EUR/USD: general review

17 December 2018, 13:57

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL LIMIT |

| Entry Point | 1.1352 |

| Take Profit | 1.1291, 1.1230 |

| Stop Loss | 1.1380 |

| Key Levels | 1.1200, 1.1230, 1.1291, 1.1352, 1.1413, 1.1474 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.1370 |

| Take Profit | 1.1413, 1.1474 |

| Stop Loss | 1.1330 |

| Key Levels | 1.1200, 1.1230, 1.1291, 1.1352, 1.1413, 1.1474 |

Current trend

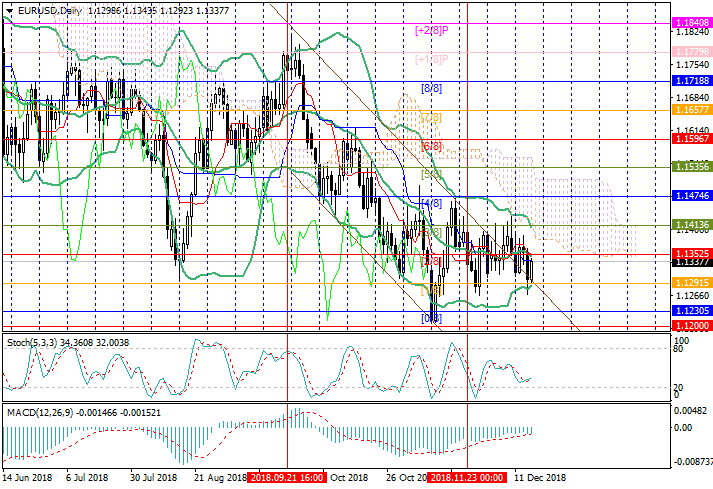

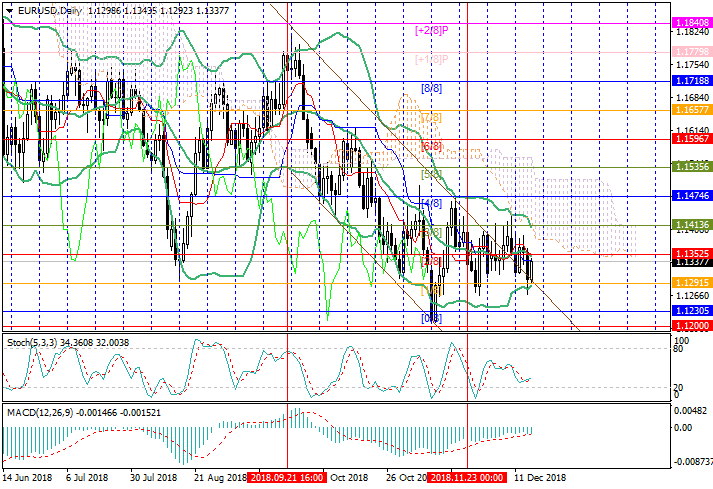

Today, the pair is correcting upwards, aiming at the level of 1.1352 (Murrey [2/8], the midline of Bollinger Bands).

The euro is strengthening, despite the weak data on inflation in the Eurozone. In November, the basic consumer price index remained at 1.0%, and the general CPI dropped from 2.0% to 1.9%, having fallen below the target level for the first time since May. Investors are more concerned about the upcoming Fed meeting. The rate is expected to be raised once again, this time from 2.25% to 2.50%; but in the future, the rate of monetary tightening may be slowed down. During the month, hints of this were made by several members of the regulator, including its chairman Jerome Powell. Currently, the market expects another three rate hikes next year, and any data on the reduction of their number could put pressure on USD.

Support and resistance

The level of 1.1352 (in the midline of Bollinger Bands) is seen as the key one for the "bulls". Its breakout will give the prospect of further growth to 1.1413 (Murrey [3/8], the upper line of Bollinger Bands) and 1.1474 (Murrey [4/8]). Otherwise, the decline will resume to the levels of 1.1291 (Murrey [1/8]) and 1.1230 (Murrey [0/8]).

Technical indicators do not provide a clear signal: MACD histogram is stable in the negative zone and Stochastic is directed horizontally.

Support levels: 1.1291, 1.1230, 1.1200.

Resistance levels: 1.1352, 1.1413, 1.1474.

Trading tips

Short positions may be opened after the reversal near 1.1352 with targets at 1.1291, 1.1230 and stop loss at 1.1380.

Long positions may be opened from the level of 1.1370 with targets at 1.1413, 1.1474 and stop loss at 1.1330.

Implementation period: 4-5 days.

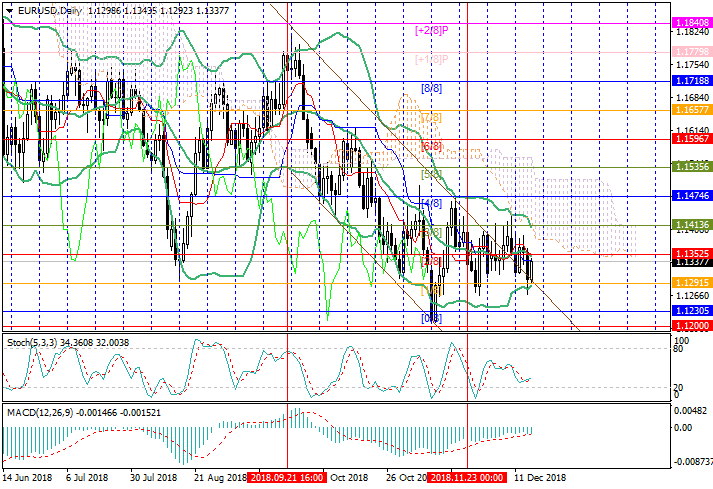

Today, the pair is correcting upwards, aiming at the level of 1.1352 (Murrey [2/8], the midline of Bollinger Bands).

The euro is strengthening, despite the weak data on inflation in the Eurozone. In November, the basic consumer price index remained at 1.0%, and the general CPI dropped from 2.0% to 1.9%, having fallen below the target level for the first time since May. Investors are more concerned about the upcoming Fed meeting. The rate is expected to be raised once again, this time from 2.25% to 2.50%; but in the future, the rate of monetary tightening may be slowed down. During the month, hints of this were made by several members of the regulator, including its chairman Jerome Powell. Currently, the market expects another three rate hikes next year, and any data on the reduction of their number could put pressure on USD.

Support and resistance

The level of 1.1352 (in the midline of Bollinger Bands) is seen as the key one for the "bulls". Its breakout will give the prospect of further growth to 1.1413 (Murrey [3/8], the upper line of Bollinger Bands) and 1.1474 (Murrey [4/8]). Otherwise, the decline will resume to the levels of 1.1291 (Murrey [1/8]) and 1.1230 (Murrey [0/8]).

Technical indicators do not provide a clear signal: MACD histogram is stable in the negative zone and Stochastic is directed horizontally.

Support levels: 1.1291, 1.1230, 1.1200.

Resistance levels: 1.1352, 1.1413, 1.1474.

Trading tips

Short positions may be opened after the reversal near 1.1352 with targets at 1.1291, 1.1230 and stop loss at 1.1380.

Long positions may be opened from the level of 1.1370 with targets at 1.1413, 1.1474 and stop loss at 1.1330.

Implementation period: 4-5 days.

No comments:

Write comments