AUD/USD: Australian dollar is correcting

12 December 2018, 08:21

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.7235 |

| Take Profit | 0.7276, 0.7301 |

| Stop Loss | 0.7200 |

| Key Levels | 0.7150, 0.7174, 0.7200, 0.7229, 0.7257, 0.7276, 0.7301 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.7190, 0.7175 |

| Take Profit | 0.7150, 0.7130 |

| Stop Loss | 0.7210, 0.7230 |

| Key Levels | 0.7150, 0.7174, 0.7200, 0.7229, 0.7257, 0.7276, 0.7301 |

Current trend

AUD showed moderate growth against USD on Tuesday, continuing the development of a weak "bullish" momentum formed earlier this week.

On Monday, the deputy head of the RBA, Christopher Kent, recently noted that the next action of the regulator is likely to be a rate increase, but this does not mean that, the Bank will not be able to lower it. In general, the official remained optimistic, saying that the RBA is counting on a further decline in unemployment and an increase in inflation. However, the Australian business is pessimistic. The latest NAB survey showed a decline in business confidence in the country to 3 points — the lowest since 2016. Currently, support for AUD is provided only by hopes for concluding a trade agreement between the US and China, since the parties have not abandoned the negotiations, despite the arrest of Huawei CFO Meng Wanzhou.

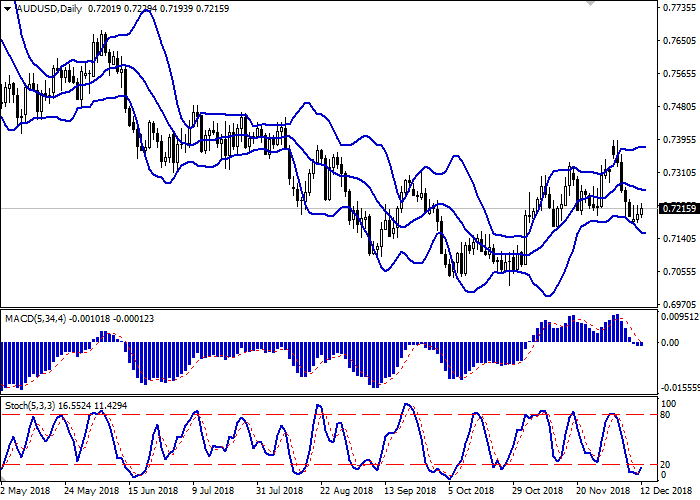

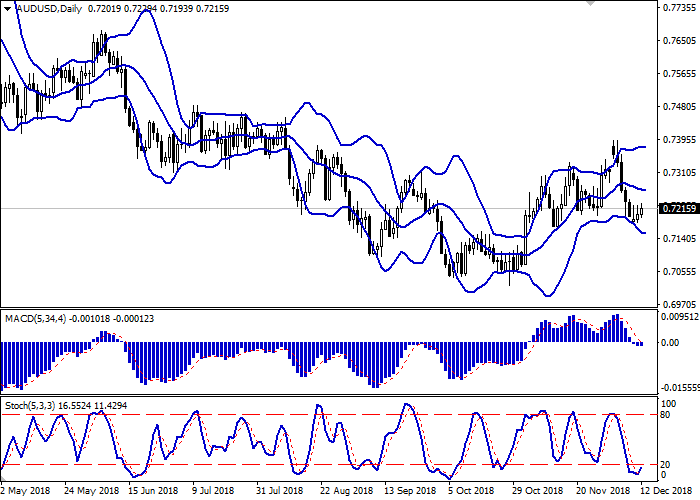

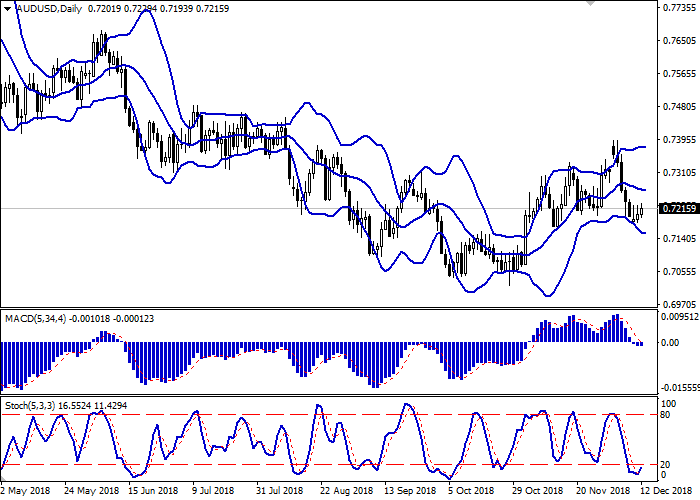

Support and resistance

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is trying to consolidate, but remains rather spacious for the current level of activity in the market. MACD is going down keeping a moderate sell signal (located below the signal line). Stochastic retreats from its minimum levels indicating the risk of corrective growth development in the short and/or ultra-short term.

