SPX: general analysis

05 December 2018, 09:14

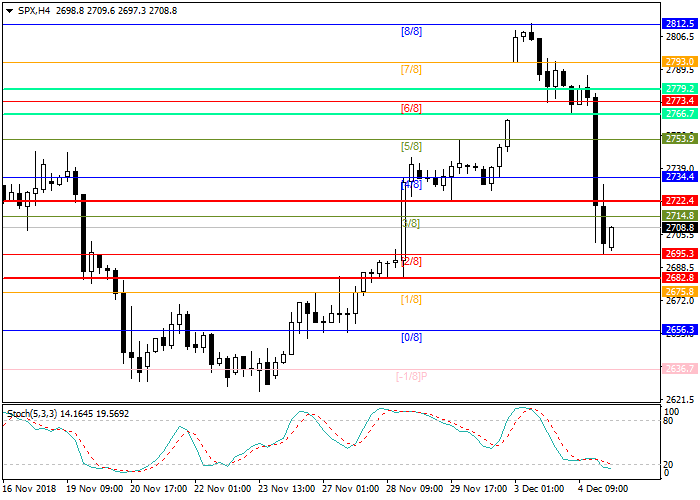

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 2735.0 |

| Take Profit | 2779.2 |

| Stop Loss | 2722.4 |

| Key Levels | 2682.8, 2695.3, 2722.4, 2734.4 |

Current trend

The euphoria from the negotiations at the G20 summit and the concluded truce between the US and China is gradually dying out: stock markets are beginning to decline. Thus, yesterday, the S&P 500 broad spectrum index lost about 0.5% and is currently trading near the support level of 2/8 Murrey or 2695.3. Markets are under pressure of a decrease in November PMI to 55.3, which is a sign of slowing economic growth. On the other hand, the yield on ten-year bonds is below 3%, which supports the stock market but, as economists note, with a change in the Fed's rhetoric and further strengthening of the rate, the yield on debt securities will continue to grow. The political crisis in the USA can also have a negative effect on the market. On Thursday, a former lawyer who represented the interests of the current president of the country admitted that he had lied to Congress about projects related to Trump's development activities in Russia. His testimony may trigger a new round of investigations.

As for economic data, this week statistics on production orders, Trade Balance, as well as Nonfarm Payrolls will be published.

Support and resistance

Stochastic is at 26 points and signals a possibility of a correction.

Resistance levels: 2722.4, 2734.4.

Support levels: 2695.3, 2682.8.

Trading tips

Long positions can be opened after the breakdown of the level of 2734.4 with the target at 2779.2 and stop loss at 2722.4.

The euphoria from the negotiations at the G20 summit and the concluded truce between the US and China is gradually dying out: stock markets are beginning to decline. Thus, yesterday, the S&P 500 broad spectrum index lost about 0.5% and is currently trading near the support level of 2/8 Murrey or 2695.3. Markets are under pressure of a decrease in November PMI to 55.3, which is a sign of slowing economic growth. On the other hand, the yield on ten-year bonds is below 3%, which supports the stock market but, as economists note, with a change in the Fed's rhetoric and further strengthening of the rate, the yield on debt securities will continue to grow. The political crisis in the USA can also have a negative effect on the market. On Thursday, a former lawyer who represented the interests of the current president of the country admitted that he had lied to Congress about projects related to Trump's development activities in Russia. His testimony may trigger a new round of investigations.

As for economic data, this week statistics on production orders, Trade Balance, as well as Nonfarm Payrolls will be published.

Support and resistance

Stochastic is at 26 points and signals a possibility of a correction.

Resistance levels: 2722.4, 2734.4.

Support levels: 2695.3, 2682.8.

Trading tips

Long positions can be opened after the breakdown of the level of 2734.4 with the target at 2779.2 and stop loss at 2722.4.

No comments:

Write comments