Bitcoin: technical analysis

09 January 2019, 10:46

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 4070.00 |

| Take Profit | 4140.63, 4218.75 |

| Stop Loss | 4020.00 |

| Key Levels | 3828.13, 3906.25, 3984.38, 4062.50, 4140.63, 4218.75 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 3980.00 |

| Take Profit | 3906.25, 3828.13 |

| Stop Loss | 4032.00 |

| Key Levels | 3828.13, 3906.25, 3984.38, 4062.50, 4140.63, 4218.75 |

Current trend

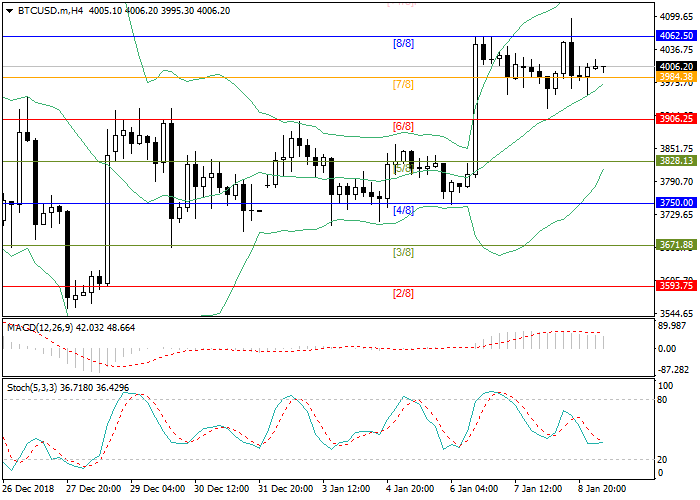

After several attempts to consolidate above the level of 4062.50 (Murrey [8/8]), Bitcoin quotes were corrected downwards to the area of 3984.38 (Murrey [7/8]) amid low trading activity. Fixing the price below the level of 3984.38 (Murrey [7/8]) will be a signal for the development of a downward trend and will open the way to the area of 3906.25 (Murrey [6/8]). The continuation of the upward trend will be possible only after the price fixes above the level of 4062.50. In this case, it may grow to the level of 4140.63 (Murrey [+1/8]) – 4218.75 (Murrey [+2/8]).

Technical indicators do not give a single signal. Bollinger bands converge, indicating the continuation of the current sideways trend. MACD volumes are slowly declining in the positive zone. Stochastic lines are directed sideways, indicating the development of a sideways trend.

Support and resistance

Resistance levels: 4062.50, 4140.63, 4218.75.

Support levels: 3984.38, 3906.25, 3828.13.

Trading tips

Long positions can be opened above the level of 4062.50 with the targets around 4140.63–4218.75 and stop loss 4020.00.

Short positions can be opened below the level of 3984.38 with the targets around 3906.25–3828.13 and stop loss 4032.00.

After several attempts to consolidate above the level of 4062.50 (Murrey [8/8]), Bitcoin quotes were corrected downwards to the area of 3984.38 (Murrey [7/8]) amid low trading activity. Fixing the price below the level of 3984.38 (Murrey [7/8]) will be a signal for the development of a downward trend and will open the way to the area of 3906.25 (Murrey [6/8]). The continuation of the upward trend will be possible only after the price fixes above the level of 4062.50. In this case, it may grow to the level of 4140.63 (Murrey [+1/8]) – 4218.75 (Murrey [+2/8]).

Technical indicators do not give a single signal. Bollinger bands converge, indicating the continuation of the current sideways trend. MACD volumes are slowly declining in the positive zone. Stochastic lines are directed sideways, indicating the development of a sideways trend.

Support and resistance

Resistance levels: 4062.50, 4140.63, 4218.75.

Support levels: 3984.38, 3906.25, 3828.13.

Trading tips

Long positions can be opened above the level of 4062.50 with the targets around 4140.63–4218.75 and stop loss 4020.00.

Short positions can be opened below the level of 3984.38 with the targets around 3906.25–3828.13 and stop loss 4032.00.

No comments:

Write comments