EUR/USD: the Euro remains under pressure

12 December 2018, 09:17

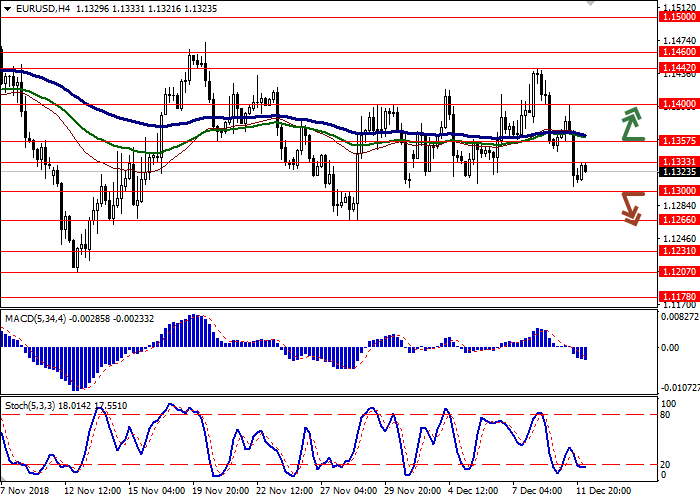

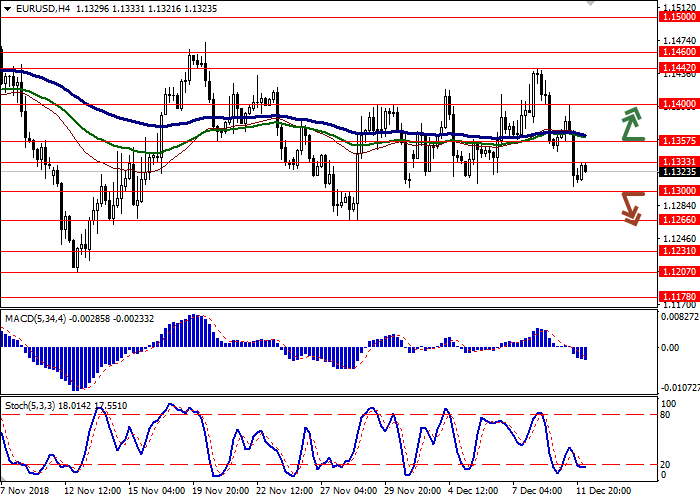

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.1360 |

| Take Profit | 1.1400, 1.1420, 1.1442, 1.1460 |

| Stop Loss | 1.1320 |

| Key Levels | 1.1207, 1.1231, 1.1266, 1.1300, 1.1333, 1.1357, 1.1400, 1.1442 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.1290 |

| Take Profit | 1.1231, 1.1207 |

| Stop Loss | 1.1333 |

| Key Levels | 1.1207, 1.1231, 1.1266, 1.1300, 1.1333, 1.1357, 1.1400, 1.1442 |

Current trend

EUR declined against USD on Tuesday updating local lows of November 28. At the same time, in the morning EUR traded mainly with an increase.

The instrument was supported by the possibility of a compromise on the Italian budget for the next year. The Italian government can reduce the estimated state budget deficit from 2.4% to 1.95%. This figure is higher than the one which EU officials negotiated with the previous Italian government (0.8%), but it still significantly reduces the risk of Italy violating the EU budget rules. The data on ZEW Business Sentiment published today turned out to be better than market expectations, although the number of pessimists in European business continues to prevail over optimists. In December, the indicator for Germany was –17.5 points (instead of the expected –25 points), and for the eurozone it was –21.0 (instead of the expected –23.2 points).

