WTI Crude Oil: oil prices are consolidating

05 December 2018, 09:31

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 53.35 |

| Take Profit | 55.64, 57.00 |

| Stop Loss | 52.00 |

| Key Levels | 48.09, 49.00, 50.00, 51.32, 53.30, 54.43, 55.64, 57.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 51.25 |

| Take Profit | 49.00, 48.09 |

| Stop Loss | 53.00 |

| Key Levels | 48.09, 49.00, 50.00, 51.32, 53.30, 54.43, 55.64, 57.00 |

Current trend

Oil prices are moving horizontally after a rather confident “bullish” start of the week. The instrument is supported by the expectations of the OPEC+ meeting, which will take place on December 6, and at which, as predicted, cartel members will try to agree on a further reduction in energy production.

On the other hand, the price is under pressure of API Weekly Crude Oil Stock, published yesterday. For the reporting week on November 30, the volume increased by 5.360 million barrels after rising by 3.453 million barrels over the previous period.

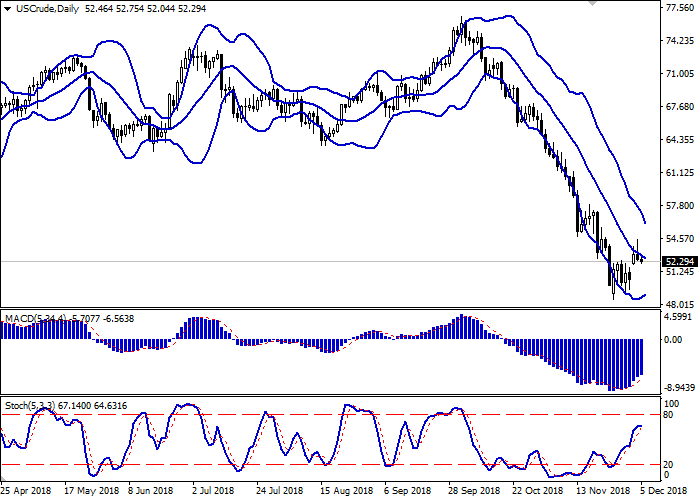

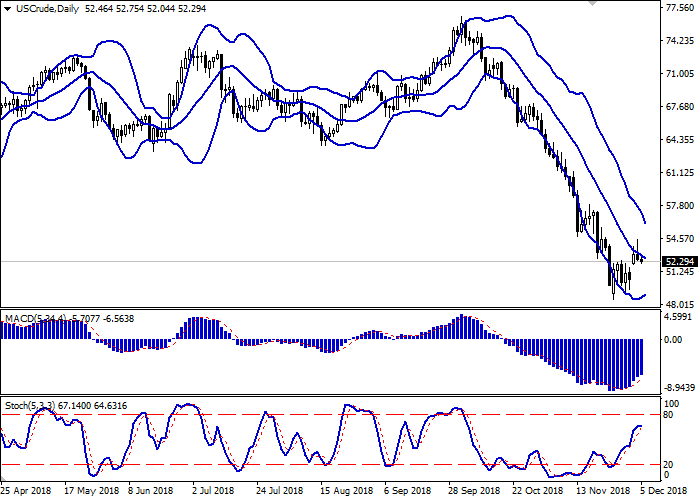

Support and resistance

On the daily chart, Bollinger bands smoothly reverse into a horizontal plane. The price range is actively narrowing, reflecting the emergence of ambiguous trading dynamics in the short term. MACD indicator is growing, keeping a strong buy signal (the histogram is above the signal line). Stochastic, approaching its highs, reversed horizontally, responding to the "bearish" nature of yesterday's trading.

It is better to wait until the situation and the indicators’ signals are clear.

Resistance levels: 53.30, 54.43, 55.64, 57.00.

Support levels: 51.32, 50.00, 49.00, 48.09.

Trading tips

Long positions can be opened after the rebound from the level of 51.32 and the breakout of the level of 53.30 with the targets at 55.64 or 57.00. Stop loss is 52.00.

Short positions can be opened after the breakdown of the level of 51.32 with the target at 49.00 or 48.09. Stop loss is 53.00.

Implementation period: 2–3 days.

Oil prices are moving horizontally after a rather confident “bullish” start of the week. The instrument is supported by the expectations of the OPEC+ meeting, which will take place on December 6, and at which, as predicted, cartel members will try to agree on a further reduction in energy production.

On the other hand, the price is under pressure of API Weekly Crude Oil Stock, published yesterday. For the reporting week on November 30, the volume increased by 5.360 million barrels after rising by 3.453 million barrels over the previous period.

Support and resistance

On the daily chart, Bollinger bands smoothly reverse into a horizontal plane. The price range is actively narrowing, reflecting the emergence of ambiguous trading dynamics in the short term. MACD indicator is growing, keeping a strong buy signal (the histogram is above the signal line). Stochastic, approaching its highs, reversed horizontally, responding to the "bearish" nature of yesterday's trading.

It is better to wait until the situation and the indicators’ signals are clear.

Resistance levels: 53.30, 54.43, 55.64, 57.00.

Support levels: 51.32, 50.00, 49.00, 48.09.

Trading tips

Long positions can be opened after the rebound from the level of 51.32 and the breakout of the level of 53.30 with the targets at 55.64 or 57.00. Stop loss is 52.00.

Short positions can be opened after the breakdown of the level of 51.32 with the target at 49.00 or 48.09. Stop loss is 53.00.

Implementation period: 2–3 days.

No comments:

Write comments