NZD/USD: the New Zealand dollar is trading in both directions

18 December 2018, 08:47

| Scenario | |

|---|---|

| Timeframe | Intraday |

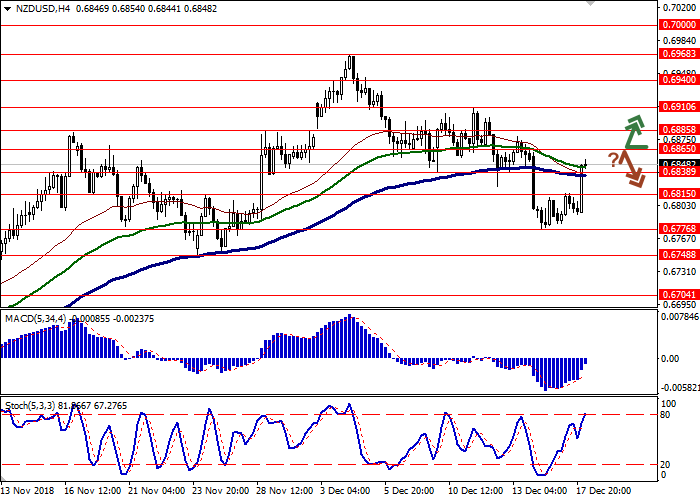

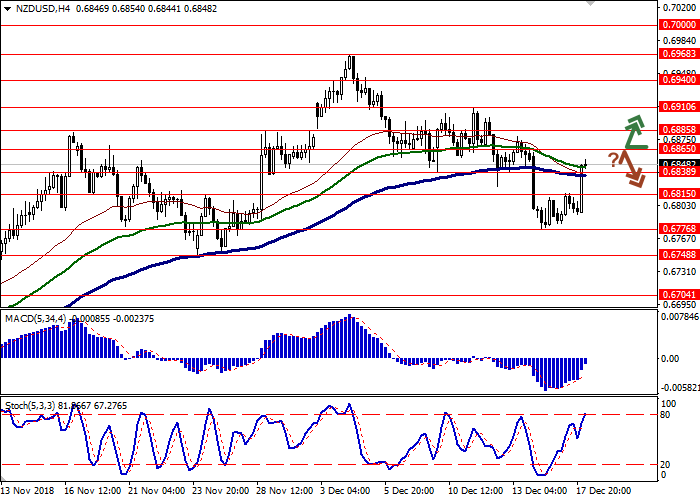

| Recommendation | BUY STOP |

| Entry Point | 0.6870 |

| Take Profit | 0.6940 |

| Stop Loss | 0.6830 |

| Key Levels | 0.6748, 0.6776, 0.6815, 0.6838, 0.6865, 0.6885, 0.6910, 0.6940 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6830 |

| Take Profit | 0.6776, 0.6760 |

| Stop Loss | 0.6870 |

| Key Levels | 0.6748, 0.6776, 0.6815, 0.6838, 0.6865, 0.6885, 0.6910, 0.6940 |

Current trend

NZD almost did not change against USD on Monday, which was caused by the relatively calm macroeconomic background from New Zealand and the USA.

Investors are focused on the upcoming Fed meeting. It is expected that the rate will once again be raised, this time from 2.25% to 2.50%, but in the future the monetary policy tightening may slow down. Jerome Powell mentioned this fact three weeks ago. He noted that the interest rate is just below the neutral level; therefore, the potential for its further increase is limited.

Today, the pair is showing stable growth. NZD is supported by the data from New Zealand released tonight. NBNZ Own Activity was raised in December from 7.6% to 13.6%. ANZ Business Confidence rose from –37.1 to –24.1 points in December.

