AUD/USD: general review

11 December 2018, 14:02

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 0.7220 |

| Take Profit | 0.7263, 0.7324 |

| Stop Loss | 0.7180 |

| Key Levels | 0.7080, 0.7141, 0.7202, 0.7263, 0.7324 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.7170 |

| Take Profit | 0.7141, 0.7080 |

| Stop Loss | 0.7200 |

| Key Levels | 0.7080, 0.7141, 0.7202, 0.7263, 0.7324 |

Current trend

This week, the pair attempted corrective growth after a serious weakening of the Australian currency at the beginning of the month. It was caused by the instability of world trade markets, the deterioration of the Australian real estate market and the unexpected decline in GDP growth in the third quarter from 3.1% to 2.8%. The combination of these negative factors forced the Reserve Bank of Australia to consider a rate increase. The RBA is counting on a further decline in unemployment and an increase in inflation. However, the Australian business is pessimistic. The latest NAB survey showed a decline in business confidence in the country to 3 points – the lowest since 2016. Currently, support for the Australian currency is provided only by hopes for concluding a trade agreement between the United States and China, since the parties have not abandoned the negotiations, despite the arrest of the Chief Financial Officer of Huawei Meng Wanzhou.

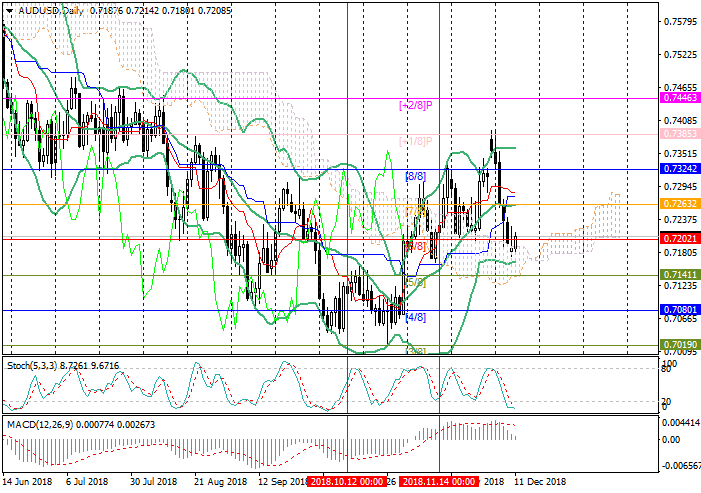

Support and resistance

The price is testing now the 0.7202 level (Murray [6/8]) and can continue to rise to the levels of 0.7263 (Murray [7/8], the middle line of the Bollinger Bands) and 0.7324 (Murray [8/8]). Otherwise, the decline may resume to the levels of 0.7141 (Murray [5/8]) and 0.7080 (Murray [4/8]). Technical indicators give opposite signals. The Stochastic is trying to reverse in the oversold zone, and the MACD histogram is going to enter the negative zone.

Support levels: 0.7141, 0.7080.

Resistance levels: 0.7202, 0.7263, 0.7324.

Trading tips

Long positions can be opened above 0.7202 with targets at 0.7263, 0.7324 and a stop loss around 0.7180.

Short positions can be set at the level of 0.7170 with targets at 0.7141, 0.7080 and a stop loss at 0.7200.

Implementation period: 4-5 days.

This week, the pair attempted corrective growth after a serious weakening of the Australian currency at the beginning of the month. It was caused by the instability of world trade markets, the deterioration of the Australian real estate market and the unexpected decline in GDP growth in the third quarter from 3.1% to 2.8%. The combination of these negative factors forced the Reserve Bank of Australia to consider a rate increase. The RBA is counting on a further decline in unemployment and an increase in inflation. However, the Australian business is pessimistic. The latest NAB survey showed a decline in business confidence in the country to 3 points – the lowest since 2016. Currently, support for the Australian currency is provided only by hopes for concluding a trade agreement between the United States and China, since the parties have not abandoned the negotiations, despite the arrest of the Chief Financial Officer of Huawei Meng Wanzhou.

Support and resistance

The price is testing now the 0.7202 level (Murray [6/8]) and can continue to rise to the levels of 0.7263 (Murray [7/8], the middle line of the Bollinger Bands) and 0.7324 (Murray [8/8]). Otherwise, the decline may resume to the levels of 0.7141 (Murray [5/8]) and 0.7080 (Murray [4/8]). Technical indicators give opposite signals. The Stochastic is trying to reverse in the oversold zone, and the MACD histogram is going to enter the negative zone.

Support levels: 0.7141, 0.7080.

Resistance levels: 0.7202, 0.7263, 0.7324.

Trading tips

Long positions can be opened above 0.7202 with targets at 0.7263, 0.7324 and a stop loss around 0.7180.

Short positions can be set at the level of 0.7170 with targets at 0.7141, 0.7080 and a stop loss at 0.7200.

Implementation period: 4-5 days.

No comments:

Write comments