AUD/USD: general analysis

14 January 2019, 09:06

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 0.7180 |

| Take Profit | 0.7230 |

| Stop Loss | 0.7160 |

| Key Levels | 0.6992, 0.7037, 0.7082, 0.7143, 0.7185, 0.7228, 0.7282, 0.7320 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.7165 |

| Take Profit | 0.7115 |

| Stop Loss | 0.7195 |

| Key Levels | 0.6992, 0.7037, 0.7082, 0.7143, 0.7185, 0.7228, 0.7282, 0.7320 |

Current trend

Today, the AUD/USD pair fell moderately after the publication of poor import/export data from the National Bureau of Statistics of China.

Last week, AUD strengthened against USD due to a decrease in tensions between the United States and China. In late January, in Washington, both sides are planning summit talks that should bring an end to the trade war. At the same time, USD is under pressure caused by the Fed's cautious position regarding the pace of tightening monetary policy in 2019.

This week, no significant macroeconomic publications are predicted in Australia, and the further dynamics of the instrument are still dependent on USD. Tomorrow at 04:00 (GMT+2), the People's Bank of China will publish statistics on the volume of consumer lending for December 2018. In addition, the report of the Ministry of Commerce of China on foreign direct investment in the economy of the country will be released. At 15:30 (GMT+2), US Producer Prices Index release is expected.

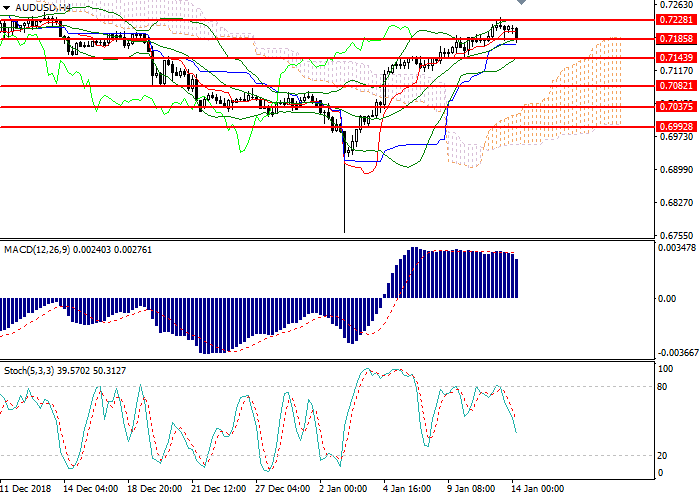

Support and resistance

On the 4-hour chart, the instrument is being corrected to a strong support level of 0.7184. Bollinger bands are directed upwards, and the price range has widened, indicating the resumption of upward dynamics during the day. MACD histogram is in the positive zone, keeping a strong buy signal. Stochastic does not give a clear signal to enter the market.

Resistance levels: 0.7228, 0.7282, 0.7320.

Support levels: 0.7185, 0.7143, 0.7082, 0.7037, 0.6992.

Trading tips

Long positions can be opened from the current level with the target at 0.7230 and stop loss 0.7160. Implementation period: 1 day.

Short positions can be opened below the level of 0.7170 with the target at 0.7115 and stop loss 0.7195. Implementation period: 1–2 days.

Today, the AUD/USD pair fell moderately after the publication of poor import/export data from the National Bureau of Statistics of China.

Last week, AUD strengthened against USD due to a decrease in tensions between the United States and China. In late January, in Washington, both sides are planning summit talks that should bring an end to the trade war. At the same time, USD is under pressure caused by the Fed's cautious position regarding the pace of tightening monetary policy in 2019.

This week, no significant macroeconomic publications are predicted in Australia, and the further dynamics of the instrument are still dependent on USD. Tomorrow at 04:00 (GMT+2), the People's Bank of China will publish statistics on the volume of consumer lending for December 2018. In addition, the report of the Ministry of Commerce of China on foreign direct investment in the economy of the country will be released. At 15:30 (GMT+2), US Producer Prices Index release is expected.

Support and resistance

On the 4-hour chart, the instrument is being corrected to a strong support level of 0.7184. Bollinger bands are directed upwards, and the price range has widened, indicating the resumption of upward dynamics during the day. MACD histogram is in the positive zone, keeping a strong buy signal. Stochastic does not give a clear signal to enter the market.

Resistance levels: 0.7228, 0.7282, 0.7320.

Support levels: 0.7185, 0.7143, 0.7082, 0.7037, 0.6992.

Trading tips

Long positions can be opened from the current level with the target at 0.7230 and stop loss 0.7160. Implementation period: 1 day.

Short positions can be opened below the level of 0.7170 with the target at 0.7115 and stop loss 0.7195. Implementation period: 1–2 days.

No comments:

Write comments