USD/CAD: the upward trend persists

11 December 2018, 14:04

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 1.3397 |

| Take Profit | 1.3790 |

| Stop Loss | 1.3260 |

| Key Levels | 1.3155, 1.3170, 1.3180, 1.3225, 1.3225, 1.3270, 1.3300, 1.3320, 1.3350, 1.3380, 1.3410, 1.3450, 1.3570, 1.3650, 1.3790 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY LIMIT |

| Entry Point | 1.3320, 1.3300 |

| Take Profit | 1.3790 |

| Stop Loss | 1.3260 |

| Key Levels | 1.3155, 1.3170, 1.3180, 1.3225, 1.3225, 1.3270, 1.3300, 1.3320, 1.3350, 1.3380, 1.3410, 1.3450, 1.3570, 1.3650, 1.3790 |

Current trend

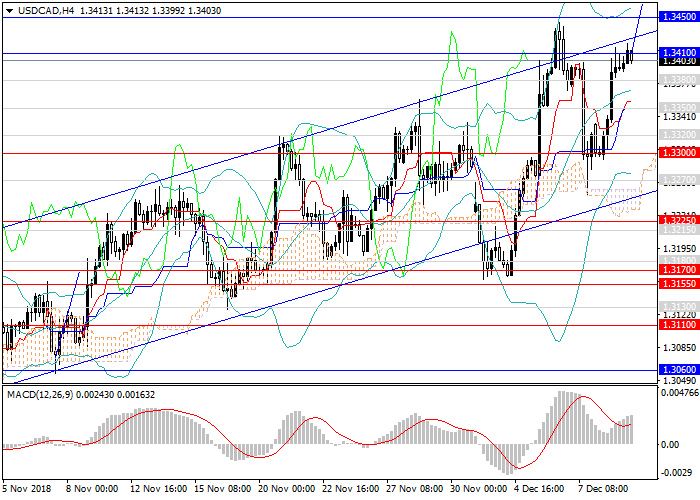

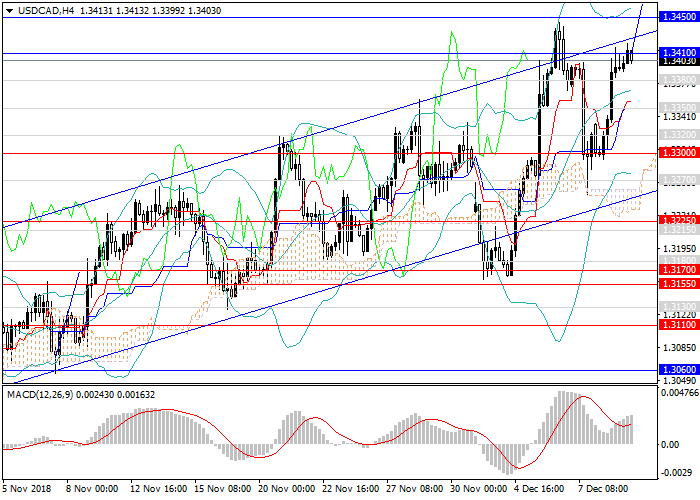

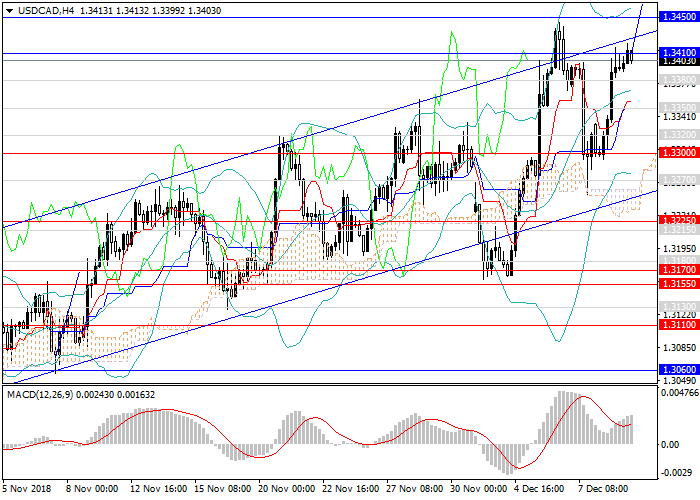

USD against CAD continues to be traded within a long-term upward channel. Since early October, the pair gained more than 600 points and reached the level of 1.3450.

The instrument is strengthened consistently, showing strong corrective movements after each upward impulse. Last week, the pair significantly increased, gaining almost 300 points in a few days, but then fell sharply on weak data on changes in Nonfarm Payrolls and, on the contrary, strong data on unemployment in Canada. After that, the instrument lost 150 points in a few hours and descended to the lower border of the channel. Later, the pair received an upward momentum and continues to strengthen to local highs of 1.3410, 1.3450.

This week, a number of key releases on the US indices and labor market will be published. There will be no important data from Canada.

Support and resistance

In the short term, further USD strengthening is expected against all major competitors. In the medium term, one can expect the strengthening of the US dollar against CAD to the historical highs of 1.3570, 1.3650, 1.3790. After that, the pair may move to a long-term downward correction within a wide upward channel.

Indicators still show a growth momentum: MACD shows a rapid growth in the volume of long positions, Bollinger Bands are directed up.

Support levels: 1.3380, 1.3350, 1.3320, 1.3300, 1.3270, 1.3225, 1.3225, 1.3180, 1.3170, 1.3155.

Resistance levels: 1.3410, 1.3450, 1.3570, 1.3650, 1.3790.

Trading tips

Long positions may be opened from the current level; deferred long positions may be opened from 1.3320, 1.3300 with the target at 1.3790 and stop loss at 1.3260.

USD against CAD continues to be traded within a long-term upward channel. Since early October, the pair gained more than 600 points and reached the level of 1.3450.

The instrument is strengthened consistently, showing strong corrective movements after each upward impulse. Last week, the pair significantly increased, gaining almost 300 points in a few days, but then fell sharply on weak data on changes in Nonfarm Payrolls and, on the contrary, strong data on unemployment in Canada. After that, the instrument lost 150 points in a few hours and descended to the lower border of the channel. Later, the pair received an upward momentum and continues to strengthen to local highs of 1.3410, 1.3450.

This week, a number of key releases on the US indices and labor market will be published. There will be no important data from Canada.

Support and resistance

In the short term, further USD strengthening is expected against all major competitors. In the medium term, one can expect the strengthening of the US dollar against CAD to the historical highs of 1.3570, 1.3650, 1.3790. After that, the pair may move to a long-term downward correction within a wide upward channel.

Indicators still show a growth momentum: MACD shows a rapid growth in the volume of long positions, Bollinger Bands are directed up.

Support levels: 1.3380, 1.3350, 1.3320, 1.3300, 1.3270, 1.3225, 1.3225, 1.3180, 1.3170, 1.3155.

Resistance levels: 1.3410, 1.3450, 1.3570, 1.3650, 1.3790.

Trading tips

Long positions may be opened from the current level; deferred long positions may be opened from 1.3320, 1.3300 with the target at 1.3790 and stop loss at 1.3260.

No comments:

Write comments