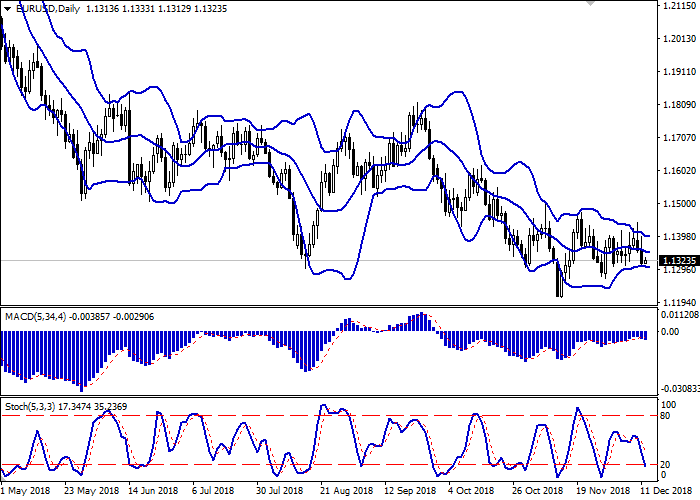

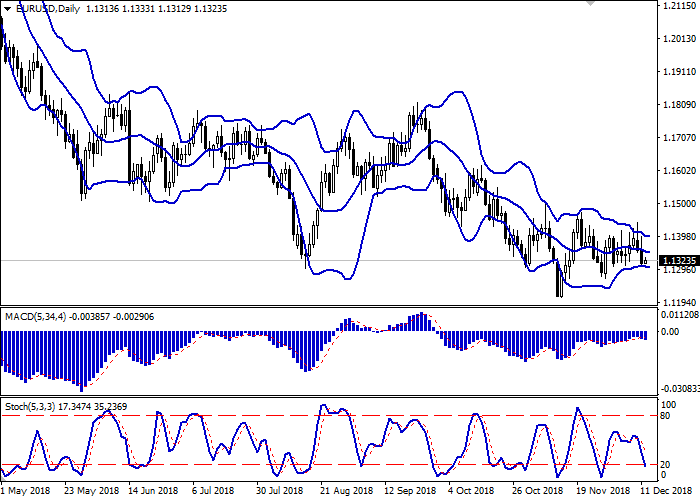

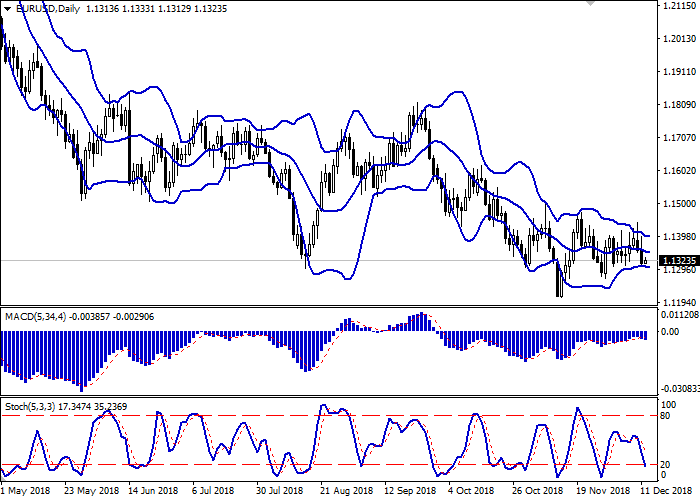

Support and resistance

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range expands slightly from below, making way for new local lows for the "bears". MACD has reversed downwards, having formed a signal for sale (located below a signal line). Stochastic keeps its downward direction but is approaching its minimum levels, which reflects the oversold euro in the ultra-short term.

Existing short positions should be kept until the situation clears up.

Resistance levels: 1.1333, 1.1357, 1.1400, 1.1442.

Support levels: 1.1300, 1.1266, 1.1231, 1.1207.

Trading tips

To open long positions, one can rely on the breakout of 1.1357. Take profit — 1.1400, 1.1420 or 1.1442, 1.1460. Stop loss — 1.1320.

A breakdown of 1.1300 may be a signal to further sales with target at 1.1231 or 1.1207. Stop loss — 1.1333.

Implementation period: 2-3 days.

EUR declined against USD on Tuesday updating local lows of November 28. At the same time, in the morning EUR traded mainly with an increase.

The instrument was supported by the possibility of a compromise on the Italian budget for the next year. The Italian government can reduce the estimated state budget deficit from 2.4% to 1.95%. This figure is higher than the one which EU officials negotiated with the previous Italian government (0.8%), but it still significantly reduces the risk of Italy violating the EU budget rules. The data on ZEW Business Sentiment published today turned out to be better than market expectations, although the number of pessimists in European business continues to prevail over optimists. In December, the indicator for Germany was –17.5 points (instead of the expected –25 points), and for the eurozone it was –21.0 (instead of the expected –23.2 points).

Support and resistance

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range expands slightly from below, making way for new local lows for the "bears". MACD has reversed downwards, having formed a signal for sale (located below a signal line). Stochastic keeps its downward direction but is approaching its minimum levels, which reflects the oversold euro in the ultra-short term.

Existing short positions should be kept until the situation clears up.

Resistance levels: 1.1333, 1.1357, 1.1400, 1.1442.

Support levels: 1.1300, 1.1266, 1.1231, 1.1207.

Trading tips

To open long positions, one can rely on the breakout of 1.1357. Take profit — 1.1400, 1.1420 or 1.1442, 1.1460. Stop loss — 1.1320.

A breakdown of 1.1300 may be a signal to further sales with target at 1.1231 or 1.1207. Stop loss — 1.1333.

Implementation period: 2-3 days.

No comments:

Write comments