NZD/USD: New Zealand dollar strengthens

14 January 2019, 08:46

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.6850 |

| Take Profit | 0.6900, 0.6910 |

| Stop Loss | 0.6815 |

| Key Levels | 0.6704, 0.6748, 0.6770, 0.6789, 0.6842, 0.6865, 0.6885, 0.6910 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6780, 0.6765 |

| Take Profit | 0.6704 |

| Stop Loss | 0.6800, 0.6820 |

| Key Levels | 0.6704, 0.6748, 0.6770, 0.6789, 0.6842, 0.6865, 0.6885, 0.6910 |

Current trend

NZD rose against USD on Friday, updating local highs of December 19.

USD was under pressure due to the statements of Fed Chairman Jerome Powell at the meeting of the Economic Club in Washington. He confirmed that the regulator was ready to wait for the clarification of the economic situation before raising the rate again. However, other monetary tightening measures are likely to be implemented. Powell said that the Fed's balance would be significantly reduced but he did not mention the timing and volume of the procedure. Also, the head of the regulator noted that the long government shutdown may adversely affect the American economy.

News of the trade negotiations between China and the US, which could go to a higher level, is still encouraging the market. It is predicted that the PRC Vice Premier Liu He will visit Washington in late January, and negotiations will continue.

Support and resistance

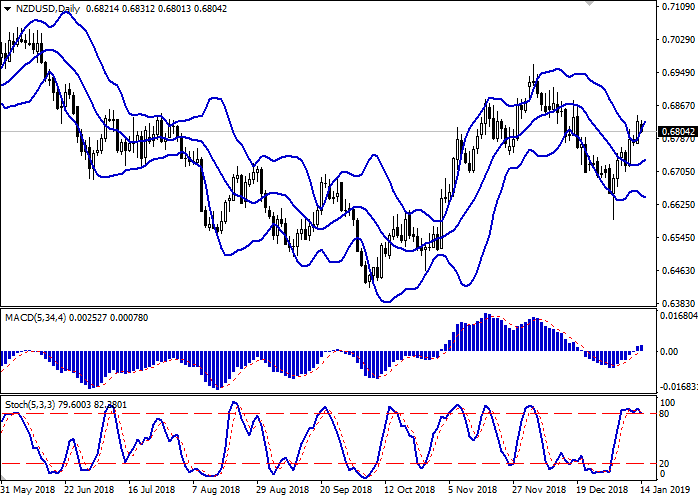

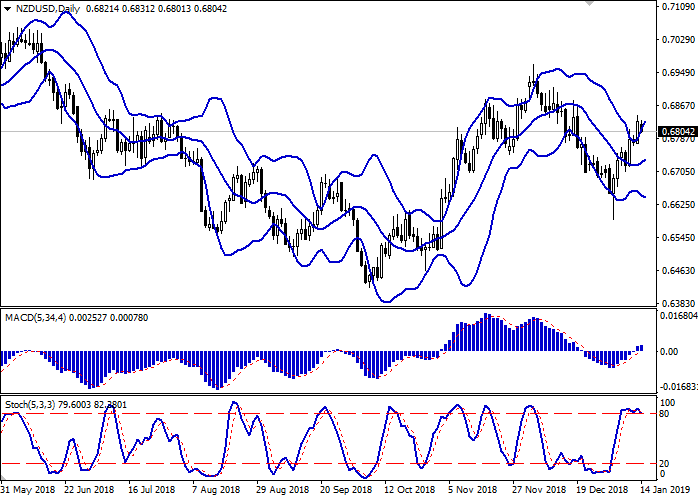

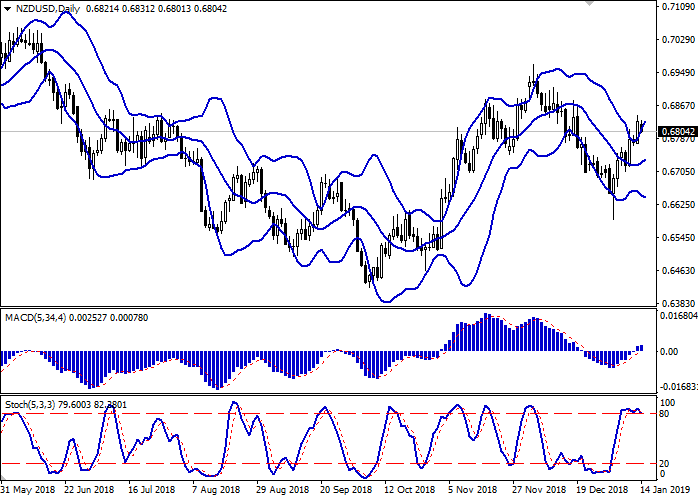

Bollinger Bands in D1 chart show moderate growth. The price range is widening but does not conform to the development of the "bullish" trend in the short term currently. MACD indicator is growing keeping a stable buy signal (located above the signal line). Stochastic, located near its maximum levels, tends to reverse into a descending plane, indicating the risks of overbought NZD.

