USD/CHF: technical analysis

17 December 2018, 13:43

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.0000 |

| Take Profit | 1.0040 |

| Stop Loss | 0.9970 |

| Key Levels | 0.9830, 0.9863, 0.9905, 0.9945, 0.9984, 1.0008, 1.0039, 1.0086, 1.0128 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.9940 |

| Take Profit | 0.9905 |

| Stop Loss | 0.9960 |

| Key Levels | 0.9830, 0.9863, 0.9905, 0.9945, 0.9984, 1.0008, 1.0039, 1.0086, 1.0128 |

USD/CHF, D1

On the daily chart, the instrument is trading at the upper part of the Bollinger Bands. The indicator is directed horizontally, and the price range has slightly expanded, which is the basis for the continuation of the current trend. The MACD histogram is in the neutral zone, the signal to enter the market is not formed. Stochastic entered the oversold area, a signal to open positions to sell can be formed within 1-2 days.

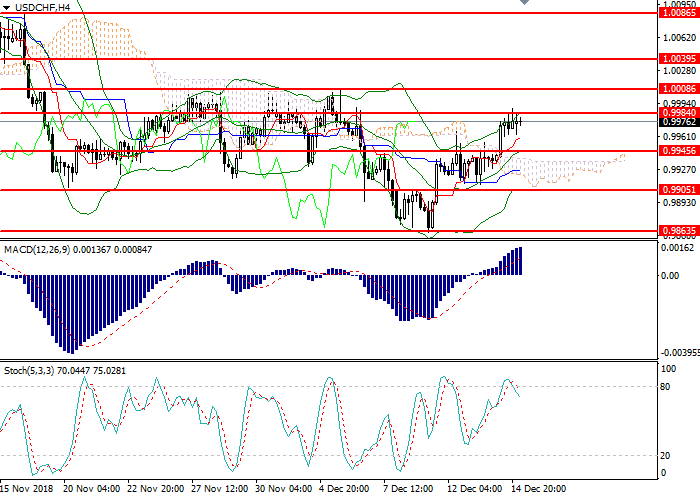

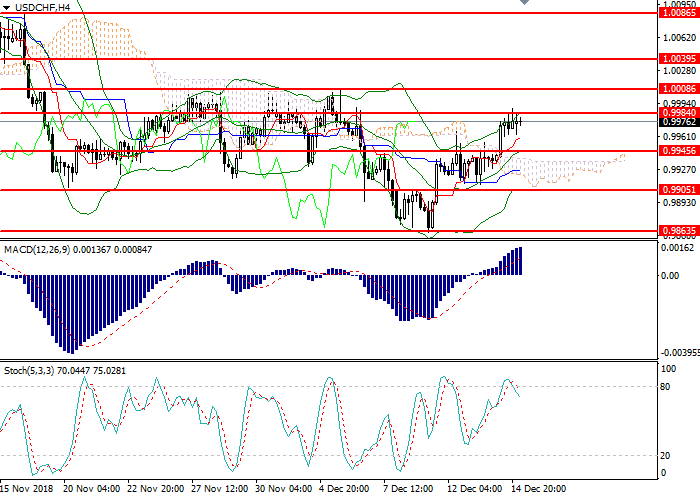

USD/CHF, H4

On the 4-hour chart, the pair was corrected to the upper Bollinger band. The key resistance level is 0.9985. The indicator is directed upwards, and the price range remains unchanged, indicating a continuation of the uptrend. MACD histogram volumes are growing in the positive zone, keeping a strong buy signal. The Stochastic left the overbought area, generating a strong signal to open short positions.

Key levels

Support levels: 0.9830, 0.9863, 0.9905, 0.9945.

Resistance levels: 0.9984, 1.0008, 1.0039, 1.0086, 1.0128.

Trading tips

Long positions can be opened above the level of 0.9995 with a target at 1.0040 and a stop loss at 0.9970.

Short positions can be placed below 0.9945 with a target at 0.9905 and a stop loss at 0.9960.

Implementation period is 1-2 days.

On the daily chart, the instrument is trading at the upper part of the Bollinger Bands. The indicator is directed horizontally, and the price range has slightly expanded, which is the basis for the continuation of the current trend. The MACD histogram is in the neutral zone, the signal to enter the market is not formed. Stochastic entered the oversold area, a signal to open positions to sell can be formed within 1-2 days.

USD/CHF, H4

On the 4-hour chart, the pair was corrected to the upper Bollinger band. The key resistance level is 0.9985. The indicator is directed upwards, and the price range remains unchanged, indicating a continuation of the uptrend. MACD histogram volumes are growing in the positive zone, keeping a strong buy signal. The Stochastic left the overbought area, generating a strong signal to open short positions.

Key levels

Support levels: 0.9830, 0.9863, 0.9905, 0.9945.

Resistance levels: 0.9984, 1.0008, 1.0039, 1.0086, 1.0128.

Trading tips

Long positions can be opened above the level of 0.9995 with a target at 1.0040 and a stop loss at 0.9970.

Short positions can be placed below 0.9945 with a target at 0.9905 and a stop loss at 0.9960.

Implementation period is 1-2 days.

No comments:

Write comments