SPX: general review

03 December 2018, 11:12

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 2823.0 |

| Take Profit | 2868.6 |

| Stop Loss | 2799.5 |

| Key Levels | 2754.0, 2779.2, 2822.5, 2851.6 |

Current trend

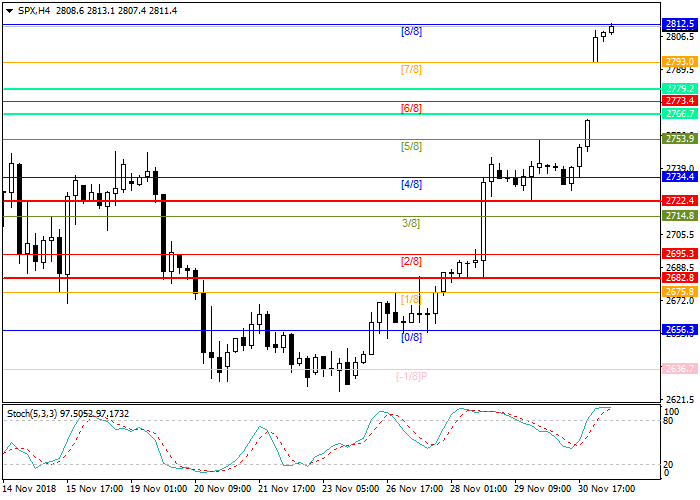

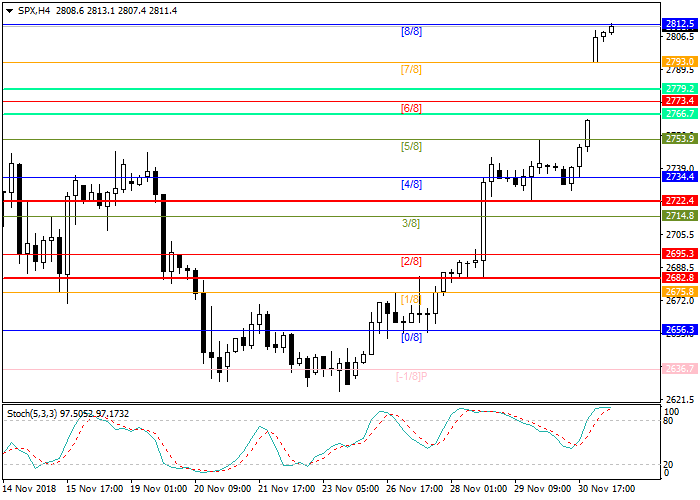

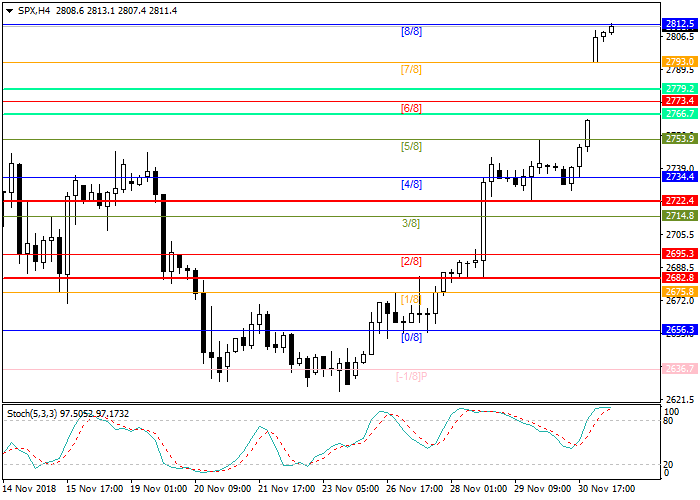

S&P 500 continues strengthening. Currently the index is trading around the resistance level of 2812.5 (Murrey [8/8]). If the price can consolidate above it, the next target will be at the level of 2851.6 (Murrey [5/8]).

The demand for the asset was triggered by positive news from the G20 summit, where the United States and China were able to reach common agreements on trade tariffs. An agreement was reached about a 90-day break, during which Washington would not introduce new tariffs for Chinese goods. Beijing, in turn, promised to "reduce and remove 40% tariffs on cars from the US" as Donald Trump wrote on his Twitter. However, according to experts, for the automotive industry this will not play a special role, since about 250,000 new cars a year are shipped for export, and most of the profits of the companies are from sales in the domestic market. In addition, it is worth considering that such large automakers as Ford and General Motors sold cars that were partially assembled in factories in China and therefore were not subject to 40% duty.

Today, data on construction spending, as well as November Manufacturing PMI will be published in the United States.

Support and resistance

Stochastic is at the level of 96 points and indicates the possible correction.

Resistance levels: 2822.5, 2851.6.

Support levels: 2779.2, 2754.0.

Trading tips

Open long positions after the breakout of 2822.5 with take profit at 2868.6 and stop loss at 2799.5.

S&P 500 continues strengthening. Currently the index is trading around the resistance level of 2812.5 (Murrey [8/8]). If the price can consolidate above it, the next target will be at the level of 2851.6 (Murrey [5/8]).

The demand for the asset was triggered by positive news from the G20 summit, where the United States and China were able to reach common agreements on trade tariffs. An agreement was reached about a 90-day break, during which Washington would not introduce new tariffs for Chinese goods. Beijing, in turn, promised to "reduce and remove 40% tariffs on cars from the US" as Donald Trump wrote on his Twitter. However, according to experts, for the automotive industry this will not play a special role, since about 250,000 new cars a year are shipped for export, and most of the profits of the companies are from sales in the domestic market. In addition, it is worth considering that such large automakers as Ford and General Motors sold cars that were partially assembled in factories in China and therefore were not subject to 40% duty.

Today, data on construction spending, as well as November Manufacturing PMI will be published in the United States.

Support and resistance

Stochastic is at the level of 96 points and indicates the possible correction.

Resistance levels: 2822.5, 2851.6.

Support levels: 2779.2, 2754.0.

Trading tips

Open long positions after the breakout of 2822.5 with take profit at 2868.6 and stop loss at 2799.5.

No comments:

Write comments