Existing long positions should be kept until clear "bearish" signals appear.

Resistance levels: 0.6842, 0.6865, 0.6885, 0.6910.

Support levels: 0.6789, 0.6770, 0.6748, 0.6704.

Trading tips

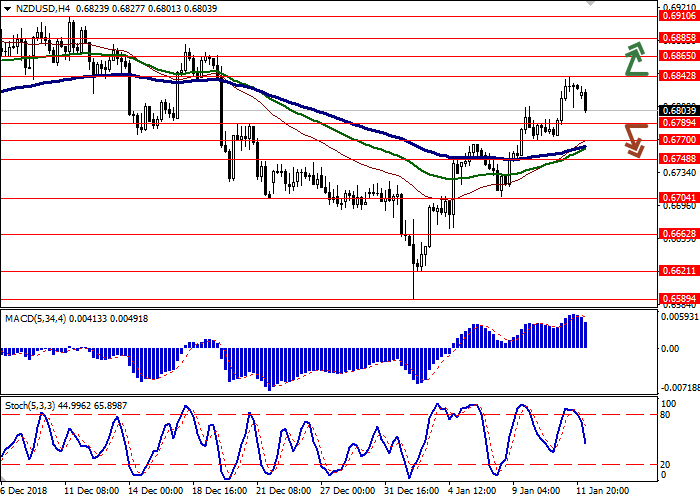

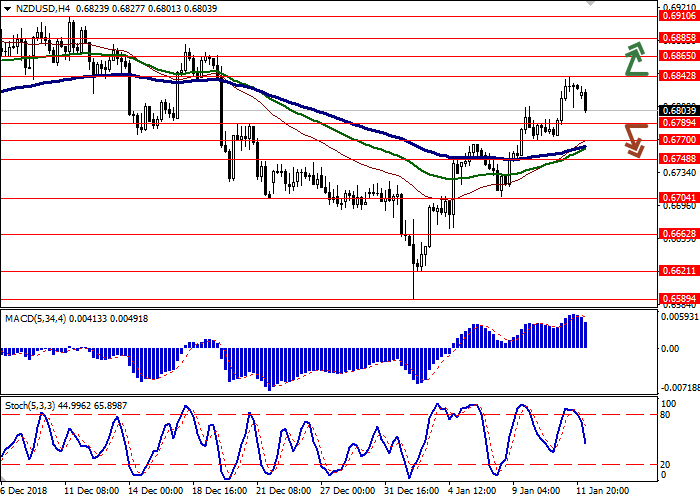

To open long positions, one can rely on the breakout of 0.6842. Take profit — 0.6900 or 0.6910. Stop loss — 0.6815.

The development of corrective dynamics with the breakdown of the level of 0.6789 or 0.6770 may become a signal to open short positions with target at 0.6704. Stop loss — 0.6800 or 0.6820.

Implementation period: 2-3 days.

NZD rose against USD on Friday, updating local highs of December 19.

USD was under pressure due to the statements of Fed Chairman Jerome Powell at the meeting of the Economic Club in Washington. He confirmed that the regulator was ready to wait for the clarification of the economic situation before raising the rate again. However, other monetary tightening measures are likely to be implemented. Powell said that the Fed's balance would be significantly reduced but he did not mention the timing and volume of the procedure. Also, the head of the regulator noted that the long government shutdown may adversely affect the American economy.

News of the trade negotiations between China and the US, which could go to a higher level, is still encouraging the market. It is predicted that the PRC Vice Premier Liu He will visit Washington in late January, and negotiations will continue.

Support and resistance

Bollinger Bands in D1 chart show moderate growth. The price range is widening but does not conform to the development of the "bullish" trend in the short term currently. MACD indicator is growing keeping a stable buy signal (located above the signal line). Stochastic, located near its maximum levels, tends to reverse into a descending plane, indicating the risks of overbought NZD.

Existing long positions should be kept until clear "bearish" signals appear.

Resistance levels: 0.6842, 0.6865, 0.6885, 0.6910.

Support levels: 0.6789, 0.6770, 0.6748, 0.6704.

Trading tips

To open long positions, one can rely on the breakout of 0.6842. Take profit — 0.6900 or 0.6910. Stop loss — 0.6815.

The development of corrective dynamics with the breakdown of the level of 0.6789 or 0.6770 may become a signal to open short positions with target at 0.6704. Stop loss — 0.6800 or 0.6820.

Implementation period: 2-3 days.

No comments:

Write comments