USD/JPY: the pair is trading in both directions

05 December 2018, 09:21

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 113.25 |

| Take Profit | 113.64, 113.83 |

| Stop Loss | 113.00 |

| Key Levels | 111.82, 112.29, 112.65, 113.00, 113.18, 113.37, 113.64 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 112.90 |

| Take Profit | 112.29 |

| Stop Loss | 113.25 |

| Key Levels | 111.82, 112.29, 112.65, 113.00, 113.18, 113.37, 113.64 |

Current trend

On December 4, USD showed a steady decline against JPY, retreating to local minima since November 20.

Investors "digest" a truce in the US-Chinese trade war, concluded for 90 days, and continue to monitor the situation. Hiroshige Seko, the Minister of Economy, Trade and Industry of Japan, noted that the threat of the introduction of new tariffs still exists, and, therefore, the trade war can be continued. The market is also preparing for a trilateral meeting of Japan, China, and South Korea to discuss the creation of a free trade zone, which in the future may include 20% of world turnover. The meeting will be held on Thursday and Friday in Beijing.

Today, the trend is upward, and investors are adjusting their positions due to closed markets in the US. The statistics from Japan also pressures the yen: in November, Markit Services PMI declined from 52.4 to 52.3 points.

Support and resistance

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is slightly narrowed from below, remaining rather spacious, given the current level of activity in the market. MACD is going down preserving a stable sell signal (being located under the signal line). Stochastic shows similar dynamics, rapidly approaching its minimum marks, which indicates the risks associated with the oversold dollar in the ultra-short term.

One should keep existing short positions until clarification.

Resistance levels: 113.00, 113.18, 113.37, 113.64.

Support levels: 112.65, 112.29, 111.82.

Trading tips

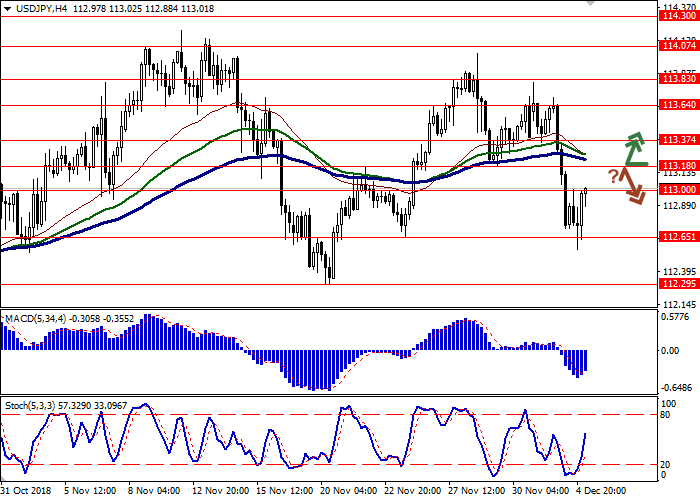

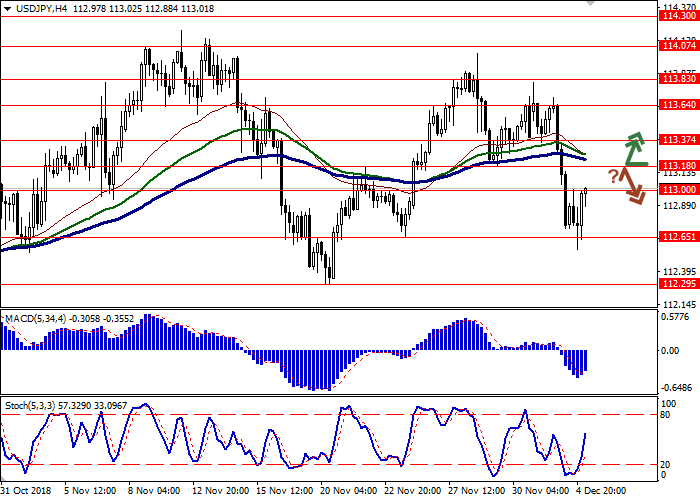

Long positions may be opened after breaking out 113.18 with take profit at 113.64-113.83 and stop loss at 113.00.

