NZD/USD: general analysis

03 December 2018, 10:54

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 0.6929 |

| Take Profit | 0.6977 |

| Stop Loss | 0.6890 |

| Key Levels | 0.6800, 0.6820, 0.6837, 0.6853, 0.6886, 0.6930, 0.6954, 0.6977, 0.7020, 0.7085 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6837 |

| Take Profit | 0.6753 |

| Stop Loss | 0.6870 |

| Key Levels | 0.6800, 0.6820, 0.6837, 0.6853, 0.6886, 0.6930, 0.6954, 0.6977, 0.7020, 0.7085 |

Current trend

NZD strengthened against USD after the reaching a trade agreement between the US and China at the G20 summit. For 90 days, the United States will suspend the decision to raise duties from 10% to 25%. In this case, Washington reserves the right to increase tariffs after the period, if Beijing does not comply with the terms of the agreement. China, in turn, will purchase "very significant" volume of products from the United States. It is predicted that such measures may correct the situation with the trade imbalance between the two states. China's economy has a big impact on the entire Pacific region, and the truce in the trade war gave impetus to the growth of NZD, sending a pair to the level of 0.6920.

Today, investors should pay attention to data from the United States, in particular, the ISM Manufacturing PMI publication at 17:00 (GMT+2), high volatility is predicted on the market.

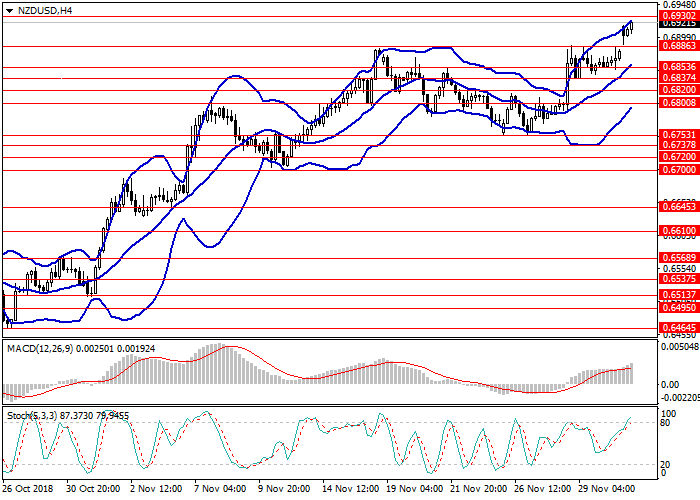

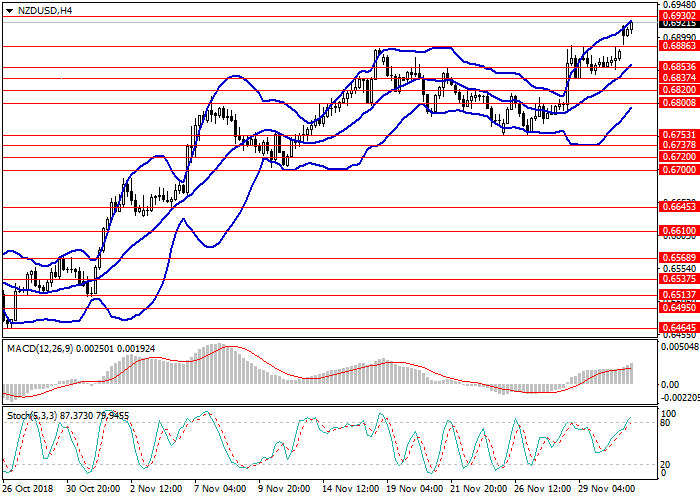

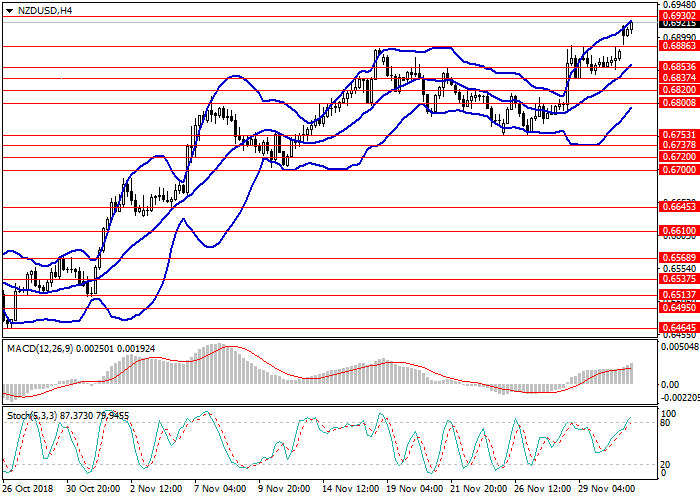

Support and resistance

On the 4-hour chart, the instrument grows along the upper border of Bollinger bands, the price range is expanded. MACD histogram is in the positive area, keeping the signal to open long positions.

Resistance levels are 0.6930, 0.6954, 0.6977, 0.7020, 0.7085.

Support levels: 0.6886, 0.6853, 0.6837, 0.6820, 0.6800.

Trading tips

Long positions can be opened from the current level with the target at 0.6977 and stop loss 0.6890. Implementation period: 1–3 days.

Short positions can be opened from the level of 0.6837 with the target at 0.6753 and stop loss 0.6870. Implementation period: 3–5 days.

NZD strengthened against USD after the reaching a trade agreement between the US and China at the G20 summit. For 90 days, the United States will suspend the decision to raise duties from 10% to 25%. In this case, Washington reserves the right to increase tariffs after the period, if Beijing does not comply with the terms of the agreement. China, in turn, will purchase "very significant" volume of products from the United States. It is predicted that such measures may correct the situation with the trade imbalance between the two states. China's economy has a big impact on the entire Pacific region, and the truce in the trade war gave impetus to the growth of NZD, sending a pair to the level of 0.6920.

Today, investors should pay attention to data from the United States, in particular, the ISM Manufacturing PMI publication at 17:00 (GMT+2), high volatility is predicted on the market.

Support and resistance

On the 4-hour chart, the instrument grows along the upper border of Bollinger bands, the price range is expanded. MACD histogram is in the positive area, keeping the signal to open long positions.

Resistance levels are 0.6930, 0.6954, 0.6977, 0.7020, 0.7085.

Support levels: 0.6886, 0.6853, 0.6837, 0.6820, 0.6800.

Trading tips

Long positions can be opened from the current level with the target at 0.6977 and stop loss 0.6890. Implementation period: 1–3 days.

Short positions can be opened from the level of 0.6837 with the target at 0.6753 and stop loss 0.6870. Implementation period: 3–5 days.

No comments:

Write comments