It is necessary to wait for confirmation of "bullish" signals from technical indicators.

Resistance levels: 0.7229, 0.7257, 0.7276, 0.7301.

Support levels: 0.7200, 0.7174, 0.7150.

Trading tips

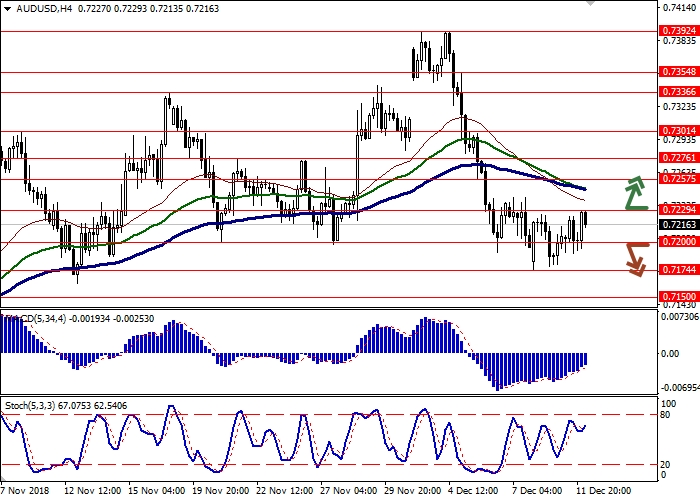

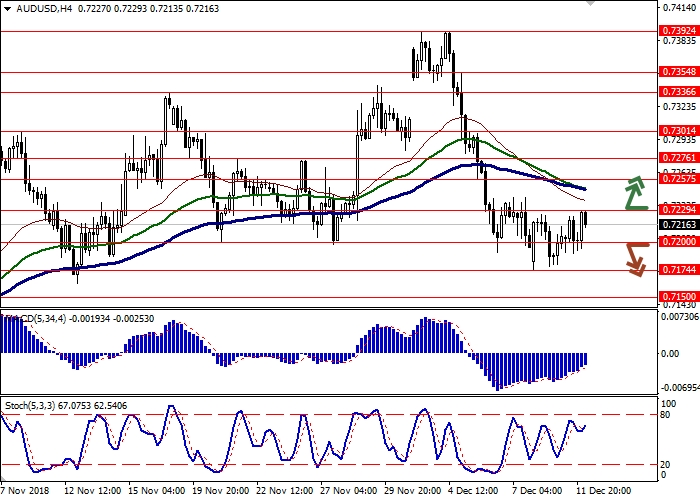

To open long positions, one can rely on the breakout of 0.7229. Take profit — 0.7276 or 0.7301. Stop loss — 0.7200.

The return of "bearish" trend with the breakdown of 0.7200 or 0.7180 may become a signal for new sales with the target at 0.7150 or 0.7130. Stop loss — 0.7210 or 0.7230.

Implementation period: 2-3 days.

AUD showed moderate growth against USD on Tuesday, continuing the development of a weak "bullish" momentum formed earlier this week.

On Monday, the deputy head of the RBA, Christopher Kent, recently noted that the next action of the regulator is likely to be a rate increase, but this does not mean that, the Bank will not be able to lower it. In general, the official remained optimistic, saying that the RBA is counting on a further decline in unemployment and an increase in inflation. However, the Australian business is pessimistic. The latest NAB survey showed a decline in business confidence in the country to 3 points — the lowest since 2016. Currently, support for AUD is provided only by hopes for concluding a trade agreement between the US and China, since the parties have not abandoned the negotiations, despite the arrest of Huawei CFO Meng Wanzhou.

Support and resistance

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is trying to consolidate, but remains rather spacious for the current level of activity in the market. MACD is going down keeping a moderate sell signal (located below the signal line). Stochastic retreats from its minimum levels indicating the risk of corrective growth development in the short and/or ultra-short term.

It is necessary to wait for confirmation of "bullish" signals from technical indicators.

Resistance levels: 0.7229, 0.7257, 0.7276, 0.7301.

Support levels: 0.7200, 0.7174, 0.7150.

Trading tips

To open long positions, one can rely on the breakout of 0.7229. Take profit — 0.7276 or 0.7301. Stop loss — 0.7200.

The return of "bearish" trend with the breakdown of 0.7200 or 0.7180 may become a signal for new sales with the target at 0.7150 or 0.7130. Stop loss — 0.7210 or 0.7230.

Implementation period: 2-3 days.

No comments:

Write comments