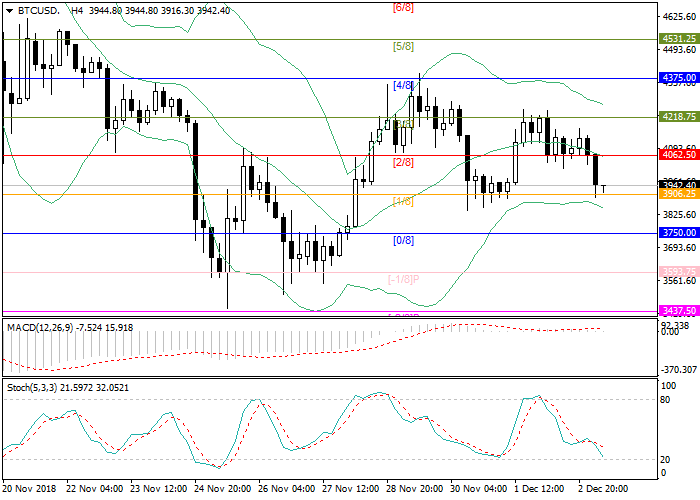

Bitcoin: technical analysis

03 December 2018, 09:46

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 3890.00 |

| Take Profit | 3750.00 |

| Stop Loss | 3940.00 |

| Key Levels | 3593.75, 3750.00, 3906.25, 4062.50, 4218.75, 4375.00 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 4070.00 |

| Take Profit | 4218.75 |

| Stop Loss | 4020.00 |

| Key Levels | 3593.75, 3750.00, 3906.25, 4062.50, 4218.75, 4375.00 |

Current trend

Bitcoin quotes could not consolidate above 4000.00 and went down again. Currently, the price is testing the support level of 3906.25 (Murrey [1/8]). If the current dynamics remains, the next target of sellers for the near future will be the level of 3750.00 (Murrey [0/8]). A more active decline will be possible in case of a confident breakdown of the level of 3750.0 and consolidation of the price below it. In this scenario, the return of quotations to the November lows at 3446.90 looks quite probable. Rebound from 3906.25 and consolidation of the price above the level of the center line of Bollinger Bands (4062.50) will open path to the area of 4218.75 (Murrey [3/8])–4375.00 (Murrey [4/8]) for Bitcoin.

Technical indicators confirm the downtrend. Bollinger Bands and Stochastic lines are directed downwards. MACD histogram is about to move to the negative zone and to form a sell signal.

Support and resistance

Resistance levels: 4062.50, 4218.75, 4375.00.

Support levels: 3906.25, 3750.00, 3593.75.

Trading tips

Short positions may be opened below the level of 3900.00 with target at 3750.00 and stop loss at 3940.00.

Long positions may be opened above the level of 4062.50 with target at 4218.75 and stop loss at 4020.00.

Bitcoin quotes could not consolidate above 4000.00 and went down again. Currently, the price is testing the support level of 3906.25 (Murrey [1/8]). If the current dynamics remains, the next target of sellers for the near future will be the level of 3750.00 (Murrey [0/8]). A more active decline will be possible in case of a confident breakdown of the level of 3750.0 and consolidation of the price below it. In this scenario, the return of quotations to the November lows at 3446.90 looks quite probable. Rebound from 3906.25 and consolidation of the price above the level of the center line of Bollinger Bands (4062.50) will open path to the area of 4218.75 (Murrey [3/8])–4375.00 (Murrey [4/8]) for Bitcoin.

Technical indicators confirm the downtrend. Bollinger Bands and Stochastic lines are directed downwards. MACD histogram is about to move to the negative zone and to form a sell signal.

Support and resistance

Resistance levels: 4062.50, 4218.75, 4375.00.

Support levels: 3906.25, 3750.00, 3593.75.

Trading tips

Short positions may be opened below the level of 3900.00 with target at 3750.00 and stop loss at 3940.00.

Long positions may be opened above the level of 4062.50 with target at 4218.75 and stop loss at 4020.00.

No comments:

Write comments