NZD/USD: New Zealand dollar strengthens

12 December 2018, 09:37

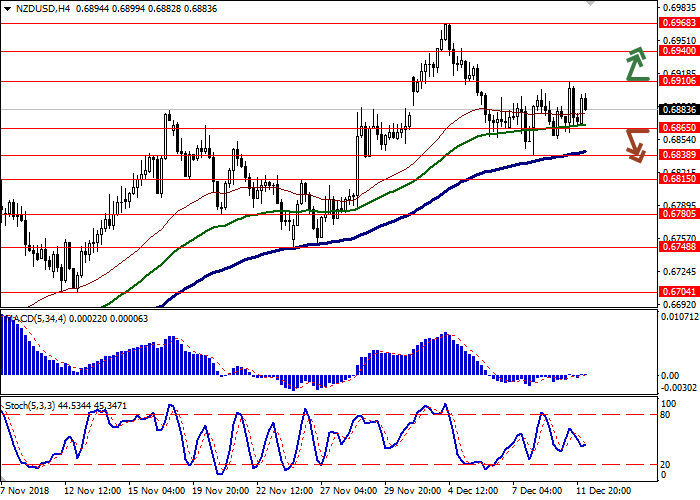

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.6915 |

| Take Profit | 0.6968, 0.7000 |

| Stop Loss | 0.6880 |

| Key Levels | 0.6780, 0.6815, 0.6838, 0.6865, 0.6910, 0.6940, 0.6968, 0.7000 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6860 |

| Take Profit | 0.6815, 0.6800 |

| Stop Loss | 0.6890 |

| Key Levels | 0.6780, 0.6815, 0.6838, 0.6865, 0.6910, 0.6940, 0.6968, 0.7000 |

Current trend

NZD showed uncertain growth against USD on Tuesday, having corrected after four "bearish" sessions in a row. Active "bullish" dynamics can be traced during the Asian session on December 12.

The traders are focused on US-China trade talks. Despite the condemnation by the Chinese side of the arrest of Huawei CFO Meng Wanzhou, there was no breakdown in the negotiations. Yesterday, Liu He, Vice-Premier of the State Council of the People's Republic of China, Stephen Mnuchin, the US Treasury, and Robert Lighthizer, the American sales representative, held telephone talks to discuss the supply of American agricultural products to China and the changes in support of Chinese industry "Made in China 2025". A schedule for further trade advice was also reviewed. Recall that on the eve of Lighthizer, citing President Donald Trump, said that the agreement with Beijing should be concluded before March 1, otherwise a new increase in US export duties is likely.

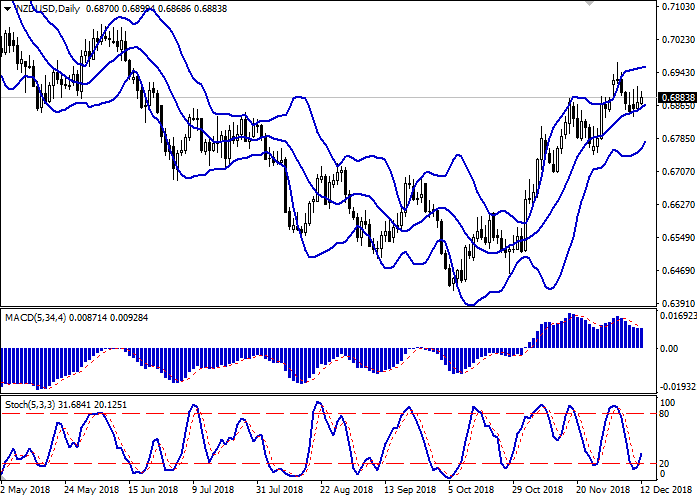

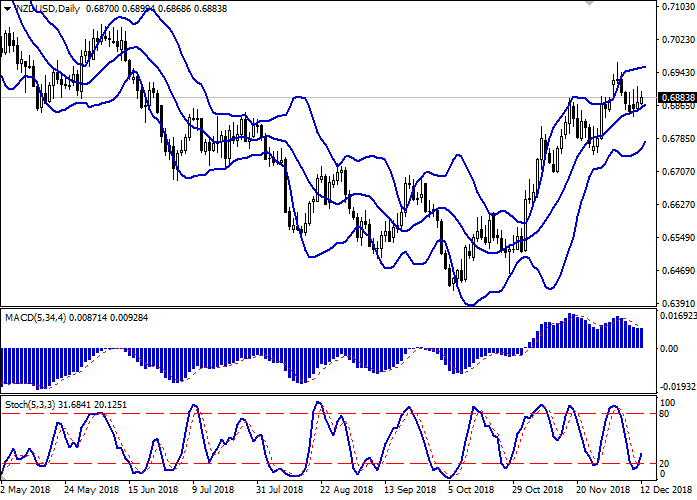

Support and resistance

Bollinger Bands in D1 chart show stable growth. The price range is narrowing, reflecting the ambiguous nature of trading of recent days. MACD is reversing upwards preserving a sell signal (located below the signal line). Stochastic has reversed upwards near its minimum levels, indicating a sufficient potential for the development of the corrective growth in the short and/or ultra-short term.

