XAG/USD: silver prices are consolidating

19 December 2018, 08:30

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 14.72 |

| Take Profit | 15.00 |

| Stop Loss | 14.57 |

| Key Levels | 14.20, 14.31, 14.39, 14.46, 14.57, 14.69, 14.78, 14.88, 15.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 14.45, 14.43 |

| Take Profit | 14.20, 14.13 |

| Stop Loss | 14.57, 14.60 |

| Key Levels | 14.20, 14.31, 14.39, 14.46, 14.57, 14.69, 14.78, 14.88, 15.00 |

Current trend

Silver prices showed a decline on Tuesday, partially offsetting the growth of the instrument at the beginning of the week. During today's Asian session, the instrument is again trading upwards, regaining the positions lost the day before.

The main pressure on the US dollar is caused by the possible slowdown in tightening the monetary policy of the US Fed. Regulator members have repeatedly hinted that rates of increase could be reduced. And even President Trump said in his Twitter: “It is incredible that with a very strong dollar and virtually no inflation, the outside world blowing up around us, the Fed is even considering yet another interest rate hike”. Investors fear that the pressure of the administration together with a number of negative economic factors (the inverted yield curve of bonds) can lead not only to a decrease in the number of rate hikes in the next year, but also to the cancellation of the increase at the December meeting.

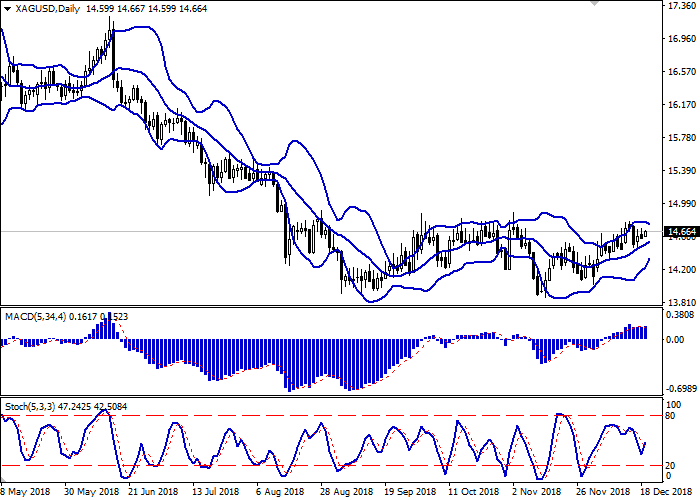

Support and resistance

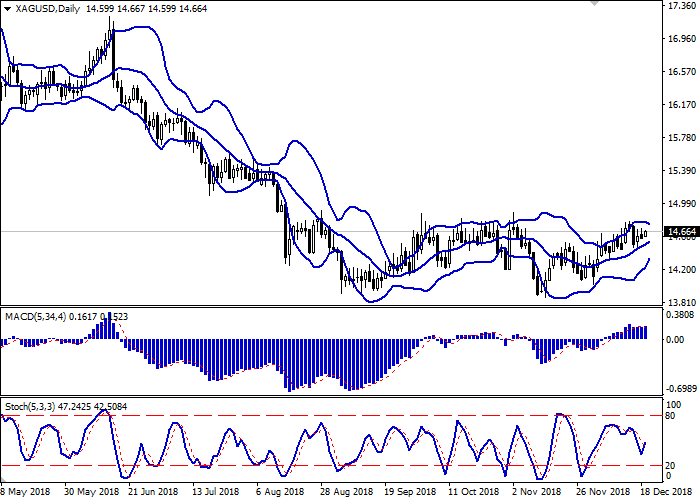

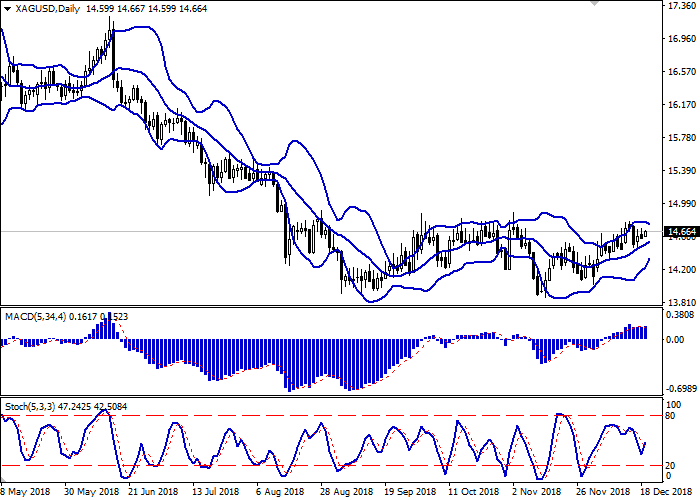

Bollinger Bands in D1 chart show moderate growth. The price range is narrowing, reflecting the ambiguous nature of trading of recent days. MACD is growing, keeping a weak buy signal (located above the signal line). Stochastic reversed upwards again after an active decline at the end of last week.

