is a holiday in the US, and there is no strong movement expected in the market. On Tuesday, data on the average wage and the number of unemployment claims in the UK will be published.

Support and resistance

Stochastic is at 98 points and signals a possibility of a correction.

Resistance levels: 1.2939, 1.2970.

Support levels: 1.2878, 1.2847.

Trading tips

Short positions can be opened from the level of 1.2939 with the target at 1.2847 and stop loss 1.2970.

No comments:

Write comments