Short positions may be opened after rebound from 113.180, followed by a breakdown of 113.00, with the target at 112.29 and stop loss at 113.25.

Implementation period: 2-3 days.

On December 4, USD showed a steady decline against JPY, retreating to local minima since November 20.

Investors "digest" a truce in the US-Chinese trade war, concluded for 90 days, and continue to monitor the situation. Hiroshige Seko, the Minister of Economy, Trade and Industry of Japan, noted that the threat of the introduction of new tariffs still exists, and, therefore, the trade war can be continued. The market is also preparing for a trilateral meeting of Japan, China, and South Korea to discuss the creation of a free trade zone, which in the future may include 20% of world turnover. The meeting will be held on Thursday and Friday in Beijing.

Today, the trend is upward, and investors are adjusting their positions due to closed markets in the US. The statistics from Japan also pressures the yen: in November, Markit Services PMI declined from 52.4 to 52.3 points.

Support and resistance

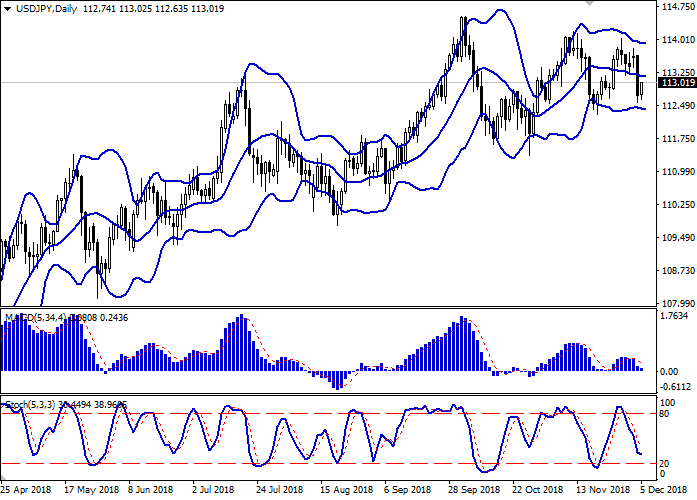

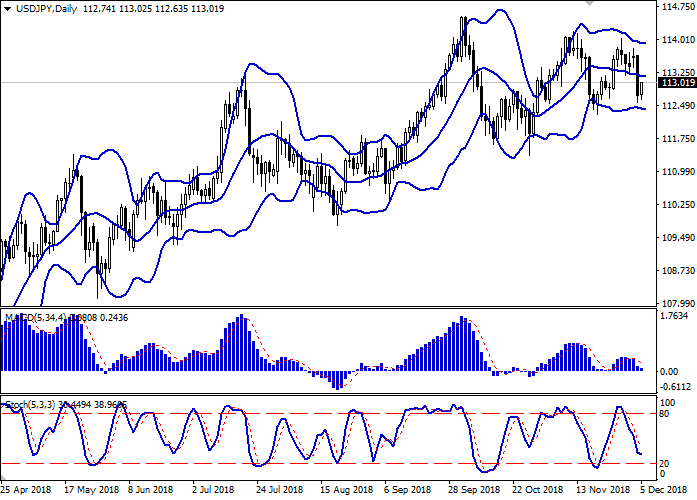

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is slightly narrowed from below, remaining rather spacious, given the current level of activity in the market. MACD is going down preserving a stable sell signal (being located under the signal line). Stochastic shows similar dynamics, rapidly approaching its minimum marks, which indicates the risks associated with the oversold dollar in the ultra-short term.

One should keep existing short positions until clarification.

Resistance levels: 113.00, 113.18, 113.37, 113.64.

Support levels: 112.65, 112.29, 111.82.

Trading tips

Long positions may be opened after breaking out 113.18 with take profit at 113.64-113.83 and stop loss at 113.00.

Short positions may be opened after rebound from 113.180, followed by a breakdown of 113.00, with the target at 112.29 and stop loss at 113.25.

Implementation period: 2-3 days.

No comments:

Write comments