USD/CAD: the pair is growing

19 December 2018, 12:48

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 1.3469 |

| Take Profit | 1.3595, 1.3785 |

| Stop Loss | 1.3355 |

| Key Levels | 1.3170, 1.3225, 1.3290, 1.3355, 1.3375, 1.3390, 1.3450, 1.3495, 1.3530, 1.3570, 1.3595, 1.3650, 1.3785 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY LIMIT |

| Entry Point | 1.3450, 1.3390 |

| Take Profit | 1.3595, 1.3785 |

| Stop Loss | 1.3310 |

| Key Levels | 1.3170, 1.3225, 1.3290, 1.3355, 1.3375, 1.3390, 1.3450, 1.3495, 1.3530, 1.3570, 1.3595, 1.3650, 1.3785 |

Current trend

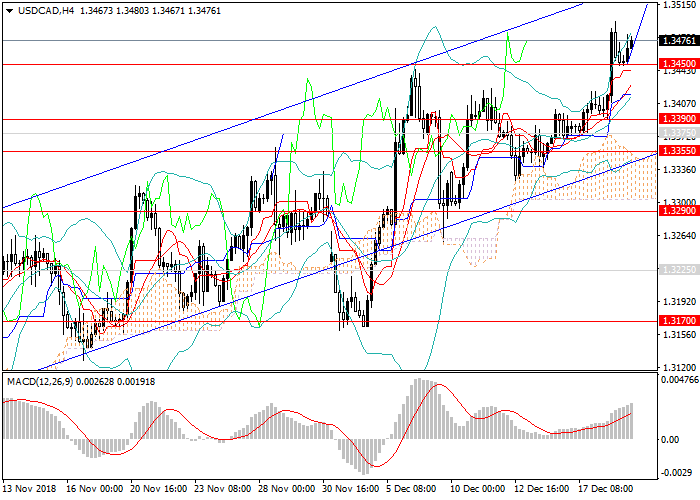

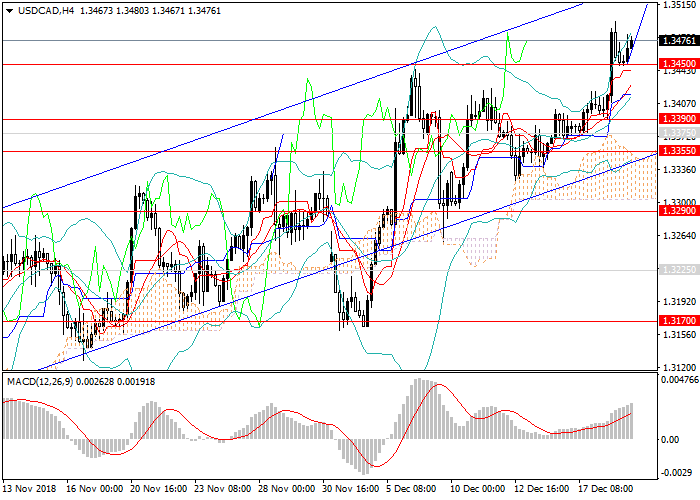

For two and a half months, the USD/CAD pair has been trading within an upward channel due to the ambiguous Canadian statistics and the growing demand for the American currency. In early December, the price fell to the key support level of 1.3170, failed to overcome it and sharply rose to a local maximum of 1.3450. It was followed by a correction, which was replaced by the current upward impulse with testing of new local highs.

This week, strong data on the US construction sector were published, but traders are waiting for new statistics that can affect the instrument. Today, special attention should be paid to inflation level data in Canada and the Fed's decision on monetary policy. In the second half of the week, GDP and Retail Sales will be released in Canada, and employment market data will be published in the USA.

Support and resistance

In the medium term, the trend will continue, as the growth rate of the economy and key US macroeconomic indicators are increasing. The price can rise to levels of 1.3595 and 1.3785, which were tested at the end of 2016 and the middle of 2017.

Technically, the pair stays within the upward channel, which is supported by the technical indicators’ readings: MACD volumes of long positions are growing, Bollinger bands are directed upwards.

Resistance levels: 1.3495, 1.3530, 1.3570, 1.3595, 1.3650, 1.3785.

Support levels: 1.3450, 1.3390, 1.3375, 1.3355, 1.3290, 1.3225, 1.3170.

Trading tips

It is relevant to increase the volumes of long positions from the current level and open pending long positions from the levels of 1.3450, 1.3390 with the targets at 1.3595, 1.3785 and stop loss 1.3310.

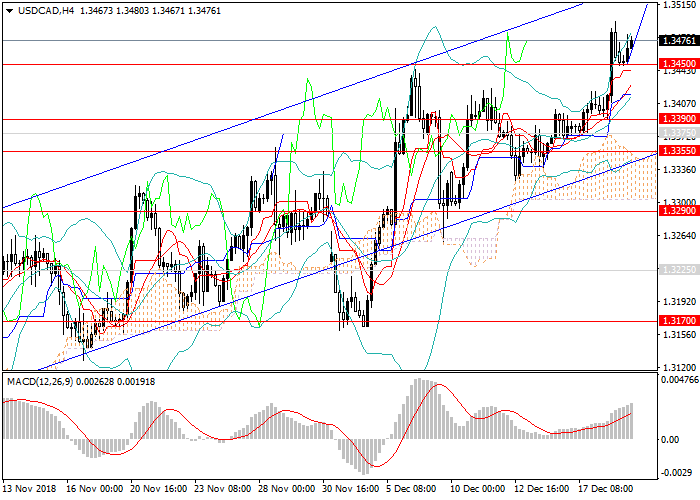

For two and a half months, the USD/CAD pair has been trading within an upward channel due to the ambiguous Canadian statistics and the growing demand for the American currency. In early December, the price fell to the key support level of 1.3170, failed to overcome it and sharply rose to a local maximum of 1.3450. It was followed by a correction, which was replaced by the current upward impulse with testing of new local highs.

This week, strong data on the US construction sector were published, but traders are waiting for new statistics that can affect the instrument. Today, special attention should be paid to inflation level data in Canada and the Fed's decision on monetary policy. In the second half of the week, GDP and Retail Sales will be released in Canada, and employment market data will be published in the USA.

Support and resistance

In the medium term, the trend will continue, as the growth rate of the economy and key US macroeconomic indicators are increasing. The price can rise to levels of 1.3595 and 1.3785, which were tested at the end of 2016 and the middle of 2017.

Technically, the pair stays within the upward channel, which is supported by the technical indicators’ readings: MACD volumes of long positions are growing, Bollinger bands are directed upwards.

Resistance levels: 1.3495, 1.3530, 1.3570, 1.3595, 1.3650, 1.3785.

Support levels: 1.3450, 1.3390, 1.3375, 1.3355, 1.3290, 1.3225, 1.3170.

Trading tips

It is relevant to increase the volumes of long positions from the current level and open pending long positions from the levels of 1.3450, 1.3390 with the targets at 1.3595, 1.3785 and stop loss 1.3310.

No comments:

Write comments