Support and resistance

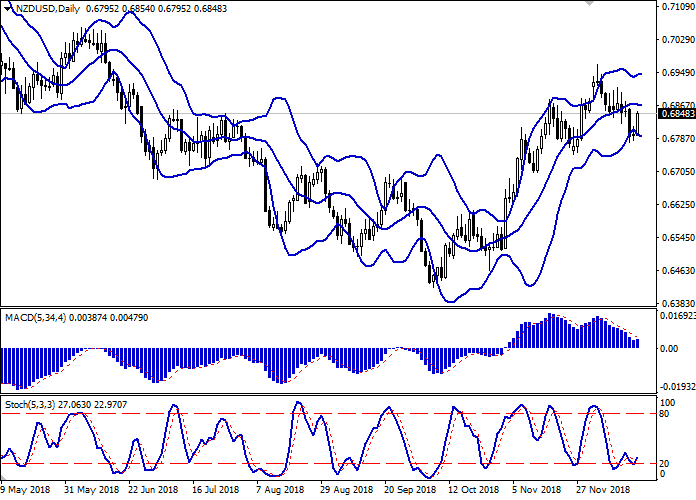

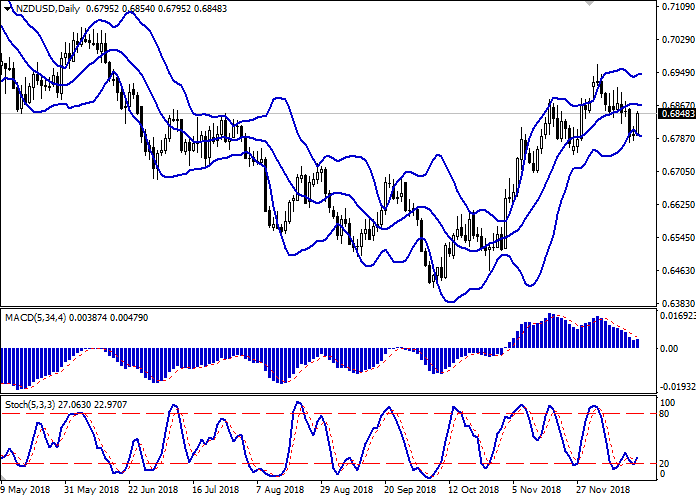

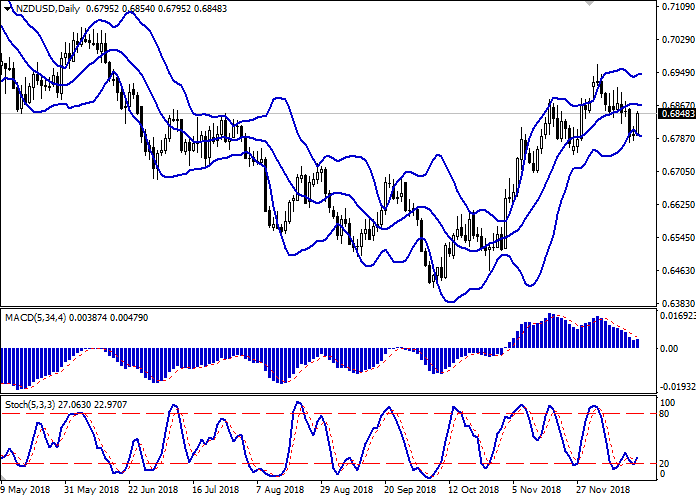

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is slightly expanded, while remaining spacious enough for the current activity level in the market. MACD is reversing upwards preserving a previous sell signal (located below the signal line). Stochastic shows oscillatory dynamics and is located in close proximity to its minimum levels, indicating that the instrument is oversold.

It is worth looking into the possibility of the uptrend development in the short and/or ultra-short term.

Resistance levels: 0.6865, 0.6885, 0.6910, 0.6940.

Support levels: 0.6838, 0.6815, 0.6776, 0.6748.

Trading tips

To open long positions, one can rely on the breakout of 0.6865. Take profit — 0.6940. Stop loss — 0.6830.

The rebound from the level of 0.6865 as from resistance with the subsequent breakdown of 0.6838 can become a signal to new sales with target at 0.6776 or 0.6760. Stop loss — 0.6870.

Implementation period: 2-3 days.

NZD almost did not change against USD on Monday, which was caused by the relatively calm macroeconomic background from New Zealand and the USA.

Investors are focused on the upcoming Fed meeting. It is expected that the rate will once again be raised, this time from 2.25% to 2.50%, but in the future the monetary policy tightening may slow down. Jerome Powell mentioned this fact three weeks ago. He noted that the interest rate is just below the neutral level; therefore, the potential for its further increase is limited.

Today, the pair is showing stable growth. NZD is supported by the data from New Zealand released tonight. NBNZ Own Activity was raised in December from 7.6% to 13.6%. ANZ Business Confidence rose from –37.1 to –24.1 points in December.

Support and resistance

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is slightly expanded, while remaining spacious enough for the current activity level in the market. MACD is reversing upwards preserving a previous sell signal (located below the signal line). Stochastic shows oscillatory dynamics and is located in close proximity to its minimum levels, indicating that the instrument is oversold.

It is worth looking into the possibility of the uptrend development in the short and/or ultra-short term.

Resistance levels: 0.6865, 0.6885, 0.6910, 0.6940.

Support levels: 0.6838, 0.6815, 0.6776, 0.6748.

Trading tips

To open long positions, one can rely on the breakout of 0.6865. Take profit — 0.6940. Stop loss — 0.6830.

The rebound from the level of 0.6865 as from resistance with the subsequent breakdown of 0.6838 can become a signal to new sales with target at 0.6776 or 0.6760. Stop loss — 0.6870.

Implementation period: 2-3 days.

No comments:

Write comments