EUR/USD: Euro is in the correction

18 February 2019, 09:00

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.1330, 1.1340 |

| Take Profit | 1.1376, 1.1400 |

| Stop Loss | 1.1300 |

| Key Levels | 1.1200, 1.1233, 1.1255, 1.1288, 1.1323, 1.1351, 1.1376, 1.1400 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.1295, 1.1285 |

| Take Profit | 1.1255, 1.1233, 1.1200 |

| Stop Loss | 1.1323 |

| Key Levels | 1.1200, 1.1233, 1.1255, 1.1288, 1.1323, 1.1351, 1.1376, 1.1400 |

Current trend

During the Asian session on February 18, EUR is recovering against USD and being corrected after the ambiguous dynamics at the end of last week. On February 15, rather cautious comments by ECB representative Benoit Coeure contributed to the euro decline. He noted that the regulator is discussing the possibility of introducing additional stimulation measures since the slowdown in the region’s economy turned out to be more extensive than expected. Inflation in the Eurozone, according to Coeure, will continue to remain low.

Markets also follow the development of the political situation in Spain. After Parliament rejected the budget from the government of the current Prime Minister Pedro Sanchez, he announced the snap elections to be held on April 28.

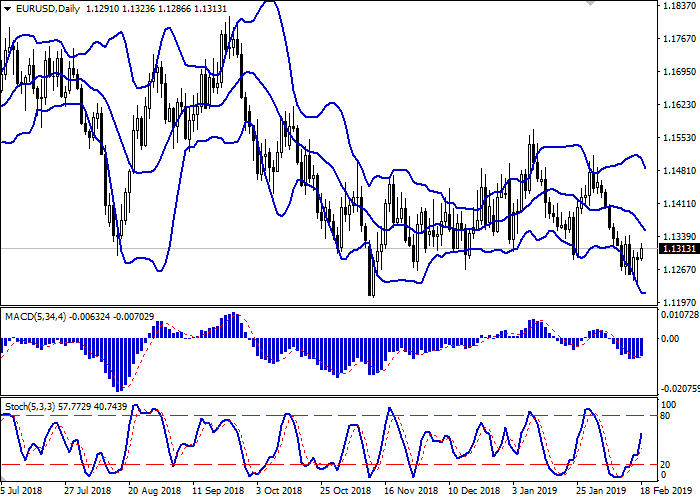

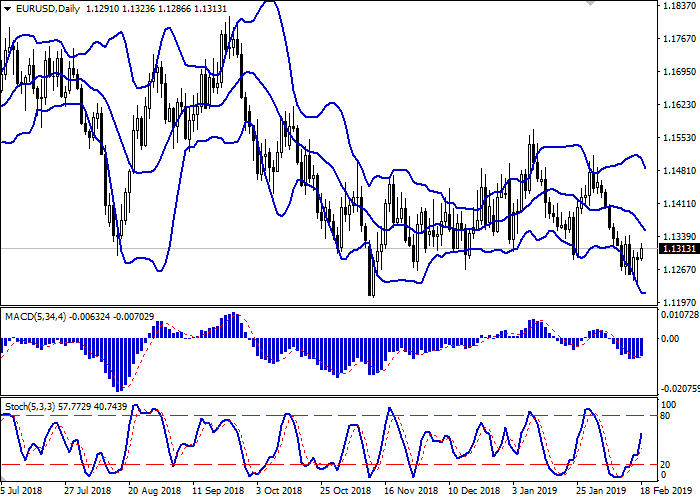

Support and resistance

On the daily chart, Bollinger bands are steadily declining. The price range is narrowing, reflecting the change in the direction of trading in the last few days. MACD indicator reversed upwards, forming a poor buy signal (the histogram is above the signal line). Stochastic is growing steadily, rapidly approaching its highs.

The development of the "bullish" trend is possible in the short and/or ultra-short term.

Resistance levels: 1.1323, 1.1351, 1.1376, 1.1400.

Support levels: 1.1288, 1.1255, 1.1233, 1.1200.

Trading tips

Long positions can be opened after the breakout of the levels of 1.1323–1.1335 with the target at 1.1376 or 1.1400. Stop loss is 1.1300.

Short positions can be opened after the rebound from the level of 1.1323 and the breakdown of the level of 1.1300 or 1.1288 with the targets at 1.1255–1.1233 or 1.1200. Stop loss is 1.1323.

Implementation period: 2–3 days.

During the Asian session on February 18, EUR is recovering against USD and being corrected after the ambiguous dynamics at the end of last week. On February 15, rather cautious comments by ECB representative Benoit Coeure contributed to the euro decline. He noted that the regulator is discussing the possibility of introducing additional stimulation measures since the slowdown in the region’s economy turned out to be more extensive than expected. Inflation in the Eurozone, according to Coeure, will continue to remain low.

Markets also follow the development of the political situation in Spain. After Parliament rejected the budget from the government of the current Prime Minister Pedro Sanchez, he announced the snap elections to be held on April 28.

Support and resistance

On the daily chart, Bollinger bands are steadily declining. The price range is narrowing, reflecting the change in the direction of trading in the last few days. MACD indicator reversed upwards, forming a poor buy signal (the histogram is above the signal line). Stochastic is growing steadily, rapidly approaching its highs.

The development of the "bullish" trend is possible in the short and/or ultra-short term.

Resistance levels: 1.1323, 1.1351, 1.1376, 1.1400.

Support levels: 1.1288, 1.1255, 1.1233, 1.1200.

Trading tips

Long positions can be opened after the breakout of the levels of 1.1323–1.1335 with the target at 1.1376 or 1.1400. Stop loss is 1.1300.

Short positions can be opened after the rebound from the level of 1.1323 and the breakdown of the level of 1.1300 or 1.1288 with the targets at 1.1255–1.1233 or 1.1200. Stop loss is 1.1323.

Implementation period: 2–3 days.

No comments:

Write comments