NZD/USD: general analysis

09 January 2019, 10:45

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.6785 |

| Take Profit | 0.6830, 0.6845 |

| Stop Loss | 0.6760 |

| Key Levels | 0.6607, 0.6644, 0.6678, 0.6707, 0.6732, 0.6778, 0.6828, 0.6877, 0.6918, 0.6966 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6725 |

| Take Profit | 0.6680 |

| Stop Loss | 0.6745 |

| Key Levels | 0.6607, 0.6644, 0.6678, 0.6707, 0.6732, 0.6778, 0.6828, 0.6877, 0.6918, 0.6966 |

Current trend

On Tuesday, the NZD/USD pair strengthened due to a reduction in JOLTs Job Openings in the United States. In November, the indicator decreased from 7.131 to 6.888 million, which allowed the instrument to rise by more than 60 points. At the same time, traders are awaiting the results of negotiations on trade and economic issues between the PRC and the United States. Previously, the meeting participants decided to extend the consultation for a day. Chinese analysts have already reported that a consensus has been reached on American agricultural products and energy carriers but the key problems regarding duties have not yet been resolved.

Today, at 15:20, 16:00 and at 18:30 (GMT+2), speeches by FOMC members are scheduled, and at 21:00 (GMT+2) Fed’s Meeting Minutes will be published. Investors expect to get the information on the pace of monetary tightening in the current year.

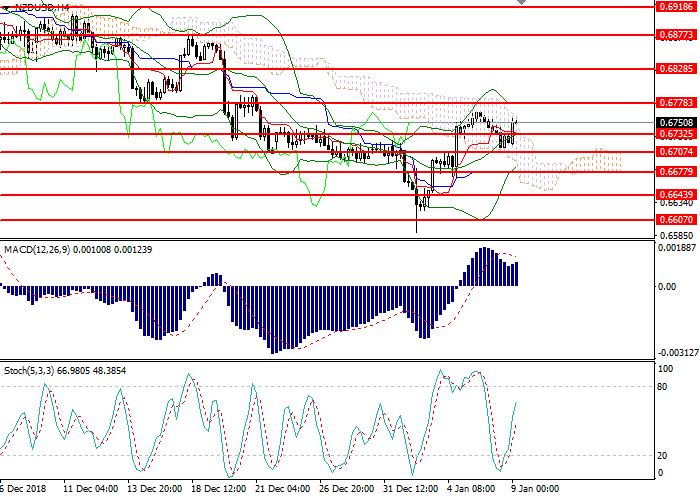

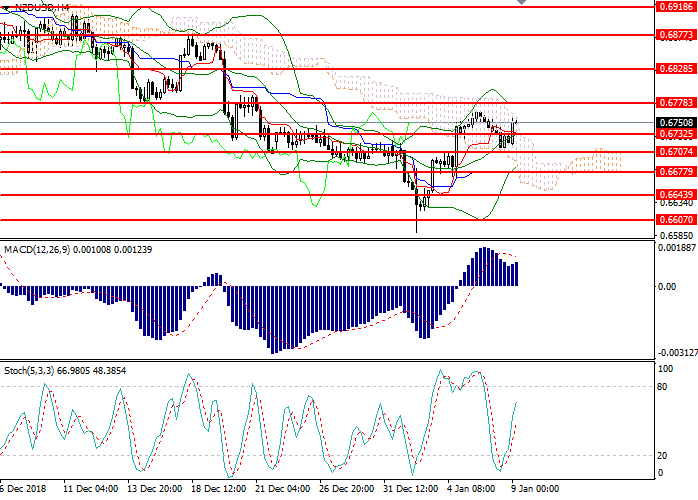

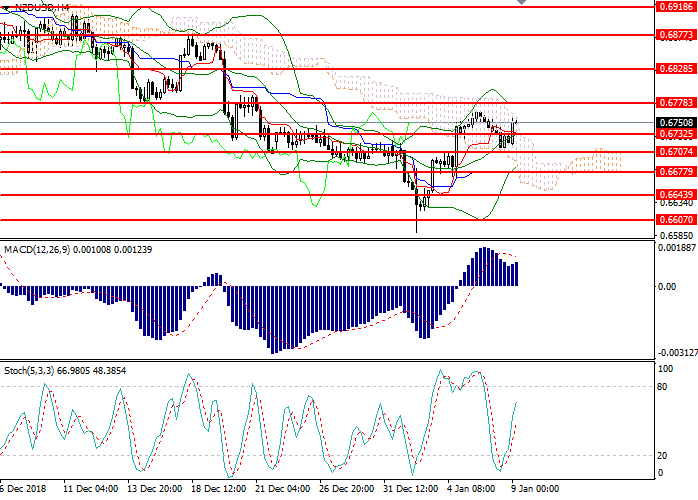

Support and resistance

On the 4-hour chart, the instrument is strengthened around the upper border of Bollinger bands. The indicator is directed upwards, and the price range has narrowed, which reflects a change of the upward trend. MACD histogram is in the positive zone, keeping a buy signal. Stochastic is approaching the overbought area but the signal for opening positions has not been formed.

Resistance levels: 0.6778, 0.6828, 0.6877, 0.6918, 0.6966.

Support levels: 0.6732, 0.6707, 0.6678, 0.6644, 0.6607.

Trading tips

Long positions can be opened above the level of 0.6780 with targets at 0.6830, 0.6845 and stop loss 0.6760.

Short positions can be opened below the level of 0.6730 with the target at 0.6680 and stop loss 0.6745.

Implementation period: 1 day.

On Tuesday, the NZD/USD pair strengthened due to a reduction in JOLTs Job Openings in the United States. In November, the indicator decreased from 7.131 to 6.888 million, which allowed the instrument to rise by more than 60 points. At the same time, traders are awaiting the results of negotiations on trade and economic issues between the PRC and the United States. Previously, the meeting participants decided to extend the consultation for a day. Chinese analysts have already reported that a consensus has been reached on American agricultural products and energy carriers but the key problems regarding duties have not yet been resolved.

Today, at 15:20, 16:00 and at 18:30 (GMT+2), speeches by FOMC members are scheduled, and at 21:00 (GMT+2) Fed’s Meeting Minutes will be published. Investors expect to get the information on the pace of monetary tightening in the current year.

Support and resistance

On the 4-hour chart, the instrument is strengthened around the upper border of Bollinger bands. The indicator is directed upwards, and the price range has narrowed, which reflects a change of the upward trend. MACD histogram is in the positive zone, keeping a buy signal. Stochastic is approaching the overbought area but the signal for opening positions has not been formed.

Resistance levels: 0.6778, 0.6828, 0.6877, 0.6918, 0.6966.

Support levels: 0.6732, 0.6707, 0.6678, 0.6644, 0.6607.

Trading tips

Long positions can be opened above the level of 0.6780 with targets at 0.6830, 0.6845 and stop loss 0.6760.

Short positions can be opened below the level of 0.6730 with the target at 0.6680 and stop loss 0.6745.

Implementation period: 1 day.

No comments:

Write comments