USD/JPY: the dollar remains under pressure

19 December 2018, 08:40

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 112.50 |

| Take Profit | 113.00, 113.18, 113.37 |

| Stop Loss | 112.17 |

| Key Levels | 111.82, 112.00, 112.17, 112.42, 112.65, 113.00, 113.18 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 112.10 |

| Take Profit | 111.82, 111.60, 111.60 |

| Stop Loss | 112.42 |

| Key Levels | 111.82, 112.00, 112.17, 112.42, 112.65, 113.00, 113.18 |

Current trend

Yesterday, USD fell significantly against JPY, updating the lows since December 10.

On Tuesday, the Japanese government revised its forecasts for the country's economic development for the current and next year. The decline is due to US-China trade conflict, as well as the natural disasters that have befallen Japan this year, causing significant damage to the economy. This year, the economy is expected to grow by 0.9% (1.5% previously assumed); next year, it will grow by 1.3% (1.5% growth was expected). Inflation in the country will reach 1.0% this year (expected 1.1%), and 1.1% next year (expected 1.5%).

Today, during the Asian session, the “bearish” dynamics maintains, despite the ambiguous Japanese statistics releases. In November, exports from Japan grew only by 0.1% YoY, which, with imports growing by 12.5% YoY, led to a sharp increase in the trade balance deficit from –450.1B to –737.3B JPY.

Support and resistance

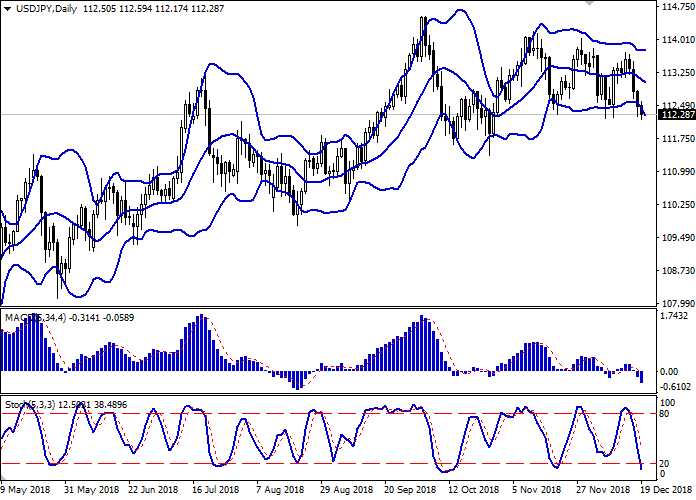

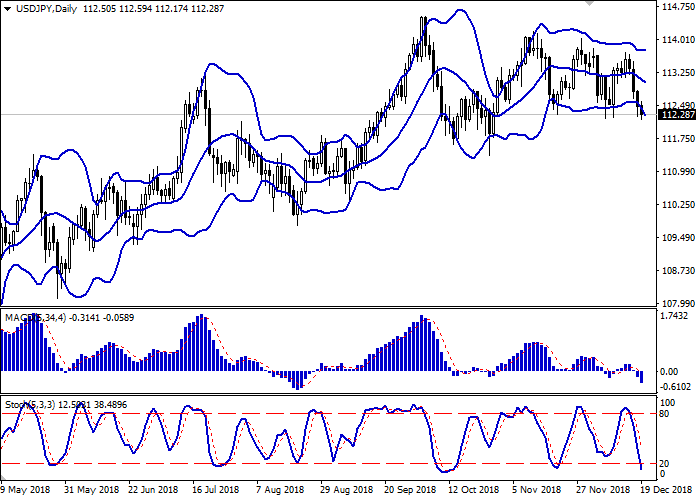

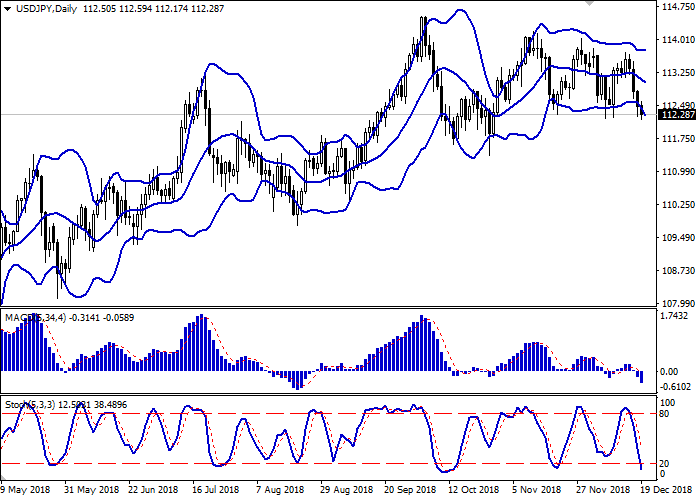

On the daily chart, Bollinger bands are moderately falling. The price range expands from below but not as fast at the “bearish” dynamics develops in the short term. MACD falls, keeping a strong sell signal (the histogram is below the signal line). Stochastic is directed downwards but is rapidly approaching its lows, reflecting that USD can become oversold soon.

It is better to keep current short positions until the situation is clarified.

Resistance levels: 112.42, 112.65, 113.00, 113.18.

Support levels: 112.17, 112.00, 111.82.

Trading tips

Long positions can be opened after the rebound from 112.17 and the breakout of 112.42 with the targets at 113.00 or 113.18–113.37 and stop loss 112.17. Implementation period: 2–3 days.

Short positions can be opened after the breakdown of 112.17 with the targets at 111.82 or 111.60–111.60. Stop loss is 112.42. Implementation period: 1–2 days.

Yesterday, USD fell significantly against JPY, updating the lows since December 10.

On Tuesday, the Japanese government revised its forecasts for the country's economic development for the current and next year. The decline is due to US-China trade conflict, as well as the natural disasters that have befallen Japan this year, causing significant damage to the economy. This year, the economy is expected to grow by 0.9% (1.5% previously assumed); next year, it will grow by 1.3% (1.5% growth was expected). Inflation in the country will reach 1.0% this year (expected 1.1%), and 1.1% next year (expected 1.5%).

Today, during the Asian session, the “bearish” dynamics maintains, despite the ambiguous Japanese statistics releases. In November, exports from Japan grew only by 0.1% YoY, which, with imports growing by 12.5% YoY, led to a sharp increase in the trade balance deficit from –450.1B to –737.3B JPY.

Support and resistance

On the daily chart, Bollinger bands are moderately falling. The price range expands from below but not as fast at the “bearish” dynamics develops in the short term. MACD falls, keeping a strong sell signal (the histogram is below the signal line). Stochastic is directed downwards but is rapidly approaching its lows, reflecting that USD can become oversold soon.

It is better to keep current short positions until the situation is clarified.

Resistance levels: 112.42, 112.65, 113.00, 113.18.

Support levels: 112.17, 112.00, 111.82.

Trading tips

Long positions can be opened after the rebound from 112.17 and the breakout of 112.42 with the targets at 113.00 or 113.18–113.37 and stop loss 112.17. Implementation period: 2–3 days.

Short positions can be opened after the breakdown of 112.17 with the targets at 111.82 or 111.60–111.60. Stop loss is 112.42. Implementation period: 1–2 days.

No comments:

Write comments