USD/JPY: upward momentum may resume

14 December 2018, 13:43

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 113.57 |

| Take Profit | 114.00, 114.50, 115.50 |

| Stop Loss | 113.20 |

| Key Levels | 111.75, 112.85, 113.15, 114.00, 114.50, 115.00 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY LIMIT |

| Entry Point | 113.15, 112.85 |

| Take Profit | 114.00, 114.50, 115.50 |

| Stop Loss | 112.30 |

| Key Levels | 111.75, 112.85, 113.15, 114.00, 114.50, 115.00 |

Current trend

The pair continues to trade in a narrowing sideways consolidation, like most of major currency pairs. The flat market at the end of 2018 is due to the lack of important macroeconomic releases and decisions of the Central Banks.

Despite the weak data for Japan this trading week, the US dollar did not take advantage of this, and the pair remained in the channel. In addition, in December there were negative releases in the US, for example, labor market and inflation indicators dropped significantly.

Today, special attention should be paid to data on retail sales, industrial production and major indices, which will be published in the United States and might support the pair.

Support and resistance

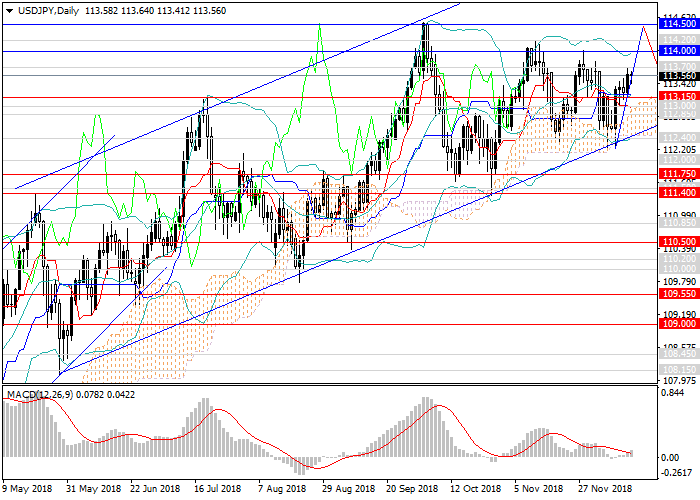

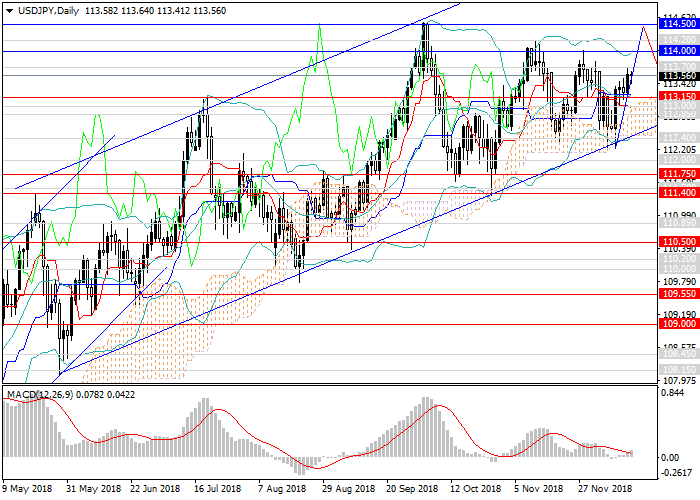

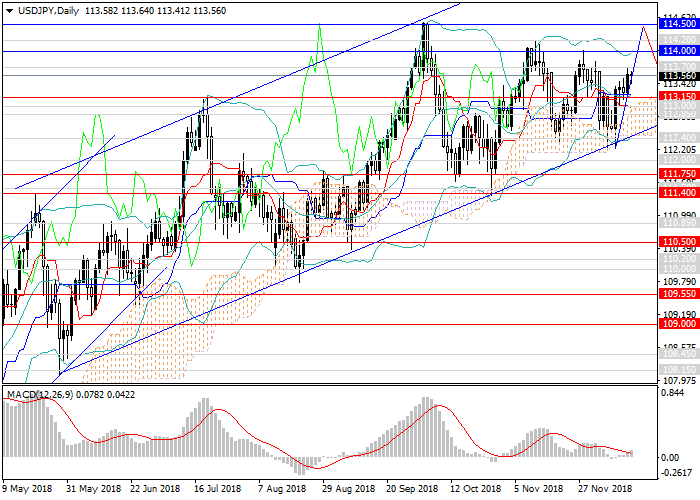

After the news release, the pair may reach key resistances of 114.00, 114.50, but will hardly be able to overcome them immediately. Despite this, the trend remains upward in the medium and long term. Technical indicators on the 4-hour chart confirm the growth forecast: MACD shows an increase in the volume of long positions, and the Bollinger bands are directed upwards.

Support levels: 113.15, 112.85, 111.75.

Resistance levels: 114.00, 114.50, 115.00.

Trading tips

In this situation, the volume of long positions can be increased at the current level and pending buy orders can be set at the strong support levels of 113.15, 112.85 with targets at 114.00, 114.50, 115.50 and a stop loss at 112.30.

The pair continues to trade in a narrowing sideways consolidation, like most of major currency pairs. The flat market at the end of 2018 is due to the lack of important macroeconomic releases and decisions of the Central Banks.

Despite the weak data for Japan this trading week, the US dollar did not take advantage of this, and the pair remained in the channel. In addition, in December there were negative releases in the US, for example, labor market and inflation indicators dropped significantly.

Today, special attention should be paid to data on retail sales, industrial production and major indices, which will be published in the United States and might support the pair.

Support and resistance

After the news release, the pair may reach key resistances of 114.00, 114.50, but will hardly be able to overcome them immediately. Despite this, the trend remains upward in the medium and long term. Technical indicators on the 4-hour chart confirm the growth forecast: MACD shows an increase in the volume of long positions, and the Bollinger bands are directed upwards.

Support levels: 113.15, 112.85, 111.75.

Resistance levels: 114.00, 114.50, 115.00.

Trading tips

In this situation, the volume of long positions can be increased at the current level and pending buy orders can be set at the strong support levels of 113.15, 112.85 with targets at 114.00, 114.50, 115.50 and a stop loss at 112.30.

No comments:

Write comments