YM: general review

19 December 2018, 12:40

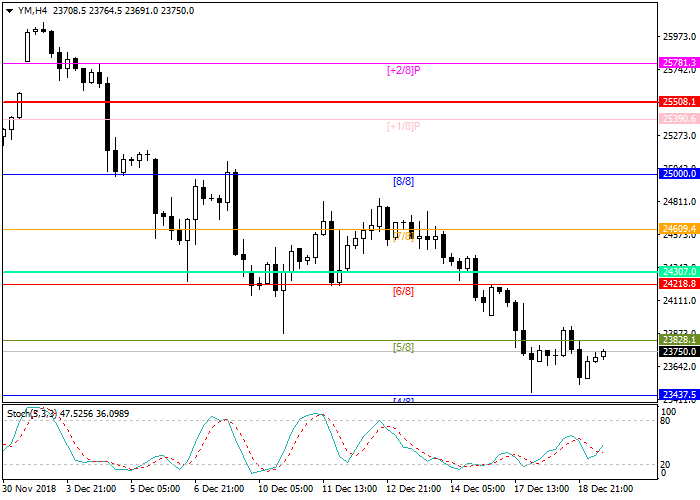

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 23437.0 |

| Take Profit | 23136.9 |

| Stop Loss | 23618.0 |

| Key Levels | 23136.9, 23437.5, 23828.1, 24218.8 |

Current trend

The Dow Jones continues to fall: an important support level is at 4/8 Murrey or 23437.5. If it is broken down, the next target will be 23136.9.

The markets are pressured by the negative data from the United States. The index of business activity of the Federal Reserve Bank of New York unexpectedly dropped to 10.9 points against the forecast of 20.6. The housing price index also fell to 56 points (the minimum value over the past three years). An important event today will be the Fed meeting on interest rates and the Jerome Powell's conference, on which forecasts for monetary policy for next year will be presented. If statements are made that the interest rate will not change so aggressively, it can support the stock market. Due to increased volatility and slower economic growth, market participants expect that in 2019 the interest rate will be increased only once. Investors are also worried about the shutdown threat — a temporary suspension of government operations if President Donald Trump cannot reach an agreement with Congress on financing government spending law. The procedure can be started on December 21st.

Support and resistance

Stochastic is at 19 points and does not provide a signal for the opening of positions.

Resistance levels: 23828.1, 24218.8.

Support levels: 23437.5, 23136.9.

Trading tips

Short positions may be opened after a breakout of the support level of 23437.5 with the take profit at 23136.9 and stop loss at 23618.0.

The Dow Jones continues to fall: an important support level is at 4/8 Murrey or 23437.5. If it is broken down, the next target will be 23136.9.

The markets are pressured by the negative data from the United States. The index of business activity of the Federal Reserve Bank of New York unexpectedly dropped to 10.9 points against the forecast of 20.6. The housing price index also fell to 56 points (the minimum value over the past three years). An important event today will be the Fed meeting on interest rates and the Jerome Powell's conference, on which forecasts for monetary policy for next year will be presented. If statements are made that the interest rate will not change so aggressively, it can support the stock market. Due to increased volatility and slower economic growth, market participants expect that in 2019 the interest rate will be increased only once. Investors are also worried about the shutdown threat — a temporary suspension of government operations if President Donald Trump cannot reach an agreement with Congress on financing government spending law. The procedure can be started on December 21st.

Support and resistance

Stochastic is at 19 points and does not provide a signal for the opening of positions.

Resistance levels: 23828.1, 24218.8.

Support levels: 23437.5, 23136.9.

Trading tips

Short positions may be opened after a breakout of the support level of 23437.5 with the take profit at 23136.9 and stop loss at 23618.0.

No comments:

Write comments