Technical indicators do not contradict the further development of the "bullish" trend in the short and/or ultra-short term.

Resistance levels: 14.69, 14.78, 14.88, 15.00.

Support levels: 14.57, 14.46, 14.39, 14.31, 14.20.

Trading tips

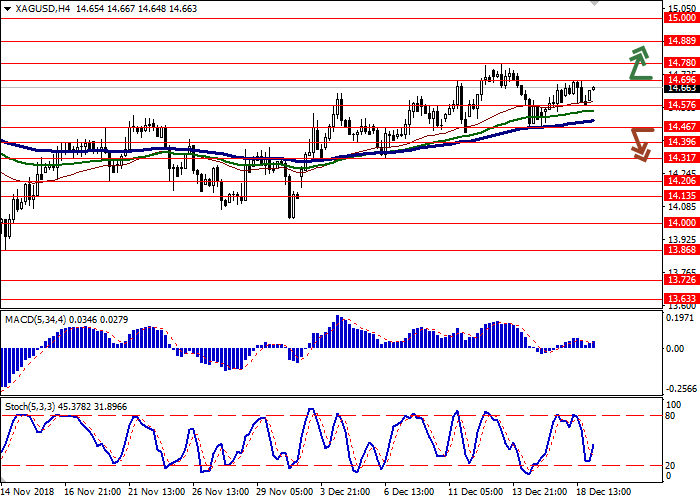

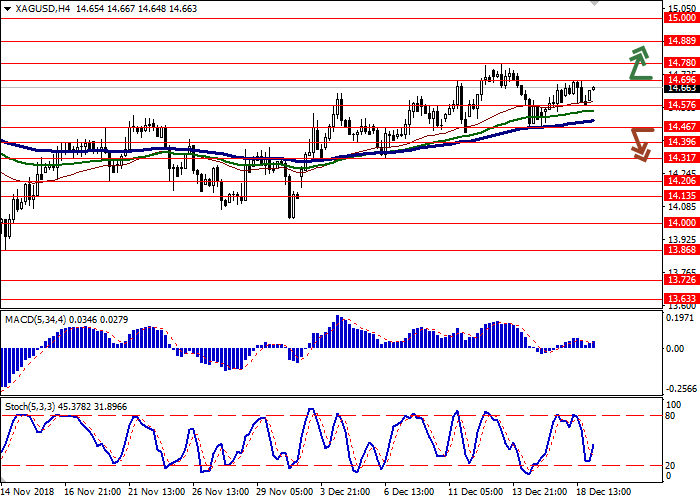

To open long positions, one can rely on the breakout of 14.69. Take profit — 15.00. Stop loss — 14.57.

A breakdown of 14.50 or 14.46 may become a signal for returning to sales with target at 14.20 or 14.13. Stop loss — 14.57 or 14.60.

Implementation period: 2-3 days.

Silver prices showed a decline on Tuesday, partially offsetting the growth of the instrument at the beginning of the week. During today's Asian session, the instrument is again trading upwards, regaining the positions lost the day before.

The main pressure on the US dollar is caused by the possible slowdown in tightening the monetary policy of the US Fed. Regulator members have repeatedly hinted that rates of increase could be reduced. And even President Trump said in his Twitter: “It is incredible that with a very strong dollar and virtually no inflation, the outside world blowing up around us, the Fed is even considering yet another interest rate hike”. Investors fear that the pressure of the administration together with a number of negative economic factors (the inverted yield curve of bonds) can lead not only to a decrease in the number of rate hikes in the next year, but also to the cancellation of the increase at the December meeting.

Support and resistance

Bollinger Bands in D1 chart show moderate growth. The price range is narrowing, reflecting the ambiguous nature of trading of recent days. MACD is growing, keeping a weak buy signal (located above the signal line). Stochastic reversed upwards again after an active decline at the end of last week.

Technical indicators do not contradict the further development of the "bullish" trend in the short and/or ultra-short term.

Resistance levels: 14.69, 14.78, 14.88, 15.00.

Support levels: 14.57, 14.46, 14.39, 14.31, 14.20.

Trading tips

To open long positions, one can rely on the breakout of 14.69. Take profit — 15.00. Stop loss — 14.57.

A breakdown of 14.50 or 14.46 may become a signal for returning to sales with target at 14.20 or 14.13. Stop loss — 14.57 or 14.60.

Implementation period: 2-3 days.

No comments:

Write comments