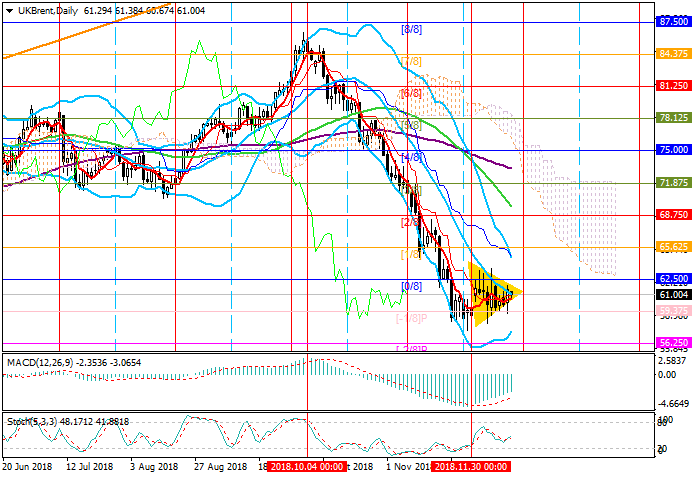

Brent Crude Oil: Murrey analysis

14 December 2018, 13:37

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 61.10 |

| Take Profit | 62.50, 64.06 |

| Stop Loss | 60.40 |

| Key Levels | 56.25, 57.81, 59.37, 62.50, 64.06, 65.62 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 59.30 |

| Take Profit | 57.81, 56.25 |

| Stop Loss | 60.50 |

| Key Levels | 56.25, 57.81, 59.37, 62.50, 64.06, 65.62 |

This month, oil quotes are generally within the lateral range of 62.50

([0/8]) and 59.37 ([-1/8]). The price cannot leave it yet, and, apparently,

forms a "triangle" with the probability to break out. The level of 62.50, which

is the lower border of the Murray trading range, is seen as key for the "bulls".

Its breakout may cause growth to 64.06 ([+2/8], H4), 65.62 ([1/8]), and 68.75

([2/8]). If the instrument consolidates below the level of 59.37 ([-1/8]), a

decline is possible to 57.81 ([2/8], H4) and 56.25 ([-2/8]). Generally,

technical indicators confirm growth: MACD histogram is reducing in the negative

zone, and Stochastic is directed upwards.

Support and resistance

Support levels: 59.37, 57.81, 56.25.

Resistance levels: 62.50, 64.06, 65.62.

Trading tips

In the short term, long positions should be opened from the level of 61.10 with targets at 62.50, 64.06 and stop loss at 60.40. In the medium term, one should wait for the price to consolidate above the level of 62.50 with targets at 64.06, 65.62 and stop loss at 61.50.

Short positions may be opened if the instrument consolidates below 59.37 with targets at 57.81, 56.25 and stop loss at 60.50.

Implementation period: 4-5 days.

Support and resistance

Support levels: 59.37, 57.81, 56.25.

Resistance levels: 62.50, 64.06, 65.62.

Trading tips

In the short term, long positions should be opened from the level of 61.10 with targets at 62.50, 64.06 and stop loss at 60.40. In the medium term, one should wait for the price to consolidate above the level of 62.50 with targets at 64.06, 65.62 and stop loss at 61.50.

Short positions may be opened if the instrument consolidates below 59.37 with targets at 57.81, 56.25 and stop loss at 60.50.

Implementation period: 4-5 days.

No comments:

Write comments