XAG/USD: general review

03 December 2018, 10:29

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 14.43 |

| Take Profit | 14.50, 14.55 |

| Stop Loss | 14.35 |

| Key Levels | 14.20, 14.25, 14.30, 14.35, 14.40, 14.45, 14.50, 14.55 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 14.23 |

| Take Profit | 14.20, 14.16 |

| Stop Loss | 14.28 |

| Key Levels | 14.20, 14.25, 14.30, 14.35, 14.40, 14.45, 14.50, 14.55 |

Current trend

Due to the general weakening of USD, silver quotations increased to 14.40.

Investors switched their attention from US currency to metals after it became known that during the two-hour talks at the G20 summit, Donald Trump and Xi Jinping agreed not to introduce new reciprocal trade duties. It is expected that such measures can correct the situation with the trade imbalance between the two states.

Today's macroeconomic releases, able to affect the instrument, include November ISM Manufacturing PMI in the US. The indicator is expected to fall to 57.5 points in November from 57.7 points a month earlier. If this assumption is right, it will support the rate in the short term.

Support and resistance

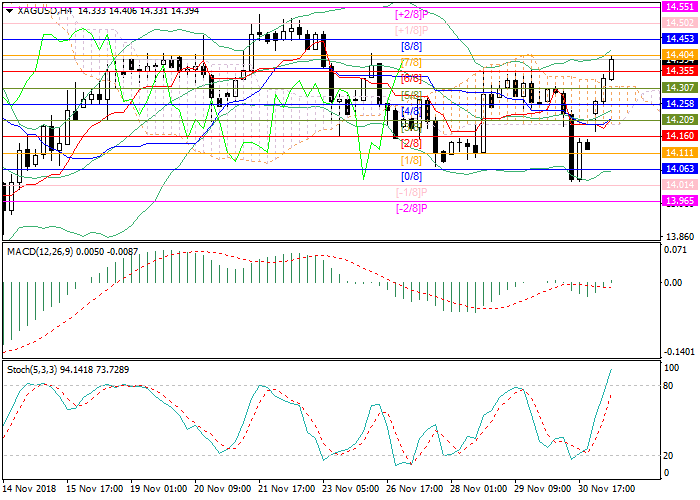

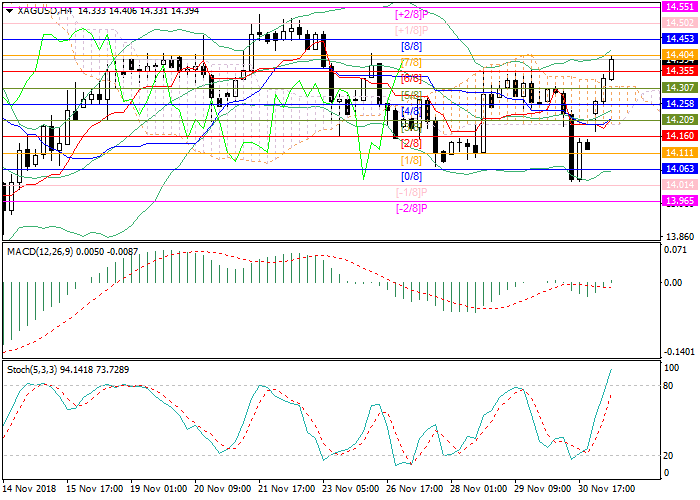

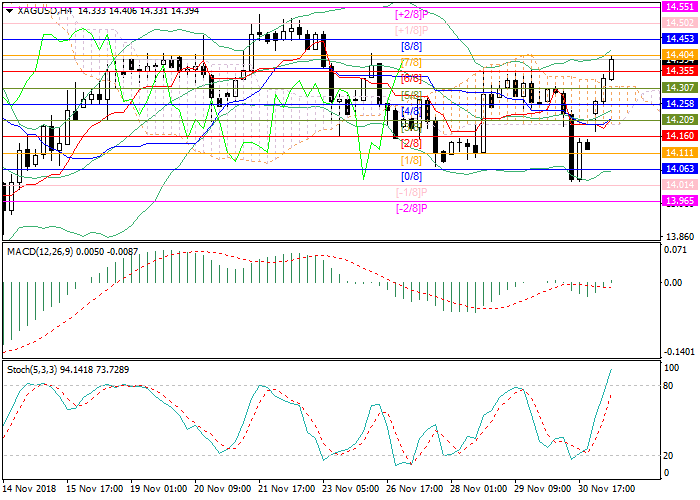

Technical indicators in the H4 chart point at the preservation of the upward trend. Bollinger Bands are directed upwards. The volumes of MACD histogram are growing in the positive zone, forming a signal for purchase. Stochastic lines are in the overbought zone and are directed upwards.

Resistance levels: 14.40, 14.45, 14.50, 14.55.

Support levels: 14.35, 14.30, 14.25, 14.20.

Trading tips

Long positions may be opened above the level of 14.40 with targets at 14.50–14.55 and stop loss at 14.35.

Short positions may be opened below 14.25 with targets at 14.20–14.16 and stop loss at 14.28.

Due to the general weakening of USD, silver quotations increased to 14.40.

Investors switched their attention from US currency to metals after it became known that during the two-hour talks at the G20 summit, Donald Trump and Xi Jinping agreed not to introduce new reciprocal trade duties. It is expected that such measures can correct the situation with the trade imbalance between the two states.

Today's macroeconomic releases, able to affect the instrument, include November ISM Manufacturing PMI in the US. The indicator is expected to fall to 57.5 points in November from 57.7 points a month earlier. If this assumption is right, it will support the rate in the short term.

Support and resistance

Technical indicators in the H4 chart point at the preservation of the upward trend. Bollinger Bands are directed upwards. The volumes of MACD histogram are growing in the positive zone, forming a signal for purchase. Stochastic lines are in the overbought zone and are directed upwards.

Resistance levels: 14.40, 14.45, 14.50, 14.55.

Support levels: 14.35, 14.30, 14.25, 14.20.

Trading tips

Long positions may be opened above the level of 14.40 with targets at 14.50–14.55 and stop loss at 14.35.

Short positions may be opened below 14.25 with targets at 14.20–14.16 and stop loss at 14.28.

No comments:

Write comments