The development of "bullish" trend is possible in the near future.

Resistance levels: 0.6910, 0.6940, 0.6968, 0.7000.

Support levels: 0.6865, 0.6838, 0.6815, 0.6780.

Trading tips

To open long positions, one can rely on the breakout of 0.6910. Take profit — 0.6968 or 0.7000. Stop loss — 0.6880.

A breakdown of 0.6865 with the target at 0.6815 or 0.6800 could be an alternative. Stop loss — 0.6890.

Implementation period: 2-3 days.

NZD showed uncertain growth against USD on Tuesday, having corrected after four "bearish" sessions in a row. Active "bullish" dynamics can be traced during the Asian session on December 12.

The traders are focused on US-China trade talks. Despite the condemnation by the Chinese side of the arrest of Huawei CFO Meng Wanzhou, there was no breakdown in the negotiations. Yesterday, Liu He, Vice-Premier of the State Council of the People's Republic of China, Stephen Mnuchin, the US Treasury, and Robert Lighthizer, the American sales representative, held telephone talks to discuss the supply of American agricultural products to China and the changes in support of Chinese industry "Made in China 2025". A schedule for further trade advice was also reviewed. Recall that on the eve of Lighthizer, citing President Donald Trump, said that the agreement with Beijing should be concluded before March 1, otherwise a new increase in US export duties is likely.

Support and resistance

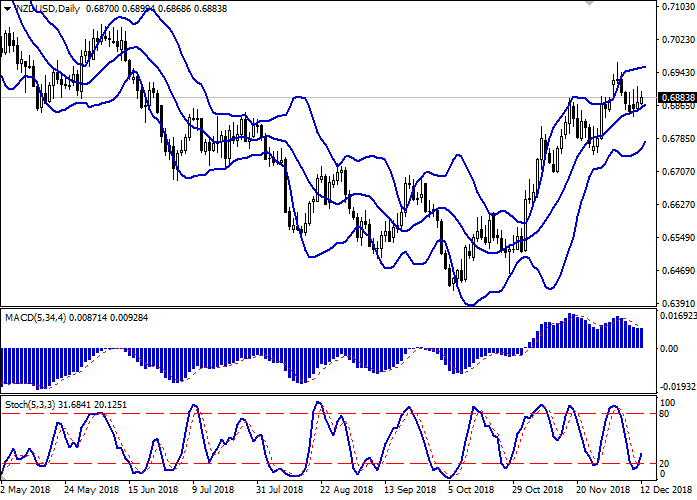

Bollinger Bands in D1 chart show stable growth. The price range is narrowing, reflecting the ambiguous nature of trading of recent days. MACD is reversing upwards preserving a sell signal (located below the signal line). Stochastic has reversed upwards near its minimum levels, indicating a sufficient potential for the development of the corrective growth in the short and/or ultra-short term.

The development of "bullish" trend is possible in the near future.

Resistance levels: 0.6910, 0.6940, 0.6968, 0.7000.

Support levels: 0.6865, 0.6838, 0.6815, 0.6780.

Trading tips

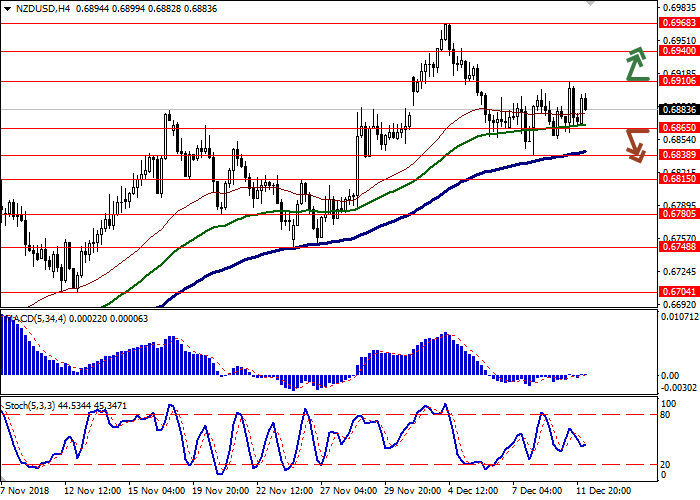

To open long positions, one can rely on the breakout of 0.6910. Take profit — 0.6968 or 0.7000. Stop loss — 0.6880.

A breakdown of 0.6865 with the target at 0.6815 or 0.6800 could be an alternative. Stop loss — 0.6890.

Implementation period: 2-3 days.

No comments:

Write comments